Health insurance doesn’t have to burn a hole in your pocket. In 2025, several family floater plans in India offer wide coverage—cashless hospitals, OPD, maternity, and even mental health—at surprisingly low premiums. Here are 10 family health policies that give you more value for less.

India Snapshot

- Family floaters often start from ₹5,500/year, scaling up by coverage and benefits.

- OPD, maternity, ambulance, AYUSH cover, and restoration features are now common in low-premium plans.

- Key offerings by insurers: thematic plans include wellness, global cover, and psychiatric benefits.

- Niva Bupa’s Heartbeat Plan covers up to 19 family members under one policy.

Top 10 Family Health Plans with Budget-Friendly Premiums

Here’s a curated list of strong plans that often come with surprisingly low premiums when you compare features:

| Plan Name | Standout Benefits |

|---|---|

| Aditya Birla Activ Health Platinum | OPD, day-care, home treatment, obesity treatment; covers entire family. |

| Bajaj Allianz Health Guard | Maternity, road ambulance, preventive check-ups; floater up to ₹1 crore. |

| Care (Religare) Supreme | Organ donor, daily allowances, maternity, check-ups. |

| Cholamandalam Flexi Health | OPD (vision/dental), maternity, ambulance, extended hospitalization. |

| Digit Health Insurance Plan | Psychiatric illness, global coverage; ₹2 lakh–₹3 crore options. |

| HDFC ERGO Optima Secure | 4× coverage, OPD, AYUSH, “Protect” non-medical cover. |

| SBI Arogya Supreme | OPD, recovery benefits, multiplier for serious illnesses. |

| Oriental Happy Family Floater | Mental illness, OPD (dental/optical), maternity. |

| Niva Bupa Heartbeat | Covers up to 19 family members; maternity, HIV/AIDS, mental illness, alternative treatment. |

| Galaxy Promise Plan | Home care, hospice, AYUSH for wide coverage beyond hospitalization. |

These plans often fall under ₹15,000/year for a floater covering parents, spouse, kids, and sometimes in-laws—ideal value for middle-class families.

What Makes These “Low-Premium Surprises” Work?

- Smart Packaging – Maternity, mental health, and OPD included in floaters.

- Wide Coverage – High sum insured up to ₹3 crore for families in some plans.

- Restoration & Multipliers – Automatic top-up benefits or restored coverage post-claim.

- Network Strength – 10,000+ hospitals across India to ensure cashless access in emergencies.

- GST Invoices & UPI Payment – Most plans issue GST-compliant invoices and support UPI or card payments.

Pros and Cons

Pros

- Comprehensive family coverage under one affordable premium.

- Includes lesser-known but valuable benefits like OPD, maternity, mental health.

- Easy cashless access at network hospitals.

- Covers pre/post-hospital care, AYUSH, ambulance, wellness.

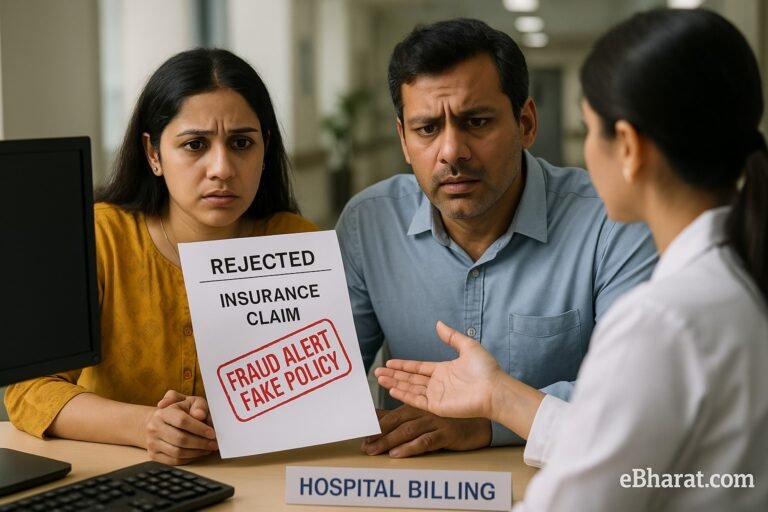

Cons

- Sum assured is shared in floaters—one major claim may exhaust coverage.

- Pre-existing diseases may carry waiting periods.

- Mental health and OPD definitions vary across plans—read fine print.

Quick Checklist for Indian Families

- Decide sum insured based on ages and health needs.

- Pick plans with OPD, maternity, AYUSH, and mental health benefits.

- Confirm network hospital coverage.

- Compare premium quotes using GST/UPI tools.

- Keep premium receipts for tax deduction under Section 80D.

- Aim for lifelong renewability and restoration features.

Secure your family’s health affordably—start comparing plans now:

Compare Quotes on PolicyBazaar

Explore Family Plans on Coverfox

In 2025, family health insurance in India offers unprecedented value. CWth OPD, restoration, and maternity features built in—and premiums well under ₹15,000/year—choosing smart means protecting your family without breaking the bank. Your peace of mind starts here.