At a Glance

- Scam Type: Fraudulent crop insurance claims under PMFBY

- Regions Affected: Karnataka, Maharashtra, Haryana

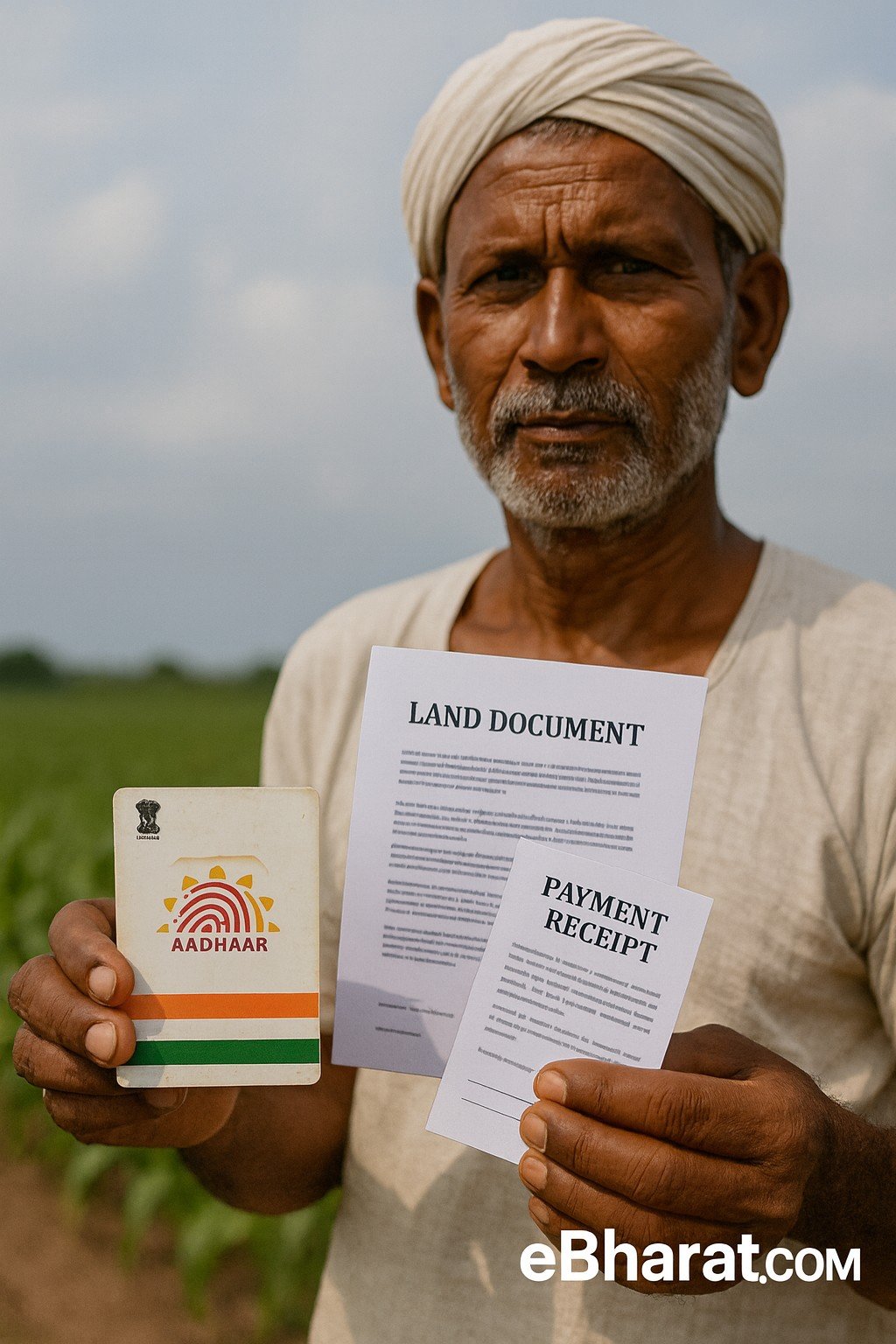

- Modes: Fake policy enrollment using Aadhaar, false crop data

- Who’s Involved: Agents, CSC operators, middlemen, officials

- Why it matters: Genuine farmers are left uncompensated, while fraudsters pocket claims

The Regulator Steps In

India’s flagship agricultural safety net — the Pradhan Mantri Fasal Bima Yojana (PMFBY) — is under fire after widespread reports of insurance scams targeting vulnerable farmers. According to multiple news reports and FIRs filed in Karnataka, Maharashtra, and Haryana, agents and Common Service Centre (CSC) operators are tricking farmers with false policy promises, fake registrations, and backdoor claim settlements.

In many cases, compensation was released under fake names, while genuine farmers received nothing — even after suffering drought or pest loss.

What Was Found

- Fake Aadhaar-linked registrations

Agents collected Aadhaar and land documents promising “free crop insurance” or “no upfront payment.” Farmers were unknowingly enrolled with fake crops or inflated land sizes. - Bogus crop entries and land fraud

Claims were submitted for crops that were never planted, or on government land. In Haryana, outsiders registered mustard fields as chickpea crops for false claims. - 50% commission demand post-payout

In Karnataka, agents asked farmers to share half of the insurance payout once the compensation arrived. Many had no idea they were even insured. - GPS tampering and record manipulation

Location tagging, which should verify crop and land details, was falsified in several districts. In some blocks, multiple farmers had identical GPS coordinates. - Genuine farmers excluded

Those who directly paid premiums or submitted correct claims often found their names missing from payout lists — because others had already claimed on their behalf.

The Loss, in Real Terms

| Region | Nature of Fraud |

|---|---|

| Maharashtra (Nanded) | 40 CSC operators filed 4,453 fake claims |

| Haryana (Mahendragarh) | 22 outsiders insured land they didn’t own |

| Karnataka (Haveri, Gadag) | Farmers promised payouts, then cheated of 50% share |

Why This Case Matters

This isn’t a one-off scam — it reveals deep cracks in how crop insurance is distributed in India. PMFBY is meant to help farmers recover from losses. But when middlemen abuse Aadhaar data and manipulate claims:

- Farmers lose trust in the system

- Taxpayer funds go to the wrong hands

- Drought-affected families are left without help

As climate risks grow, a broken insurance chain can push small farmers into debt and distress.

For Farmers: Caution Flags

- Don’t give Aadhaar or land records to anyone without written proof.

- Always submit your own crop insurance online or through verified local agriculture officers.

- Check your insurance status at pmfby.gov.in.

- If you receive a payout you didn’t apply for — report it immediately.

- Never agree to “commission sharing” or verbal policy promises.

The Government’s Message

While the Centre hasn’t issued an official nationwide probe, FIRs and agriculture department alerts suggest a growing concern among regulators. In many states, agriculture officials are calling for biometric verification and stricter audits at CSCs and agent centers.

This could trigger a PMFBY reform wave, with tighter GPS-based monitoring, real-time dashboards, and village-level transparency reports.

“As India pushes for greater rural insurance coverage, protecting farmers from fraud must be just as important as offering them protection on paper. Stay alert, verify every policy, and never sign without proof.”

Farmers’ Wake-Up Call

If someone offers you “guaranteed” crop insurance or says “no payment needed” — be alert. These scams hurt the very people the system is meant to protect. Always verify, record, and report.

If in doubt, visit your local agriculture office or check your policy at pmfby.gov.in

“As the PMFBY enrollment window remains open in many states, including Uttar Pradesh where the deadline has been extended to August 14–30, it’s critical for farmers to ensure their registration is genuine and backed by a valid receipt.”

🚜 Don’t Fall for Fake Crop Insurance Promises

Thousands of farmers have been cheated with fake crop insurance policies. Protect your hard work by comparing only verified insurance plans on Insurance+.

👉 Compare Genuine Crop Insurance Plans on Insurance+💡 Want to build trust as an ethical insurance agent? Apply here to join our verified agent network.