Introduction

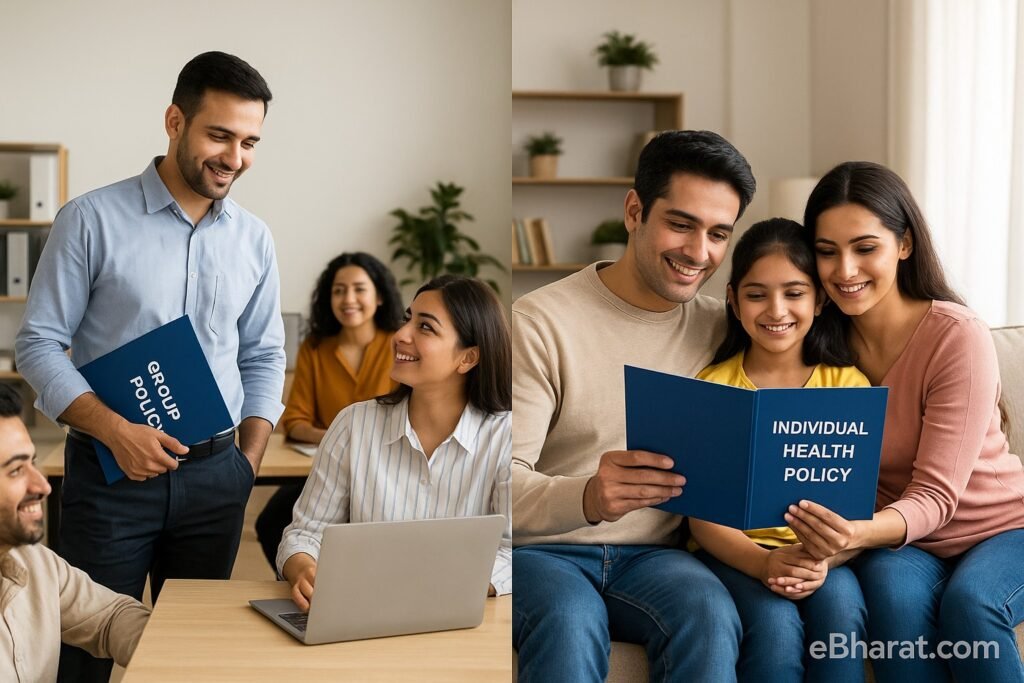

Health insurance is no longer optional—it’s a necessity in India. But when it comes to choosing between a group health policy (offered by employers) and an individual health policy (bought directly), many people get confused.

Both options provide medical protection, but they differ in coverage, cost, flexibility, and ownership. Let’s break down the key differences in simple language.

What is Group Health Insurance?

- Definition: A single health insurance plan that covers a group of people, usually employees of a company.

- Cost: Premium is usually paid by the employer (sometimes partially by employees).

- Coverage: Often includes pre-existing diseases, maternity benefits, and sometimes family cover.

- Drawback: Coverage ends if you leave the job or if the employer stops the plan.

What is Individual Health Insurance?

- Definition: A personal health policy that you buy directly from an insurer.

- Cost: Premium is paid by you (can claim tax benefits under Section 80D).

- Coverage: Fully customizable—sum insured, add-ons, and duration as per your choice.

- Benefit: Coverage continues as long as you renew, regardless of job changes.

Differences Between Group and Individual Health Policies

| Aspect | Group Health Policy | Individual Health Policy |

|---|---|---|

| Who Buys? | Employer (for employees) | Individual/family directly |

| Premium Payment | Paid by employer | Paid by policyholder |

| Pre-existing Disease Cover | Usually covered from Day 1 | Waiting period of 2–4 years |

| Portability | Ends if you quit job | Remains active if renewed |

| Customization | Limited, decided by employer | Flexible, based on individual needs |

| Tax Benefits | Not available to employee | Available under Section 80D |

Which One is Better?

- For Employees: Group health is a great starting point since it’s free or low-cost, with immediate coverage.

- For Families & Long-Term Security: Individual health insurance is better because it gives continuity, flexibility, and tax benefits.

- Best Strategy in 2025: Use group cover as a base, but always buy an individual/family floater policy for long-term protection.

Real-Life Example

Ravi works at an IT company in Bengaluru. His employer provides a group health plan of ₹3 lakh. But when his wife needed surgery costing ₹6 lakh, the group cover wasn’t enough. Luckily, Ravi had an individual floater plan of ₹10 lakh, which covered the balance.

Lesson: Group cover is good, but individual cover is essential for bigger risks.

Group and individual health policies are not competitors—they complement each other. Group plans give you instant and affordable protection, while individual plans provide long-term security and flexibility.

In 2025, the smart approach for Indian families is to use both together for maximum protection.

Confused Between Group & Individual Health Insurance?

Both policies serve important roles. Group health is cost-effective for employees, while individual health ensures long-term flexibility.

👉 Want the full picture?

Read our Complete Guide on Group Insurance.

📢 Found this guide useful? Share it with your network: