Most life insurance ads seem to talk only to people earning ₹50,000 or more. But what about the rest?

What about delivery boys, sales agents, shopkeepers, domestic workers, office assistants — the backbone of India’s daily grind — earning ₹20K to ₹30K a month?

You work hard. You support your family. You deserve protection too.

The truth is: you don’t need to be rich to buy life insurance. You just need to choose the right plan that fits your life.

What You Actually Need at This Income Level

If your monthly salary is ₹20,000–₹30,000, here’s what matters:

- Your family depends completely on your income

- You may have small savings, but not enough for emergencies

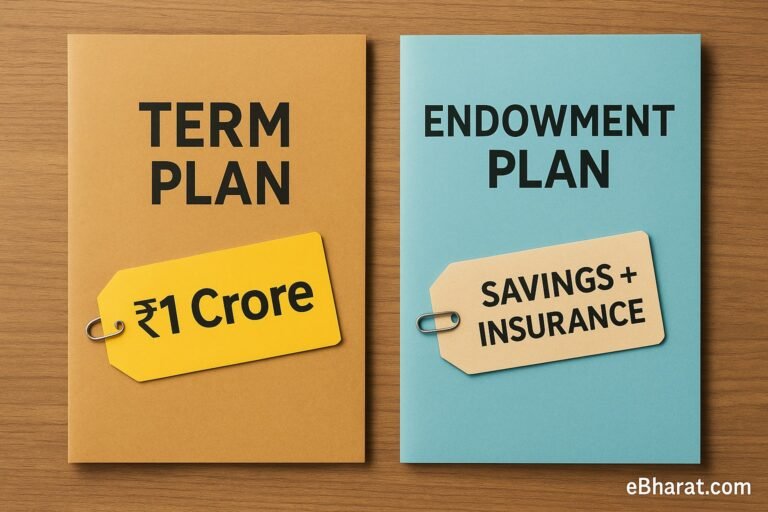

- A ₹1 crore term plan may sound tempting — but isn’t affordable or necessary right now

- What you need is basic, realistic life cover — enough to support your family for 1–3 years if something happens to you

Even a ₹5 lakh or ₹10 lakh life cover can give your loved ones breathing space to recover.

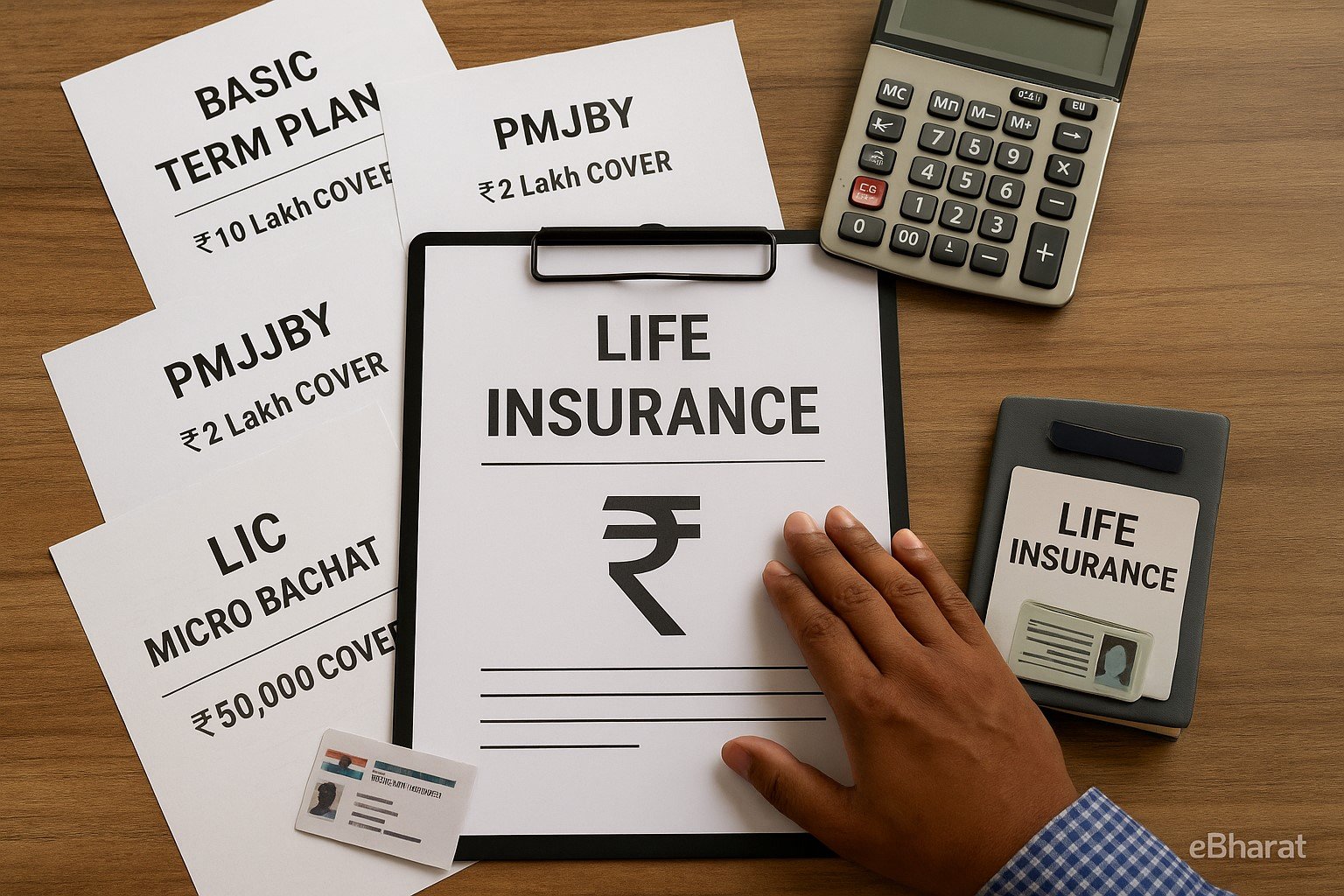

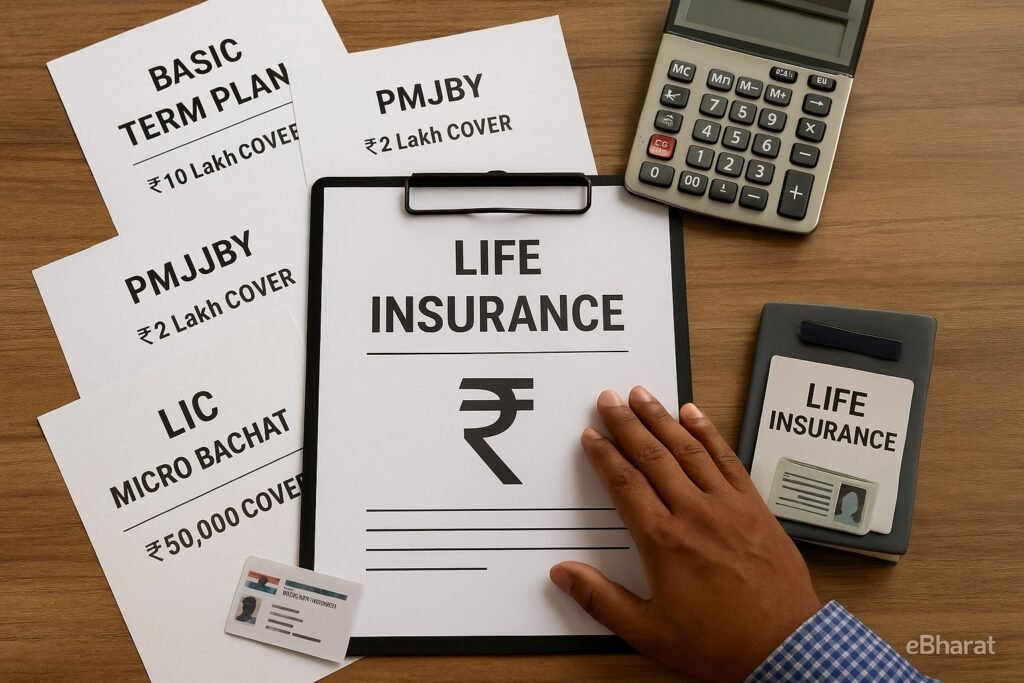

Top 3 Life Insurance Options for Low-Income Earners

Let’s keep it simple and practical. These 3 plans offer real protection at prices you can afford:

PMJJBY – ₹2 Lakh Cover for ₹436/year

- Full Name: Pradhan Mantri Jeevan Jyoti Bima Yojana

- Coverage: ₹2 lakh (on death from any cause)

- Annual Premium: ₹436 only

- Age Limit: 18 to 50 years

- Where to Buy: Through your bank (auto-debit)

- Medical Test: Not required

- Ideal For: Anyone earning below ₹30K/month with zero insurance

Why it works:

It’s basic, but better than nothing. For less than ₹40/month, your family gets ₹2 lakh if you pass away. Everyone with a savings account should activate this.

LIC Micro Bachat or Similar Low-Income Plans

- Coverage: ₹30,000 to ₹2 lakh

- Premium: Starts from ₹1,500/year

- Bonus/Maturity Return: Yes (after 10–15 years)

- Medical Test: Usually not required

- Ideal For: People who want small savings plus insurance

Why it works:

These plans won’t make you rich, but they do give back some money if you survive the policy term. Good for those who want insurance with guaranteed return.

Term Plan – ₹10 Lakh Pure Protection

- Example Plans: HDFC Life Click 2 Protect Lite, LIC Tech Term

- Coverage: ₹10 lakh

- Premium: ₹2,500 to ₹4,000/year (for a 30-year-old)

- Medical Test: May be required

- Ideal For: Sole earners with kids, loans, or ageing parents

Why it works:

No savings or returns — just serious protection. If anything happens to you, your family gets a lump sum of ₹10 lakh. That’s more than 3 years of income — a lifeline during crisis.

What to Avoid If You Earn ₹20K–₹30K

🚫 ULIPs, endowment plans, or “return” schemes that sound too good to be true.

They often eat up your money in fees and give poor protection.

🚫 Cancelling your policy midway.

Life insurance only works if you keep it active for years.

🚫 Agents who hide facts or paperwork.

Ask questions. Always check the documents. Your money is hard-earned — protect it.

Final Word: Start Small. But Start Now.

You don’t need ₹50K per month to protect your family.

You just need to make smart, honest choices.

Start with PMJJBY — it’s the easiest, cheapest step.

Then, if you can afford it, add a ₹10 lakh term plan — it could be the best gift your family ever receives, even if you’re not there to give it.

Because your income may be modest —

…but your family’s peace of mind is priceless.