In 2025, car insurance premiums in India are witnessing notable shifts. With IRDAI’s new pricing bands, digital-first underwriting, and inflation-driven repair costs, customers are paying more attention to how their premiums are calculated.

This article explores the trends in car insurance premiums across insurers in 2025, helping you understand what’s driving costs and how to save.

Factors Influencing Premium Rates in 2025

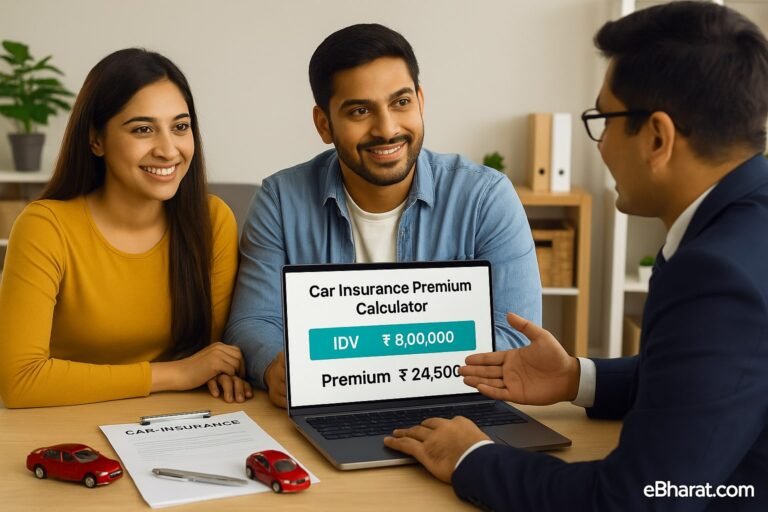

- IDV (Insured Declared Value)

- Directly linked to your car’s market value.

- New cars = higher premium; older cars = lower premium.

- Claim History

- A single claim can push your premium up by 20–30%.

- No Claim Bonus (NCB) still plays a major role in reducing premiums.

- IRDAI Pricing Adjustments

- IRDAI revised third-party liability premiums in April 2025.

- TP premiums are now banded by engine capacity more strictly.

- Repair Cost Inflation

- Spare parts, paint, and labour costs have risen by ~12% in 2025.

- Premiums adjusted to reflect this higher risk exposure.

- Add-On Covers

- Zero-depreciation, engine protection, roadside assistance → popular but increase costs.

Average Premium Trends (2025)

| Car Segment | Average Annual Premium (2024) | Average Annual Premium (2025) |

|---|---|---|

| Small Hatchbacks (Alto, WagonR) | ₹7,500–₹9,000 | ₹8,200–₹10,500 |

| Sedans (City, Verna) | ₹11,000–₹14,500 | ₹12,500–₹16,000 |

| SUVs (Creta, Harrier) | ₹15,000–₹20,000 | ₹17,000–₹22,500 |

| Luxury Cars (BMW, Audi) | ₹55,000–₹80,000 | ₹60,000–₹90,000 |

New Trends Across Insurers

- Digital Underwriting → AI-based claim prediction models adjusting premiums.

- Telematics Plans → Pay-as-you-drive introduced by some insurers.

- Regional Pricing → Metro city cars pay 10–15% more due to higher accident frequency.

- EV Discounts → Some insurers are offering lower rates for electric cars, but higher battery cover charges.

Tips to Reduce Your Premium in 2025

- Avoid small claims → protect your NCB.

- Install anti-theft devices → IRDAI-approved devices reduce premiums.

- Opt for higher voluntary deductibles if you’re a safe driver.

- Compare policies online before renewing.

Case Study: Arun’s Premium Spike

Arun, a 33-year-old SUV owner from Pune, made two claims in 2024. At renewal in 2025, his premium jumped from ₹18,000 to ₹25,000 due to claim history.

By switching insurers and increasing deductibles, he brought it down to ₹20,500.

Lesson: Always compare before renewing.

Why This Matters

Car insurance premiums in India are no longer static. In 2025, digital tools, IRDAI rules, and inflation are all reshaping how insurers price policies. Smart customers can save money by making informed choices.

Next, read: Two-Wheeler Insurance in India: Costs, Coverage, and Add-Ons

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent