Reinsurance Capacity in India: Growth Data 2025

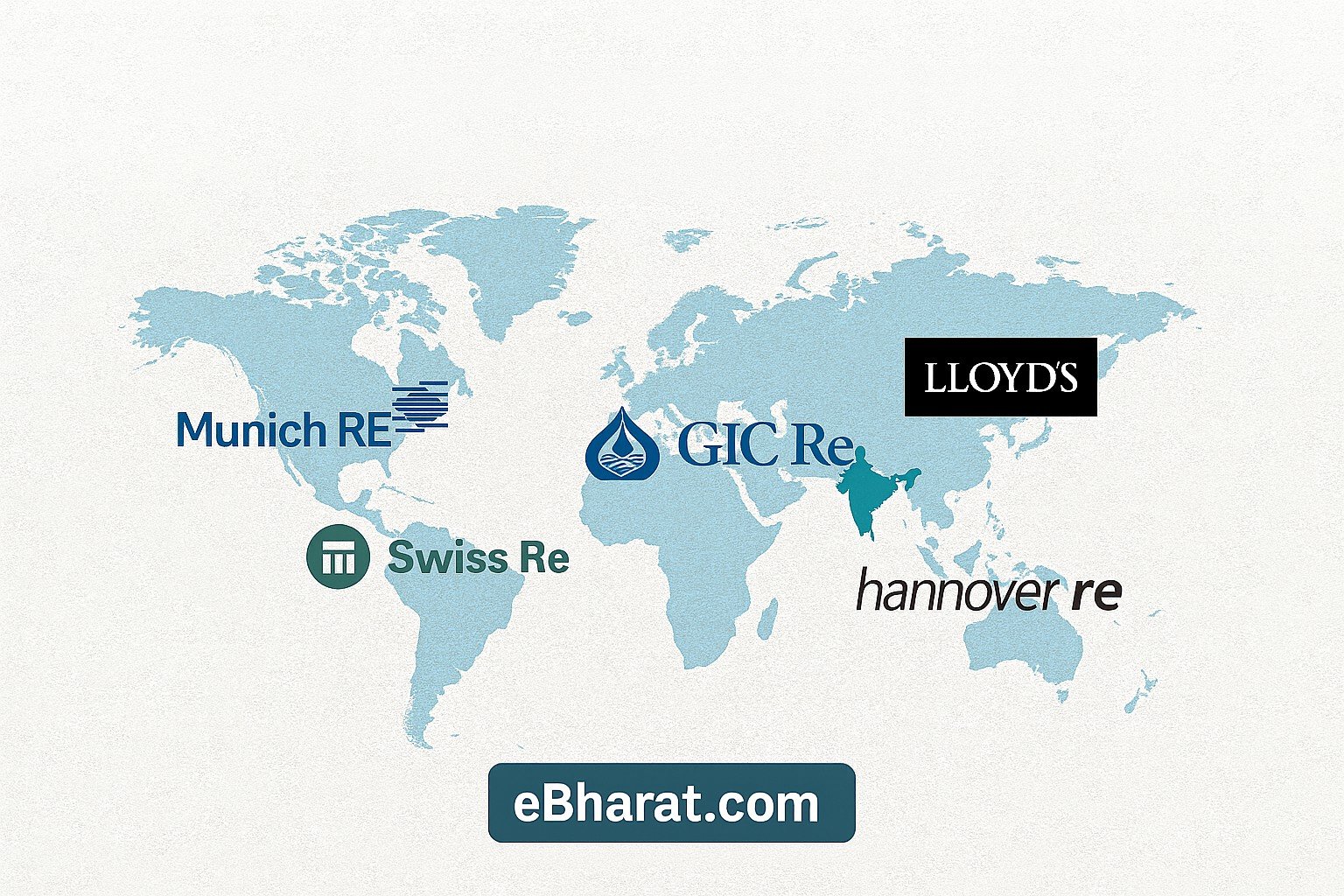

India’s reinsurance capacity is projected to cross ₹7.25 lakh crore in 2025, backed by GIC…

No popular articles found in this category.

India’s reinsurance capacity is projected to cross ₹7.25 lakh crore in 2025, backed by GIC…

Life reinsurance covers mortality and long-term risks, while non-life reinsurance protects against property, motor, health,…

Reinsurance pricing explains how global insurers value and transfer risk. This guide explores the factors,…

Catastrophe bonds connect capital markets with reinsurance, giving reinsurers extra capacity to handle disasters. Learn…

IRDAI’s 2025 reinsurance guidelines simplify cession rules, retention limits, and foreign reinsurer participation. Here’s a…

Global reinsurance market is valued at over USD 600 billion in 2025. Learn how India,…

Retrocession is the insurance of reinsurers — a process where reinsurers pass part of their…

Facultative vs Treaty Reinsurance explained in simple terms. Learn the key differences, Indian examples, and…

GIC Re, India’s national reinsurer, plays a vital role in sharing risks, stabilising insurers during…