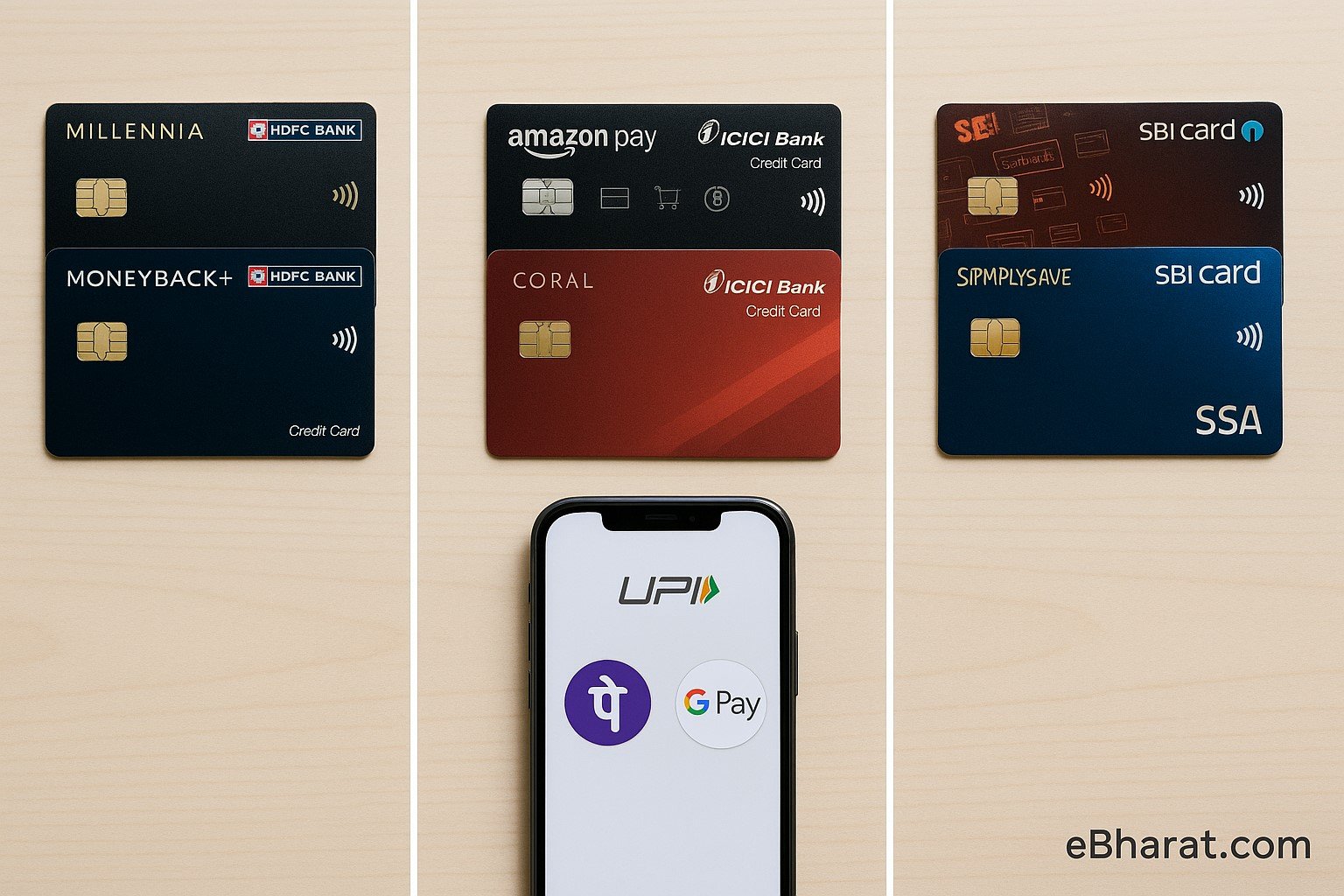

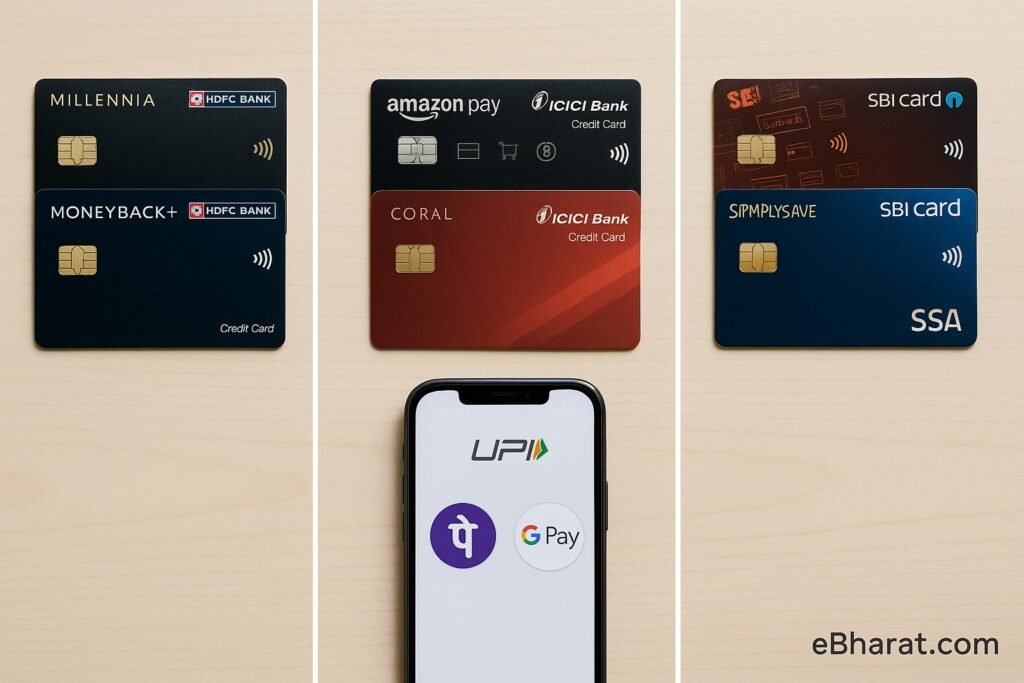

Cashback cards remain the most popular in India, but which bank does it best in 2025? HDFC shines for online shopping, ICICI dominates on Amazon, while SBI remains strong for everyday spends like groceries and fuel. Here’s a clear comparison of their top cards.

India Snapshot

| Bank | Best Cashback Cards (2025) | Cashback % | Best For | UPI Linked (RuPay) |

|---|---|---|---|---|

| HDFC | Millennia, MoneyBack+ | 1.5–5% | Online shopping, Flipkart, Myntra | Yes |

| ICICI | Amazon Pay ICICI, Coral Contactless | 1–5% | Amazon, fuel, dining | Yes |

| SBI | SimplyCLICK, SimplySAVE | 1–10X points (~2.5%) | Fuel, groceries, lifestyle | Yes |

- Annual Fee: Most cards now lifetime-free or fee-waived on annual spends.

- Payments: UPI via RuPay, EMI, NetBanking, cards.

- GST Invoice: GST only on spends, not annual fees.

Compare top cashback cards & apply online:

Apply on Paisabazaar

Check Offers on BankBazaar

HDFC Credit Cards – Cashback Leader for Shoppers

- Millennia Credit Card (RuPay variant):

- 5% cashback on Amazon, Flipkart, Myntra.

- UPI-enabled.

- 1% fuel surcharge waiver.

- MoneyBack+ Card:

- 4 reward points per ₹150 online spend.

- Great for regular online shopping.

Best for: Young professionals, online shoppers.

ICICI Credit Cards – Amazon & Fuel Specialists

- Amazon Pay ICICI Credit Card:

- 5% cashback for Prime users, 3% for non-Prime.

- Unlimited, no cap.

- Coral Contactless Card:

- 2x points on dining & groceries.

- Fuel surcharge waiver.

Best for: Amazon shoppers + fuel spenders.

SBI Credit Cards – Everyday Expense Champions

- SimplyCLICK Credit Card:

- 10x points on Amazon, BookMyShow, UrbanClap.

- Effective cashback ~2.5%.

- SimplySAVE Credit Card:

- 10x points on dining, groceries, movies.

- Entry-level, lifetime free for many users.

Best for: Families & everyday lifestyle expenses.

Pros and Cons

| Bank | Pros ✅ | Cons ❌ |

|---|---|---|

| HDFC |

• Best for online shopping. • UPI-linked RuPay variants. • Strong cashback categories. |

• Reward redemption process less transparent. |

| ICICI |

• Unlimited cashback on Amazon. • Easy fuel & dining perks. • Lifetime-free Amazon Pay card. |

• Weak on non-Amazon shopping. |

| SBI |

• Wide acceptance + simple rewards. • Fuel, grocery, dining cashback. • Good for beginners. |

• Lower cashback % compared to HDFC/ICICI. |

Quick Checklist for Applicants

- Heavy Amazon shopper → ICICI Amazon Pay.

- Frequent Flipkart/Myntra user → HDFC Millennia.

- Family lifestyle spends → SBI SimplyCLICK/SimplySAVE.

- Always choose RuPay variant for UPI linkage.

- Apply online with Aadhaar + PAN for e-KYC.

Pick the cashback card that fits your lifestyle:

Compare & Apply on Paisabazaar

Find Best Offers on BankBazaar

In 2025, the cashback crown isn’t held by one bank—it depends on your lifestyle. HDFC wins for online shopping, ICICI wins for Amazon lovers, and SBI remains the best for everyday expenses like groceries, dining, and fuel. The good news: all three now offer lifetime-free or UPI-linked options, making cashback easier for every Indian.