Riders Can Be Powerful — Or Pointless. It Depends on How You Use Them.

Riders are like toppings on a pizza — great when chosen wisely, but wasteful if you just pile them on without thinking.

In insurance, riders are optional add-ons that provide extra coverage — for critical illness, accidental death, disability, hospital cash, and more. When chosen correctly, they can save your finances in an emergency. But when picked blindly, they just add to your premium with little real benefit.

Let’s break down the most common mistakes people make with riders — and how to avoid them.

Mistake #1: Choosing Riders Without Knowing What They Actually Do

Many policyholders say “yes” to whatever rider the agent recommends — without reading the fine print.

But riders come with specific terms and narrow triggers. For example:

- Critical Illness Rider only pays on specific listed illnesses — not for general hospital stays or surgeries.

- Hospital Cash Rider gives you a fixed daily payout — not the actual medical bill.

- Waiver of Premium Rider only applies if you become permanently disabled or critically ill — not if you’re temporarily unwell or unemployed.

Solution:

👉 Read the rider brochure carefully.

👉 Ask your advisor exactly when the benefit kicks in.

👉 Only choose riders that align with your actual health and family history.

Mistake #2: Adding Too Many Riders at Once

Each rider might seem cheap — ₹100 or ₹200 per month — but add four of them and you could end up paying 25%–30% extra on your total premium.

This becomes even more expensive in long-term policies like 30-year term plans or ULIPs, where small additions multiply over time.

Example:

If you’re healthy, young, and have no major health risks, do you really need both accidental death and critical illness riders? Probably not.

Solution:

👉 Pick 1–2 high-impact riders.

👉 Base your decision on your age, health, job, and family history.

👉 Skip anything that doesn’t serve a clear purpose.

Mistake #3: Paying for Riders You Already Have

This is a very common mistake — especially for salaried individuals.

If your employer already gives you a group health or critical illness cover, or if you’ve bought standalone health insurance, you might end up duplicating benefits through your life insurance rider.

Worse, in some cases, claiming both (rider + standalone policy) could become tricky or delayed.

Solution:

👉 Audit your existing insurance policies.

👉 Don’t duplicate cover unless it’s really inadequate.

👉 Avoid accidental overlap — it costs money and complicates claims.

Mistake #4: Ignoring Eligibility Limits and Exclusions

Every rider comes with hidden conditions — many of which are overlooked at the time of purchase.

Common limits include:

- Maximum entry age (usually 50–55 years)

- Expiry of cover at 65–70 years, even if your base plan continues

- Waiting periods, especially in critical illness riders (often 90 days)

- Survival clauses, requiring you to live a certain number of days post-diagnosis

All of this means: you might pay for years — and still not be eligible when you need it most.

Solution:

👉 Ask for the rider-specific benefit illustration.

👉 Read the age and claim eligibility criteria.

👉 Reconfirm the exclusions — and don’t rely only on what the agent says.

Mistake #5: Buying Riders Just for Tax Saving

Some riders are eligible for tax deductions — under Section 80C or 80D.

But if you’re adding a rider just to save ₹2,000 in tax, and it doesn’t fit your needs or overlaps with another policy — you’re wasting your money.

Solution:

👉 Riders should solve a real financial risk.

👉 Let tax-saving be a bonus — not the reason.

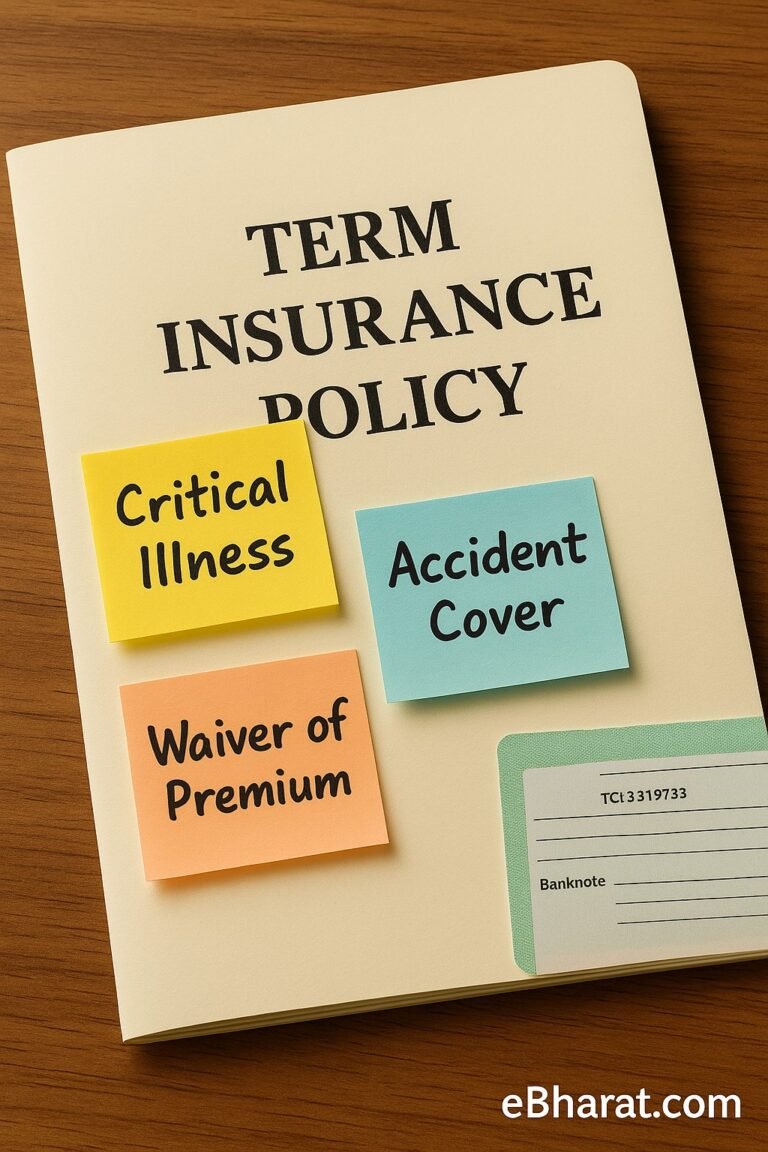

So, How Should You Choose Riders the Right Way?

Here’s a practical checklist that actually works:

- Prioritize lump-sum benefit riders like critical illness or premium waiver — they help during big life shocks.

- Avoid doubling up on things already covered elsewhere (health policy, group insurance, etc.)

- Customize for your life stage — a 25-year-old and a 50-year-old need very different protections. Review every 5 years — your health, income, and responsibilities change.

Final Word: Riders Can Be a Lifesaver — If Chosen Smartly

A good rider can make a basic insurance plan powerful. But a bad or irrelevant one is just an extra cost.

The best approach?

Choose only what you need. Skip the rest.

If you understand how each rider works — and match it to your lifestyle and risks — you’ll get real value, peace of mind, and smarter protection for your money.