Introduction

One hospital bill is enough to turn a middle-class family upside down. In Delhi NCR, a heart bypass at a private hospital can cost ₹3–6 lakh. In Jaipur, even a routine appendix surgery may cross ₹1.5 lakh. Without insurance, families often borrow, sell jewellery, or dip into savings meant for children’s education.

That’s why health insurance in 2025 is not just “a product” — it is a survival tool. For many households, it is the only shield between medical emergency and financial disaster.

What is Health Insurance?

At its simplest, health insurance means: you pay a yearly premium, and in return the insurer pays your hospital bills up to a limit (sum insured).

It covers hospitalisation, surgery, medicines, and even pre/post-treatment costs. If your hospital is on the insurer’s network list, you get cashless treatment. If not, you pay first and then get reimbursement.

Difference from govt schemes? Ayushman Bharat gives ₹5 lakh coverage for poor families, but middle-class and salaried workers often need private health insurance because medical inflation has gone far beyond that cap.private and public insurers allow customisation, higher sums insured, and a wider hospital network.

Types of Health Insurance Plans in India

- Individual Policy – covers one person only.

- Family Floater – one sum insured for the whole family, say ₹10 lakh for 4 members.

- Senior Citizen Plan – higher cover for people above 60, with features like domiciliary treatment.

- Critical Illness Policy – lump sum payout on diagnosis of cancer, kidney failure, heart attack.

- Top-up / Super Top-up – extra cover beyond your existing plan.

- Maternity Plan – delivery + newborn care.

- Disease-specific Plans – diabetes, cardiac, or even COVID add-ons.

How Premiums are Calculated

Premiums are not fixed. They depend on age, city, health history, and sum insured.

Example: A 30-year-old in Delhi can get ₹5 lakh cover for around ₹8,000 a year. The same plan for a 50-year-old in Mumbai may cost double. Family floaters are cheaper than buying separate policies.

| Age | Plan Type |

Sum Insured |

Annual Premium (Approx.) |

|---|---|---|---|

| 30 years | Individual | ₹5 lakh | ₹7,000 – ₹9,000 |

| 50 years | Individual | ₹5 lakh | ₹15,000 – ₹18,000 |

| 40 yrs (Family of 3) |

Family Floater | ₹10 lakh | ₹18,000 – ₹24,000 |

*Premiums are indicative, based on insurer websites, 2025. Vary by city and health profile.

Major Health Insurance Providers in India (2025)

Here are some of the leading health insurers, based on claim settlement ratio (CSR), premiums, and hospital network:

| Insurer | CSR (2024) |

Avg. Premium (₹5L SI, 30 yrs) |

Waiting Period (pre-existing) |

Network Hospitals |

|---|---|---|---|---|

| Star Health | 93% | ₹8,200 | 3 yrs | 14,000+ |

| Niva Bupa | 91% | ₹8,500 | 3 yrs | 10,000+ |

| Care Health | 90% | ₹7,900 | 3 yrs | 12,000+ |

| ICICI Lombard | 89% | ₹8,700 | 4 yrs | 6,500+ |

| New India Assurance | 87% | ₹7,600 | 4 yrs | 8,000+ |

| HDFC ERGO | 88% | ₹8,400 | 3 yrs | 12,000+ |

*CSR = Claim Settlement Ratio. Data: IRDAI Annual Report 2024, insurer websites.

IRDAI Rules & 2025 Updates — Why It Matters

- 30-day settlement rule: Families don’t need to wait months for claim money anymore.

- Unified claim form: No more filling different forms for each insurer. Saves stress.

- Portability rights: If you switch from Star to ICICI, your waiting period benefits move with you.

- Standard plans: Arogya Sanjeevani continues as a low-cost option.

Good news: if your claim is not cleared in 30 days, insurer must pay penal interest.

Tax Benefits (80D) with Examples

Section 80D lets you cut tax by paying premiums.

- Self + family (below 60): up to ₹25,000.

- Parents below 60: ₹25,000.

- Parents above 60: ₹50,000.

- Self + family (if any member above 60): ₹50,000.

Example: You are 35 and pay ₹20,000 for your family’s plan. You also buy a ₹35,000 plan for your 62-year-old father. You can claim total ₹55,000 under 80D.

Remember: Cash payment not allowed. Premium must be paid by card, UPI, or net banking.

Government Schemes vs Private Insurance

| Feature | Ayushman Bharat PMJAY |

Private Health Insurance |

|---|---|---|

| Coverage | ₹5 lakh per family | ₹3–50 lakh (customisable) |

| Hospitals | Govt + empanelled private | Wide private networks |

| Premium | Free | ₹5k–₹50k yearly |

| Customisation | No | Yes (add-ons, top-ups) |

Takeaway: Ayushman is a safety net for poor households, but middle class needs private insurance for bigger bills.

Claim Journey — Reality Check

Step 1: Hospital sends pre-auth to insurer.

Step 2: TPA/insurer approves. Sometimes they raise queries even after admission.

Step 3: Bills are settled cashless, but keep copies of prescriptions, diagnostics, discharge summary.

Step 4: Final settlement. If delayed, call insurer helpline directly — don’t just rely on hospital desk.

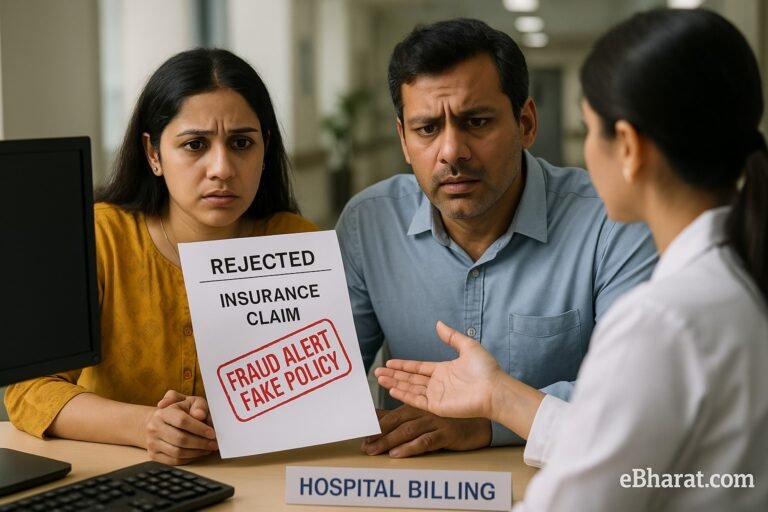

Many families face partial approvals (room rent cap, consumables not covered). Always read exclusions.

Common Misconceptions

- “I’m young, I don’t need insurance.” → IRDAI data: 60% of claims in 2024 came from people under 45.

- “My company cover is enough.” → Employer plans usually have ₹2–3 lakh cover. One surgery can exceed that.

- “Cashless always works.” → Not true. Some hospitals still demand deposit first.

FAQs

Can I claim from employer and personal policy both?

Yes, you can. Use employer cover first, then top up with personal.

What if hospital refuses cashless?

You can still file reimbursement. Keep all bills and get insurer helpline to confirm.

If I forget to renew, do I lose benefits?

Yes. Miss renewal and waiting periods reset. Always enable auto-debit.

Does insurance cover OPD or medicines?

Most plans don’t. Some new riders cover OPD but at extra cost.

Future of Health Insurance in India

Insurers like Star Health are piloting WhatsApp-based claims in Chennai. NHA is pushing for fully paperless systems by 2026.

Wearables and apps may give discounts if you meet fitness goals. But the big shift is faster claims — families won’t wait months anymore.

Health insurance is no longer optional. Whether you are salaried in Delhi or self-employed in Jhunjhunu, one medical emergency can wipe out years of savings. Don’t just look at cheapest premium. Check exclusions, room rent caps, and hospital network before you buy.

This guide is prepared by eBharat.com — an IC-38 licensed advisor. Verified with IRDAI updates (2025).

🚀 Ready to Start Your Insurance Career?

Join eBharat’s HDFC Life Agent Network today and unlock your path to income growth. Get access to digital tools, free training, and our WhatsApp Starter Kit so you can start selling policies from Day 1.

- 📊 PlanMatch tools and ready scripts

- 🎯 Daily leads from content + social funnels

- 🤝 Step-by-step onboarding & mentorship