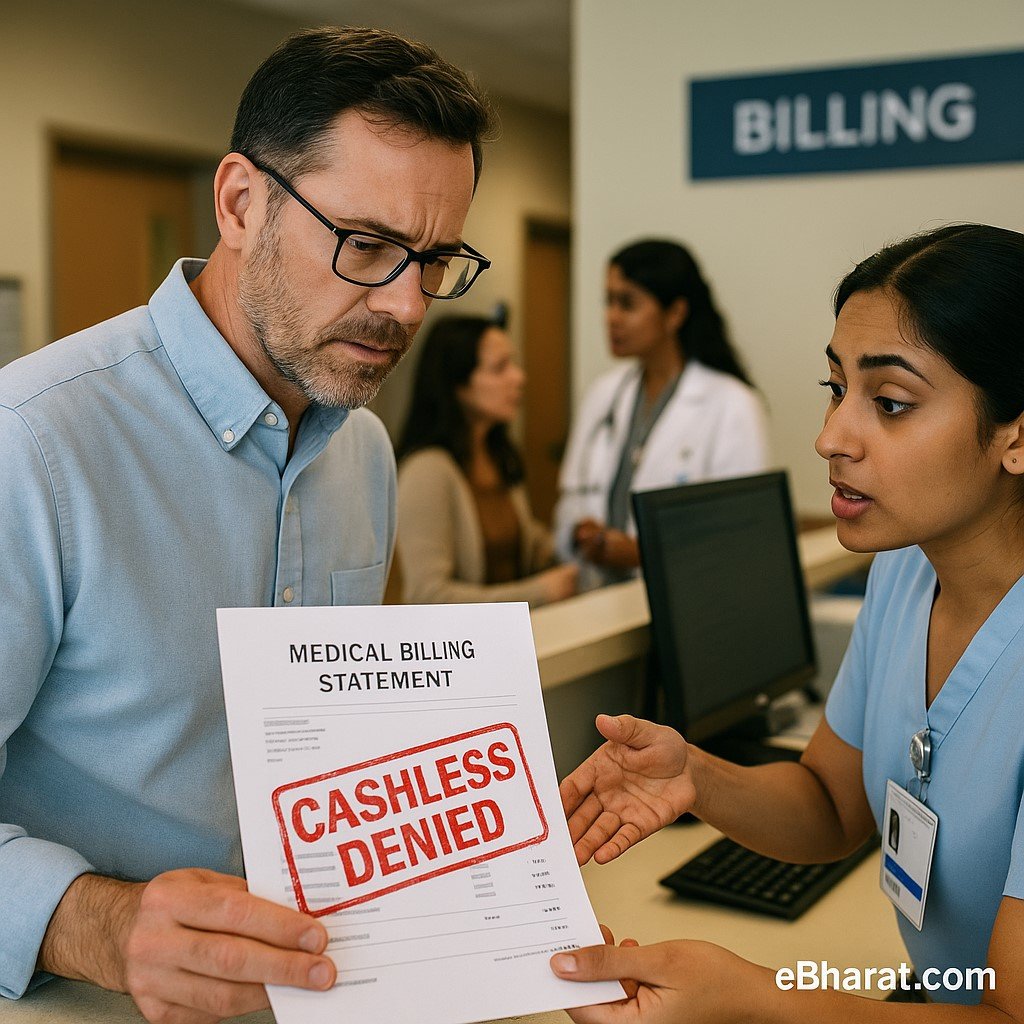

Starting September 1, 2025, thousands of policyholders of Bajaj Allianz General Insurance (and possibly CARE Health Insurance) will face a major disruption. Hospitals affiliated with the Association of Healthcare Providers of India (AHPI)—including large private chains like Max Super Speciality, Fortis Escorts, and Medanta—have announced they will stop offering cashless treatment facilities.

This means patients will now have to pay bills upfront and then apply for reimbursement, creating financial stress during medical emergencies.

Why Hospitals Took This Step

While AHPI has not officially disclosed the reasons, industry insiders point to two key issues:

- Tariff Disputes: Hospitals claim reimbursement rates set by insurers are outdated and unsustainable.

- Payment Delays: Pending dues and delays in settlement have strained hospital finances.

A similar move was earlier seen in other insurance disputes, and experts believe this decision is part of a broader push by hospitals for fairer pricing and timely payments.

Who Will Be Affected

- Bajaj Allianz General Insurance policyholders across India.

- CARE Insurance customers may also face the same issue, as AHPI has issued notices to the insurer.

- Patients planning treatment at Max, Fortis, Medanta, PSRI, and other AHPI-affiliated hospitals.

Affected patients will still be able to receive treatment, but not on a cashless basis. They must first pay the full amount and later file for reimbursement with their insurer.

Impact on Policyholders

- Emergency Burden: Families may struggle to arrange large sums immediately for surgeries or hospitalisations.

- Claim Hassles: Filing reimbursement claims often involves documentation delays and verification steps.

- Trust Deficit: Customers buy insurance for cashless convenience—removing this benefit could reduce faith in insurers.

👉 Related: Why New Agents Fail and How eBharat Helps Them Succeed

Expert Views

Healthcare experts note that cashless treatment is the core value proposition of health insurance. Removing it not only hurts patients but could also impact insurers’ brand reputation.

Industry analysts suggest that unless insurers revise their tariffs and clear dues quickly, more hospitals may join this protest, affecting lakhs of families.

Why This Matters

- For policyholders: Be prepared for upfront medical costs from September 1, 2025.

- For hospitals: It’s about fair reimbursement and financial sustainability.

- For insurers: This dispute could damage trust in private health insurance.

🔍 Worried About Cashless Cover?

Use Insurance+ to compare health policies and check which insurers still provide strong cashless hospital networks.

Explore with Insurance+🚀 Turn Insurance Challenges Into Opportunity

Become an HDFC Life Agent with eBharat. Help families choose the right plans and build a rewarding career.

Apply Now to Become an Agent