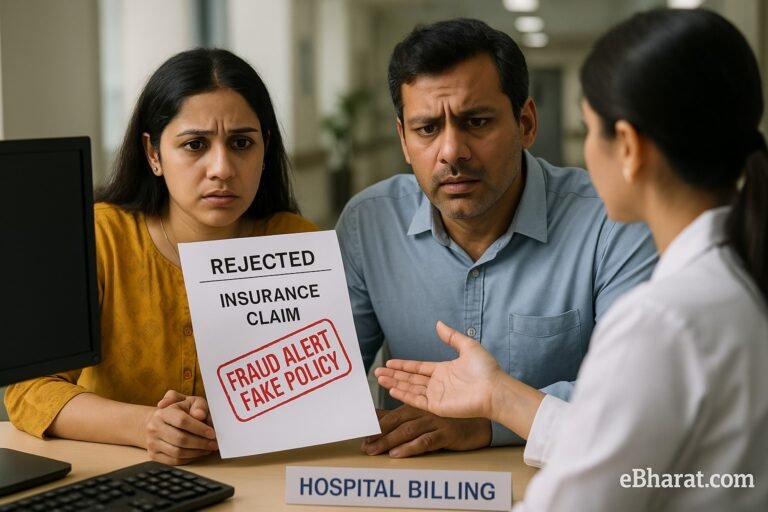

A standard health insurance plan pays for hospitalization bills, but what if you’re diagnosed with cancer, heart disease, stroke, or kidney failure? Beyond hospital bills, these conditions lead to loss of income, long-term care, and lifestyle changes.

That’s where critical illness insurance comes in. It provides a lump sum payout on diagnosis of specified illnesses—money you can use for treatment, EMIs, or daily expenses.

This guide explains why, when, and how to buy critical illness insurance in 2025.

What Is Critical Illness Insurance?

- A health insurance rider or standalone policy.

- Offers a one-time lump sum payout on diagnosis of listed illnesses.

- Covers 30–40 major illnesses depending on insurer.

- Payout can be used freely (not just hospital bills).

Top Illnesses Covered (2025)

- Cancer of specified severity

- First heart attack of specified severity

- Stroke

- Kidney failure requiring dialysis

- Major organ transplant

- Paralysis

- Multiple sclerosis

- Alzheimer’s/Parkinson’s (varies by plan)

Each insurer’s list differs—always check policy wordings.

When Should You Buy Critical Illness Cover?

1. Young Working Professionals (Age 25–35)

- Premiums are cheaper when bought young.

- Even if you already have health insurance, CI cover ensures financial safety beyond hospital bills.

- Example: A 30-year-old can get ₹20 lakh cover at ₹3,000–5,000/year.

2. Married Individuals with Loans/Dependents

- Critical illnesses can stop income for months/years.

- Lump sum helps pay EMIs, school fees, daily expenses.

3. Mid-Life Professionals (Age 40–50)

- Higher risk age group for cancer, diabetes, heart issues.

- Premiums are higher, but coverage is critical.

4. Senior Citizens (60+)

- Limited options; premiums are very high.

- Best to buy earlier to lock-in lower premiums.

Critical Illness vs Regular Health Insurance

| Feature | Health Insurance | Critical Illness Insurance |

|---|---|---|

| Payout Type | Hospital bills reimbursed | Lump sum on diagnosis |

| Usage | Hospital & medical only | Any purpose (EMIs, expenses) |

| Premium | Higher with age, hospitalization only | Lower for young, higher after 40 |

| Best For | General hospitalization | Serious diseases, income protection |

Exclusions to Watch Out For

- Illness diagnosed within 90 days of buying policy.

- Pre-existing critical illnesses.

- Lifestyle-related exclusions (HIV/AIDS, drug abuse).

- Non-specified severity (e.g., minor heart attack not covered).

Case Study: Ritu’s Safety Net

Ritu, a 35-year-old IT professional, had a ₹10 lakh health policy + ₹20 lakh CI cover. When diagnosed with breast cancer in 2024, her hospital bills (~₹7 lakh) were covered by health insurance, while her CI cover paid her ₹20 lakh lump sum. That helped her manage 6 months of no salary + EMIs stress-free.

Premium Trends in 2025

- ₹10 lakh CI cover for 30-year-old: ₹2,500–₹4,000/year.

- ₹20 lakh CI cover for 40-year-old: ₹6,000–₹10,000/year.

- ₹50 lakh CI cover for 45-year-old: ₹18,000–₹25,000/year.

Best bought before 35 to lock in affordability.

Why This Matters

Critical illness insurance fills the income gap regular health plans can’t. With rising cancer, diabetes, and cardiac cases in India, CI cover is not a luxury—it’s a necessity.

Next, read: Top 10 Exclusions in Health Insurance Policies

🩺 Protect Your Future from Critical Illness

Use Insurance+ to compare critical illness plans, or start a career guiding families with eBharat’s HDFC Life Agent Network.

🔍 Compare Critical Illness Plans