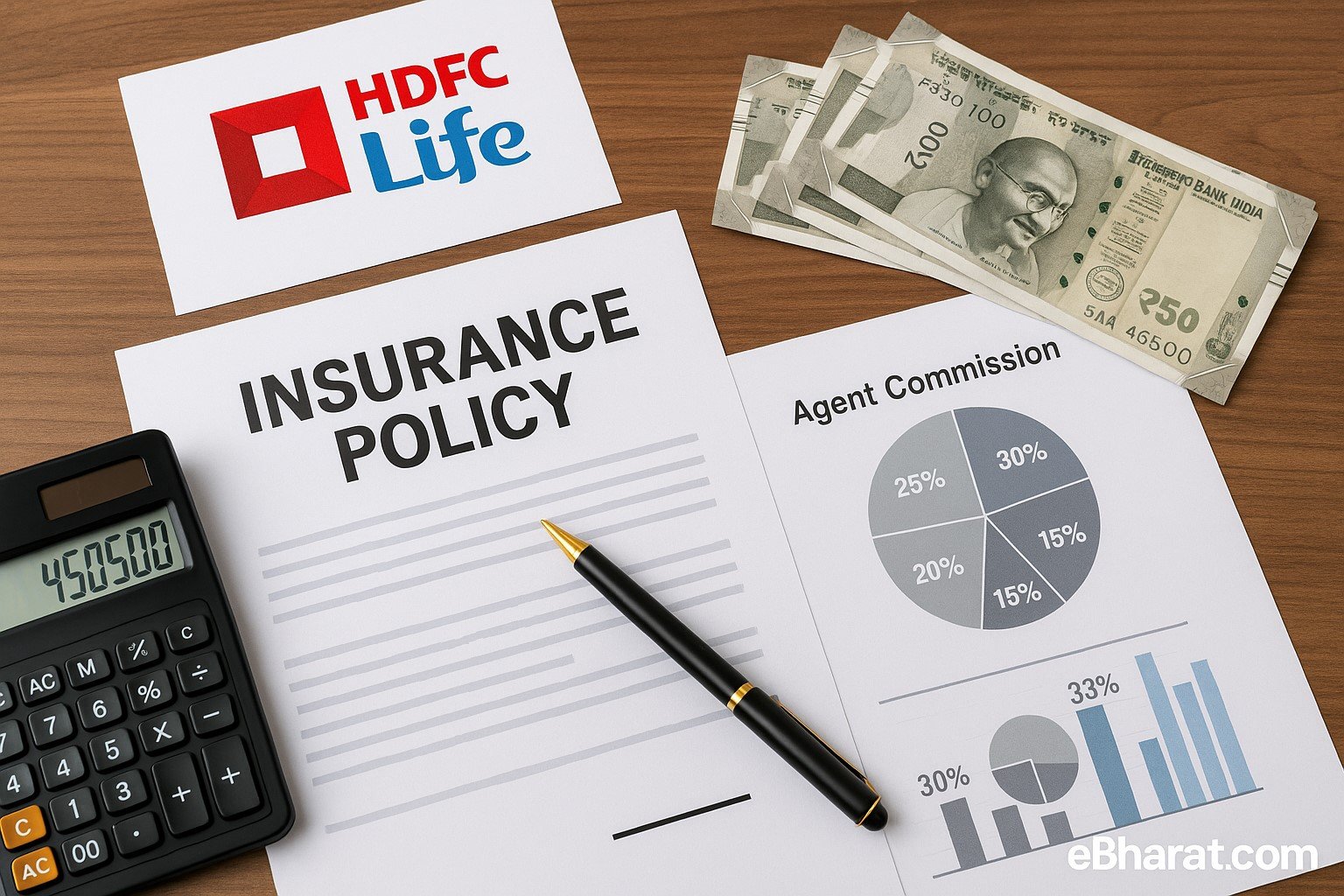

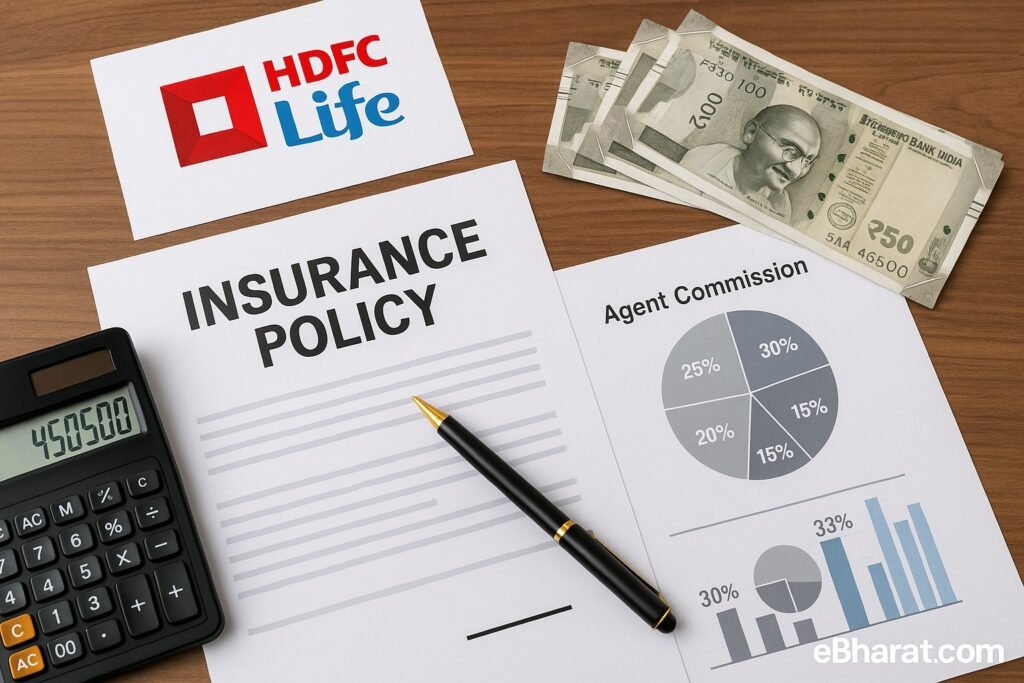

HDFC Life is one of India’s largest life insurers and also among the most preferred companies for insurance agents. For 2025, HDFC Life has updated its commission structure in line with IRDAI guidelines, offering different rates for term plans, ULIPs, pension products, and traditional savings policies. Understanding this commission chart is crucial for agents, general agency (GA) partners, and advisors planning their yearly targets.

In this guide, we break down first-year commission, renewal commission, ULIP vs Term commission differences, and GA perks, along with examples of how payouts are calculated.

First-Year Commission Rates (2025)

| Product Category |

Plan Type |

First-Year Commission |

Renewal Commission |

|---|---|---|---|

| Term Insurance | Individual Term | 30–35% | 7.5% |

| ULIPs | Equity/Hybrid | 2–7% | 1–2% |

| Pension | Retirement | 5–7% | 1–2% |

| Savings | Traditional | 30–35% | 7.5% |

| Micro & Rural | PMJJBY/Low-Ticket | 10–20% | 5% |

Renewal Commissions Explained

- Renewal commissions keep flowing as long as the policyholder continues to pay premiums.

- For term and savings plans, renewal commission is usually 7.5% after the first year.

- For ULIPs and pension products, renewals are modest (1–2%) but can add up with large-ticket clients.

- MDRT and GA structures can improve effective renewal income by giving bonus payouts on persistency.

ULIP vs Term Plan Commission

- ULIPs: Low commission but high ticket size. Example: A ₹2 lakh annual premium with 5% commission = ₹10,000 in year one.

- Term Plans: High commission percentage but usually lower premiums. Example: A ₹25,000 annual premium at 35% = ₹8,750 in year one.

ULIPs reward high-net-worth clients, while term plans give faster commission % wins.

Pension & Savings Plan Focus

- Pension plans are sticky, with clients paying for decades, ensuring stable renewal income.

- Savings/endowment products have strong first-year commission, making them attractive for short-term goals.

MDRT & GA Edge

- MDRT qualifiers with HDFC Life often achieve higher persistency bonuses.

- GA structures allow overrides of 3–5% on the business written by sub-agents.

- In 2025, HDFC Life is pushing MDRT and GA growth with digital sales incentives.

Why This Matters for Agents

Understanding HDFC Life’s commission chart helps agents:

- Plan targets between high % term plans vs high-ticket ULIPs.

- Balance short-term income (first-year commission) with long-term passive income (renewals).

- Decide between individual agent model vs GA expansion.

Conclusion

The 2025 commission structure reflects IRDAI’s focus on transparency, while still leaving room for agents and GA partners to earn well. Term and savings plans remain the bread-and-butter for fast income, while ULIPs and pensions build wealth in the long term.

🚀 Start Your Journey with HDFC Life Today!

Get instant access to commission charts, digital tools, training programs, and the WhatsApp Starter Kit.

📲 WhatsApp Us at 91191 75123