With India’s used car market growing rapidly—expected to cross 70 lakh annual sales in 2025—insurance for second-hand cars has become a key topic. Many buyers don’t realize that car insurance is mandatory even for used cars and that transfer of policy is as important as transfer of RC (Registration Certificate).

This guide explains how insurance for second-hand cars works, the latest IRDAI rules, and tips to save money.

Why Insurance Transfer Is Important

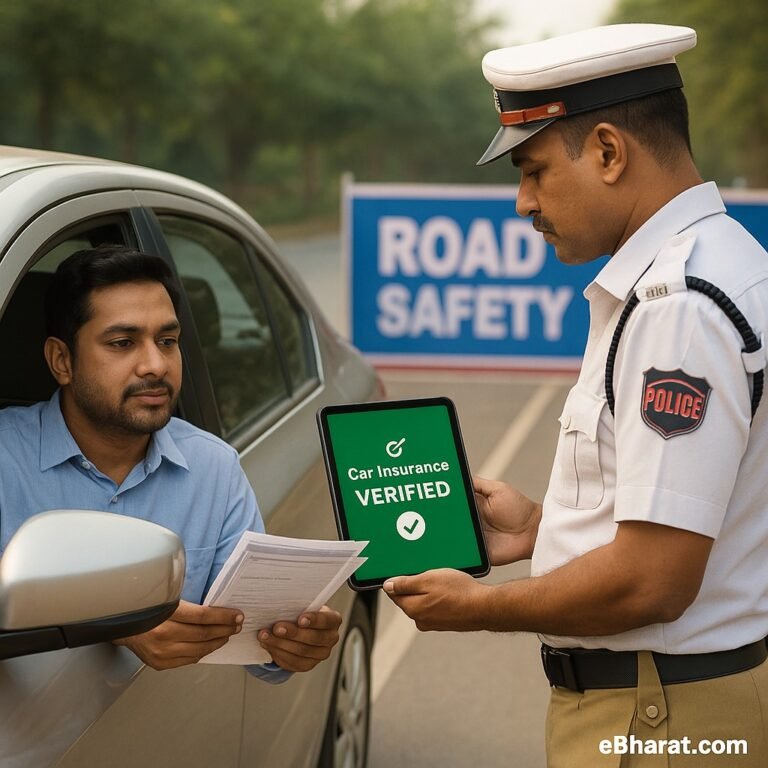

- Legal Requirement

- By law, every vehicle on Indian roads must have at least third-party insurance.

- Ownership Transfer

- If you don’t transfer the policy, claims may get rejected even if you’re the new owner.

- No Claim Bonus (NCB)

- NCB stays with the seller, not the car. Buyers must negotiate fresh premiums.

Steps to Transfer Insurance for a Used Car

- Collect Documents from Seller

- RC copy, insurance certificate, sale deed, Form 29 & 30.

- Apply for Insurance Transfer

- Approach insurer within 14 days of RC transfer.

- Inspection by Insurer

- Insurer may inspect the car before approving transfer.

- Pay Transfer Fee + Premium Difference

- Small charges plus adjusted premium if required.

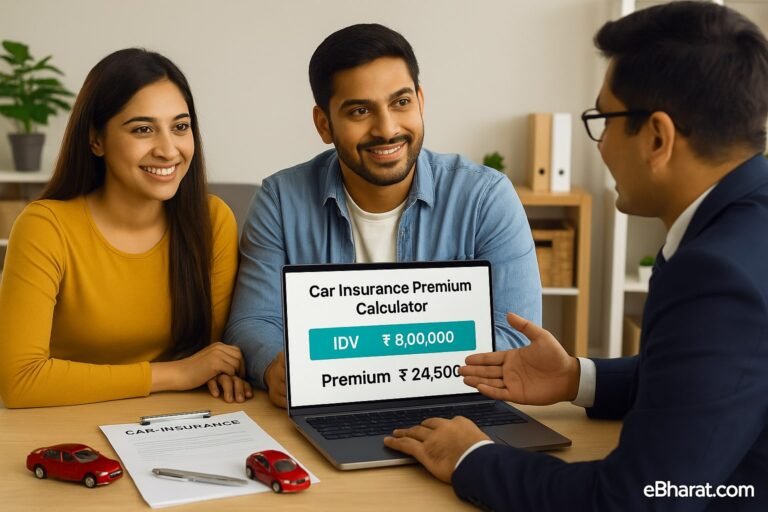

Premium Calculation for Second-Hand Cars (2025)

| Car Segment | Average Annual Premium | Factors Affecting Cost |

|---|---|---|

| Hatchbacks (Swift, i10) | ₹7,000–₹12,000 | Car age, claim history |

| Sedans (City, Verna) | ₹10,000–₹18,000 | Model, repair costs |

| SUVs (Creta, Nexon) | ₹15,000–₹25,000 | Engine size, usage |

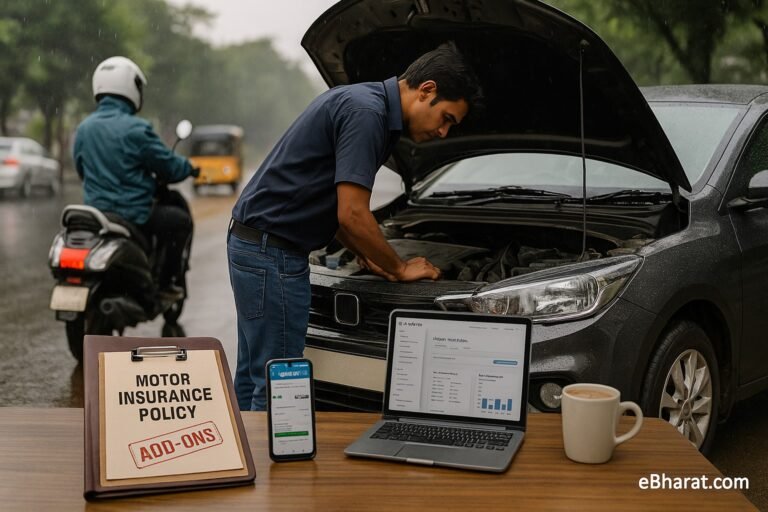

Add-Ons for Used Car Insurance

- Engine Protection Cover – useful for older vehicles.

- Zero Depreciation Cover – may be limited for cars older than 5 years.

- Roadside Assistance (RSA) – must-have for long-distance drivers.

Case Study: Rohit’s Used Sedan Purchase

Rohit bought a 5-year-old Honda City in Delhi. He transferred insurance within 10 days and added RSA. A month later, his car broke down at night, and RSA covered the towing costs.

Lesson: Transferring insurance on time saved him hassle and money.

Why This Matters

Second-hand cars are affordable, but without proper insurance, buyers risk claim rejection, financial loss, and legal trouble. In 2025, IRDAI’s stricter rules make insurance transfer mandatory and easier than before.

Next, read: Compulsory Third-Party Insurance Rates: IRDAI Price Bands 2025

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent