If you’re starting your career in insurance sales, one of the first questions you’ll face is:

“Should I sell life insurance or health insurance?”

Both have their advantages — but the better choice depends on your earning goals, client base, and selling style.

In this guide, we’ll break it down for you with real-world insights so you can decide the right path for your career.

Understanding Life Insurance Sales

Life insurance is designed to protect a family’s financial future if the policyholder passes away. In India, it’s often bought as a long-term security measure.

Advantages of Selling Life Insurance:

- Higher commissions per sale because policies have bigger ticket sizes.

- Builds long-term relationships, as policies usually last 15–25 years.

- Allows cross-selling of related products like child plans, retirement plans, and investment-linked insurance.

Challenges of Selling Life Insurance:

- Harder to convince clients since benefits are long-term and not immediately visible.

- Premiums may be too high for some customers, making it tougher to sell in lower-income markets.

Understanding Health Insurance Sales

Health insurance covers hospitalisation and medical costs, making it more relatable for clients.

Advantages of Selling Health Insurance:

- Easier to explain — people see immediate value in medical coverage.

- Recurring sales with annual renewals.

- Works well in both urban and rural markets.

Challenges of Selling Health Insurance:

- Smaller ticket size compared to life insurance.

- Higher turn rate if clients find cheaper or more attractive policies elsewhere.

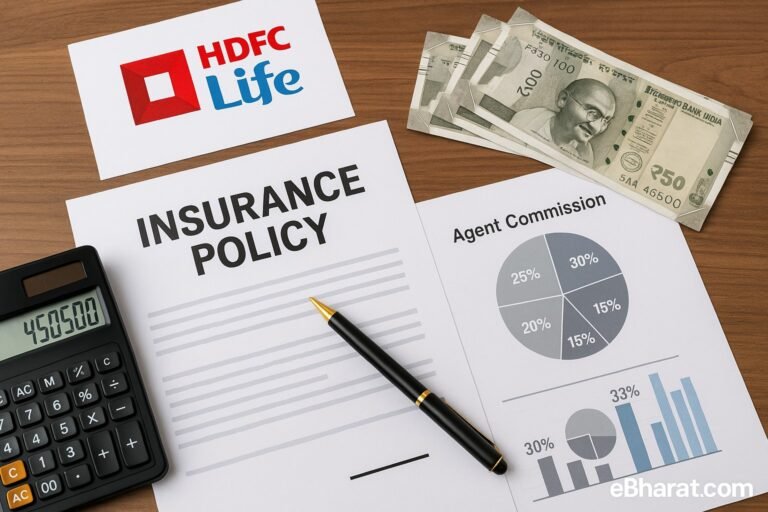

Earnings Potential – Life vs Health Insurance

| Criteria | Life Insurance Agent | Health Insurance Agent |

|---|---|---|

| Average Commission | 25–35% (First Year) | 15–20% (Annual) |

| Client Retention | High (Long-Term) | Medium (Renewal-Based) |

| Sales Difficulty | Harder | Easier |

Which is Better for You?

- Which is Better for You?

Choose Life Insurance if you’re comfortable with high-value sales and building long-term trust with clients.

Choose Health Insurance if you prefer faster sales cycles and working with a wider audience. - Many top-performing agents actually sell both — using life insurance for big-ticket commissions and health insurance for steady annual income.

Related Read: IRDAI Rules Every Insurance Agent Should Know (2025 Update) — Stay compliant while boosting your earnings.

Maximise Your Income — Sell Both Life & Health Insurance

Join the eBharat Digital Agent Network and get:

- Access to top insurers for life, health, and general insurance.

- PlanMatch — compare policies instantly for clients.

- WhatsApp Kit — ready-made creatives and messages for follow-ups.

- Sales Scripts — proven words to close more deals.

Apply Now to Become a Digital Insurance Agent and start earning from both markets today.