If you’re considering a career as an insurance agent, the first doubt is always the same—“Mujhe commission kitni milegi?” In 2025, HDFC Life continues to offer competitive commissions, attractive renewal income, and incentives that make it a strong choice for both beginners and experienced advisors.

This guide explains the HDFC Life agent commission structure in simple words—first-year payout, renewal payout, bonuses, real-life examples, and tips to grow steady monthly income.

How commissions work in life insurance

Agents earn a percentage of the premium paid by the customer. Your earnings depend on:

- Policy type (Term, Endowment/Savings, ULIP, Whole Life, Health/Riders)

- First-year vs renewal premium

- Incentives (persistency bonus, performance targets, contests/trips)

Pro tip: A smart mix of policies + strong renewals is what builds real, compounding income over time.

HDFC Life Agent Commission Rates (2025 Update)

| Policy Type | First-Year Commission | Renewal Commission |

|---|---|---|

| Term Insurance | ~30–35% | ~5–7.5% |

| Endowment / Savings Plans | ~20–25% | ~4–6% |

| ULIPs (Unit-Linked) | ~15–20% | ~4–5% |

| Whole Life Plans | ~30% | ~5% |

| Health & Riders | ~15–20% | ~5% |

Example: One policy, lifetime fayda

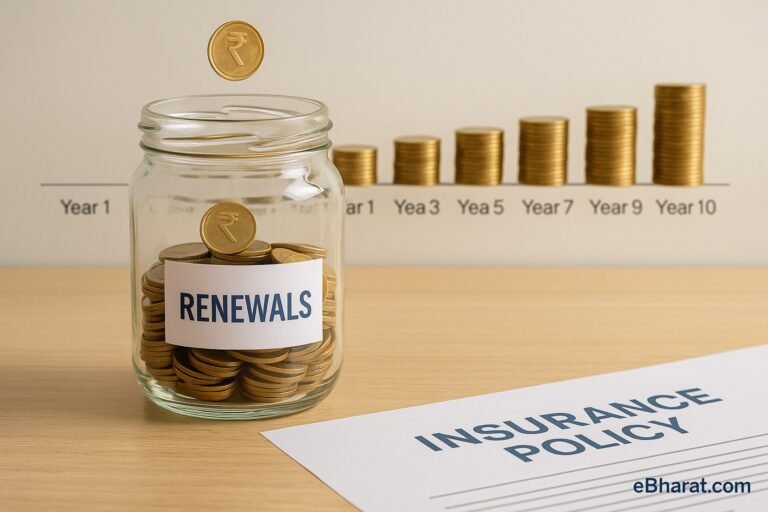

Case: 20-year Endowment plan, annual premium ₹50,000

- Year 1 commission (assume 25%) = ₹12,500

- Renewal commission (assume 5%) = ₹2,500 per year × 19 years = ₹47,500

- Total income from this one policy ≈ ₹60,000+

Renewal income = the real game-changer

New agents often chase only first-year payouts. But wealth is built with renewals. With 100+ active policies and good persistency, you can earn steady income every year, even if one month you don’t close new business.

👉 Related: Why New Agents Fail and How eBharat Helps Them Succeed

Incentives & bonuses you can earn

Beyond basic commissions, HDFC Life typically offers:

- Persistency bonus for keeping policies in force (e.g., 80%+).

- Performance incentives on meeting monthly/quarterly targets.

- Foreign trips, trophies, recognition for top performers.

Quick comparison at a glance (2025)

- Term Plans: ~30–35% first year | ~5–7.5% renewal

- ULIPs: ~15–20% first year | ~4–5% renewal

- Endowment/Savings: ~20–25% first year | ~4–6% renewal

- Whole Life: ~30% first year | ~5% renewal

Practical tips to increase your commission income

- Sell needs-based plans (not just highest commission). Happy clients = higher persistency.

- Bundle relevant riders (critical illness/accident benefit) where suitable.

- Prefer annual premium mode for better discipline and persistency.

- Build a service calendar (premium reminders, policy reviews, nominee checks).

- Use digital tools to compare and explain plans clearly.

Why this commission model works for agents

Incentives & recognition keep you motivated.

Together, it creates both active income (new sales) and passive income (renewals)—a perfect combo for financial growth.

Attractive first-year pays for your prospecting effort.

Renewal stream rewards long-term service.

🔍 Compare Insurance Plans

Use Insurance+ to explore and compare multiple

life & health policies side by side.

Find the best plan for your family in minutes.

🚀 Start Your Career as an HDFC Life Agent

Earn unlimited income, enjoy flexible working,

and build a secure career in insurance.

Join India’s most trusted network today.