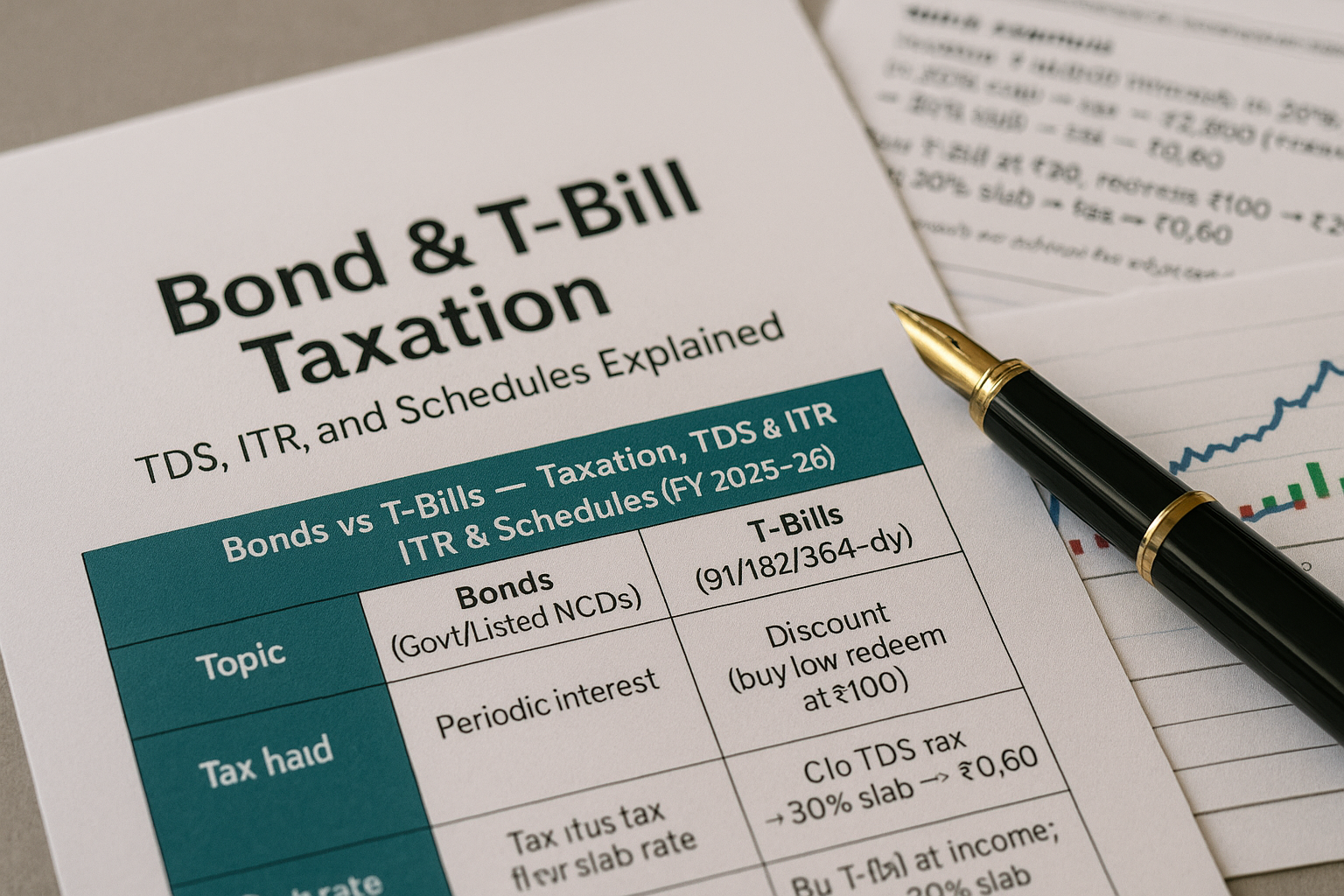

Bond & T-Bill Taxation: TDS, ITR, Schedules

Bonds and Treasury Bills, better known as T-Bills, are among the most trusted investment options…

No popular articles found in this category.

Bonds and Treasury Bills, better known as T-Bills, are among the most trusted investment options…

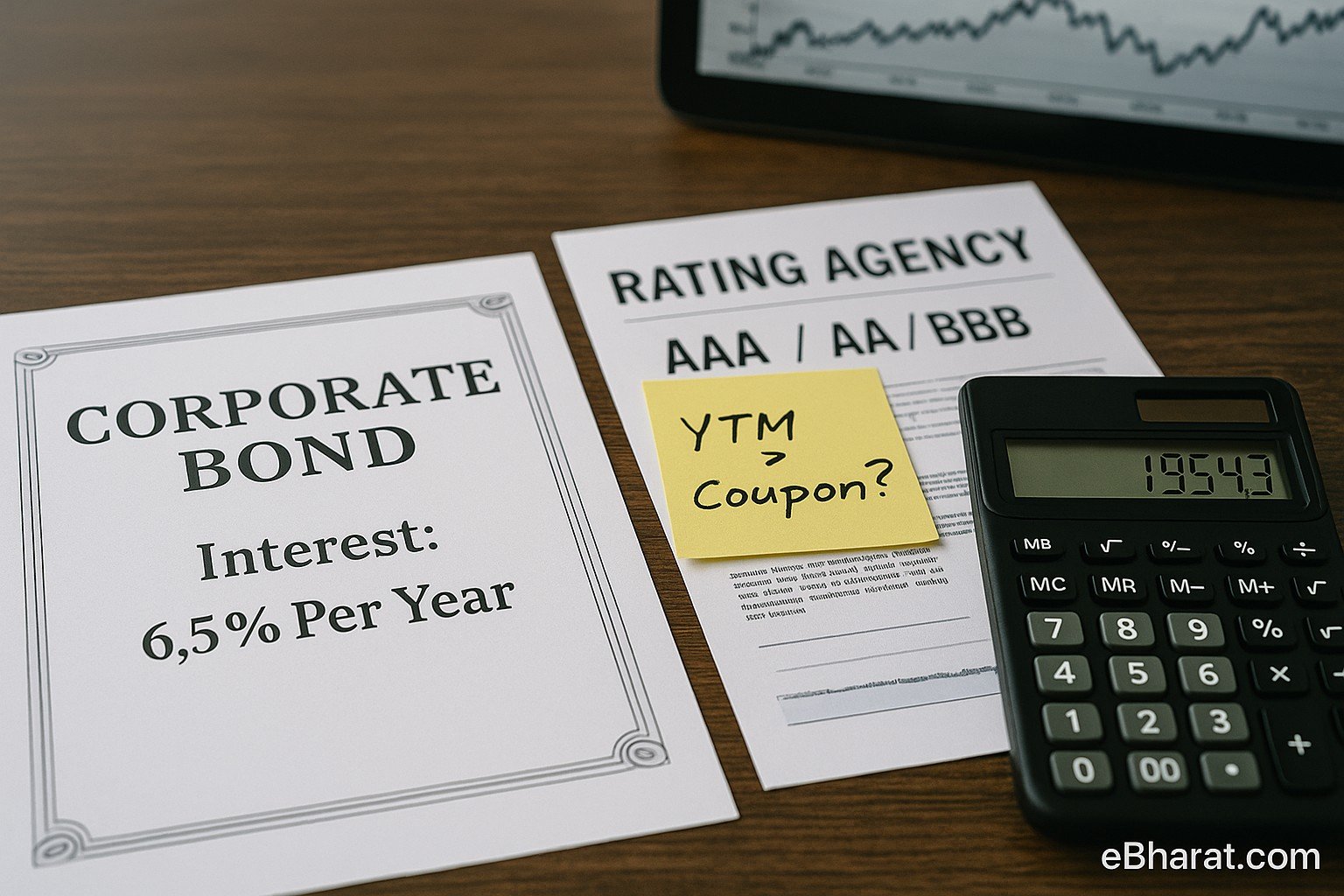

Corporate bonds are attractive for higher returns, but they carry credit risk. This article explains…

Treasury Bills (T-Bills) are India’s safest short-term securities. Here’s a simple guide to 91-day, 182-day,…

A realistic visual showing traditional investment options — Fixed Deposits, Debt Mutual Funds, and Sovereign…

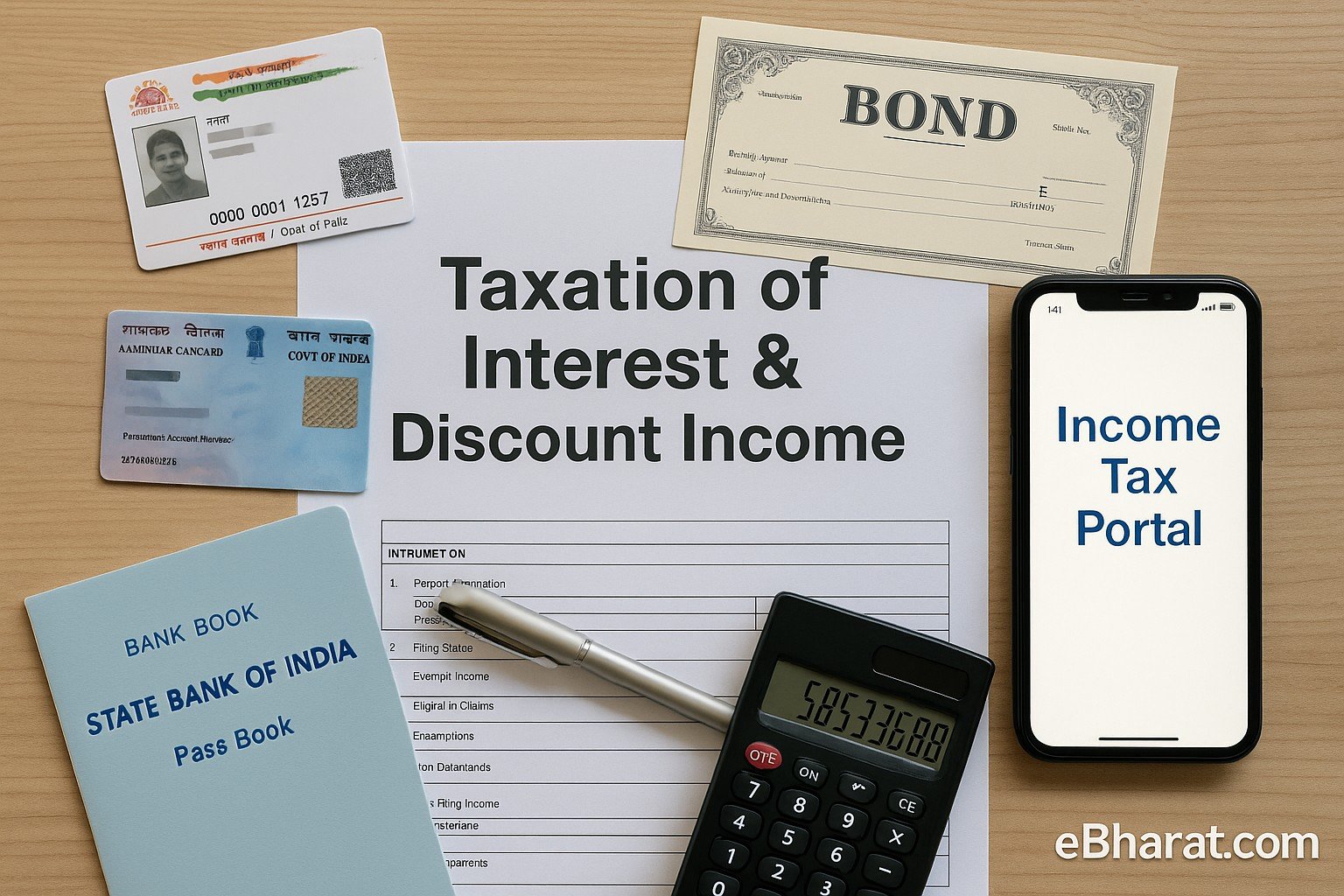

Learn how interest income and discount income from FDs, SGBs, T-Bills, and bonds are taxed…

A realistic representation of how investors in India can subscribe to Sovereign Gold Bonds using…

RBI Retail Direct lets you buy government securities directly online with zero fees. Here’s a…

Should you buy gilt funds or direct G-Secs? Compare returns, rate risk, liquidity, taxes, and…

Angel One SmartAPI vs Upstox API 2025 – comparison of pricing, execution speed, documentation, and…