As India moves toward a greener future, electric vehicles (EVs) are gaining popularity. But one surprising factor for new EV owners is the higher insurance premium compared to petrol and diesel vehicles.

In 2025, EV insurance remains costlier due to expensive batteries, limited repair networks, and higher claim risks. Let’s understand why.

Key Reasons Why EV Insurance Costs More

1. High Battery Replacement Costs

- The EV battery is the single most expensive component.

- Replacement can cost anywhere between ₹4–8 lakh for premium models.

- Since insurance covers battery damage (including fire and short-circuits), premiums are higher.

2. Limited Repair Infrastructure

- Unlike petrol/diesel cars, EV service centers are fewer in India.

- Insurers factor in higher logistics and specialized mechanic costs.

- Longer repair times = higher claim payouts.

3. Expensive Spare Parts

- EV-specific components (motors, controllers, battery packs) are mostly imported.

- This drives up claim costs when parts need replacement.

4. Higher Risk of Fire & Accidents

- Lithium-ion batteries are prone to fire if damaged.

- Insurers see this as a higher risk factor, resulting in extra premium loading.

5. Limited Data for Risk Calculation

- EVs are relatively new in India.

- Insurers have less historical data for claims.

- To cover uncertainty, they charge more initially.

IRDAI Guidelines for EV Insurance (2025)

- Discounts offered: IRDAI allows up to 15% discount on third-party EV insurance to encourage adoption.

- Mandatory battery coverage: Insurers must include battery cover in policies.

- Green incentives: Some insurers offer special discounts for EV owners under eco-friendly initiatives.

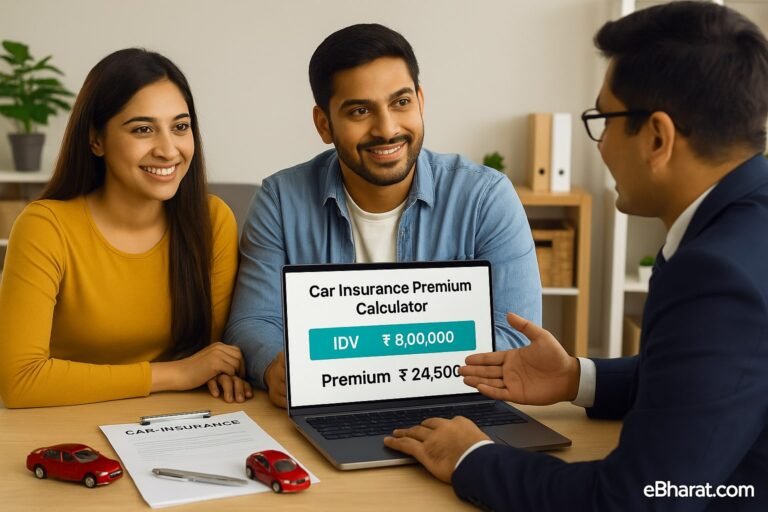

Case Study: Ritu’s EV Sedan

Ritu bought an electric sedan in Delhi in 2025. Her comprehensive premium was ₹42,000/year, compared to ₹28,000 for a similar petrol car. However, when her EV battery malfunctioned after water damage, her insurer covered ₹5.5 lakh repair cost—a payout far higher than the premium she paid.

Lesson: While EV insurance is expensive, it protects against massive financial shocks.

Quick Infobox: EV vs Petrol Car Insurance (2025)

| Factor | EV Insurance | Petrol/Diesel Insurance |

|---|---|---|

| Premium Cost | Higher | Lower |

| Battery Coverage | Included | Not applicable |

| Spare Parts | Imported, expensive | Widely available |

| Repair Centers | Limited | Extensive |

| Claim Risk | High (battery fire/water) | Moderate |

Why This Matters

India’s EV market is booming, but insurance costs remain a key factor for buyers. While premiums are higher, EV insurance offers critical protection against high battery and repair costs.

Next, read: Pay-As-You-Drive Insurance: IRDAI’s New Experiment Explained

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent