Fixed deposits are still India’s safest savings tool, but rates vary widely across banks and NBFCs. In 2025, small finance banks are offering up to 9.25%, while large private and PSU banks remain in the 6.5–7.5% range. Here’s the updated list and a smart FD ladder strategy to maximise returns.

- Current Range (Sept 2025):

- PSU Banks: 6.25%–7.25%

- Private Banks: 6.5%–7.5%

- Small Finance Banks: 7.5%–9.25%

- Senior Citizens: +0.5% extra.

- Payment: UPI, NetBanking, Debit Cards, branch cash/cheque.

- Taxation: Interest taxable under slab; 80TTB benefit up to ₹50,000 for seniors.

Compare top FD rates & open instantly online:

See FD Offers on Paisabazaar

Check Bank FDs on BankBazaar

Highest FD Rates in India Today (2025 Snapshot)

| Bank / NBFC | 1 Yr Rate | 3 Yr Rate | 5 Yr Rate | Senior Citizen | Notes |

|---|---|---|---|---|---|

| Utkarsh Small Finance | 8.25% | 8.75% | 9.25% | +0.5% | Among highest today |

| Jana Small Finance | 8.2% | 8.7% | 9.2% | +0.5% | Flexible payouts |

| Suryoday Small Finance | 8% | 8.5% | 9% | +0.5% | Monthly interest option |

| Equitas Small Finance | 7.9% | 8.4% | 8.9% | +0.5% | Good digital onboarding |

| ICICI Bank | 7% | 7.25% | 7.5% | +0.5% | Stable, large bank |

| HDFC Bank | 7% | 7.25% | 7.5% | +0.5% | Popular with seniors |

| SBI | 6.75% | 7% | 7.25% | +0.5% | Safety & wide network |

Rates updated daily — always check official bank/NBFC page before booking.

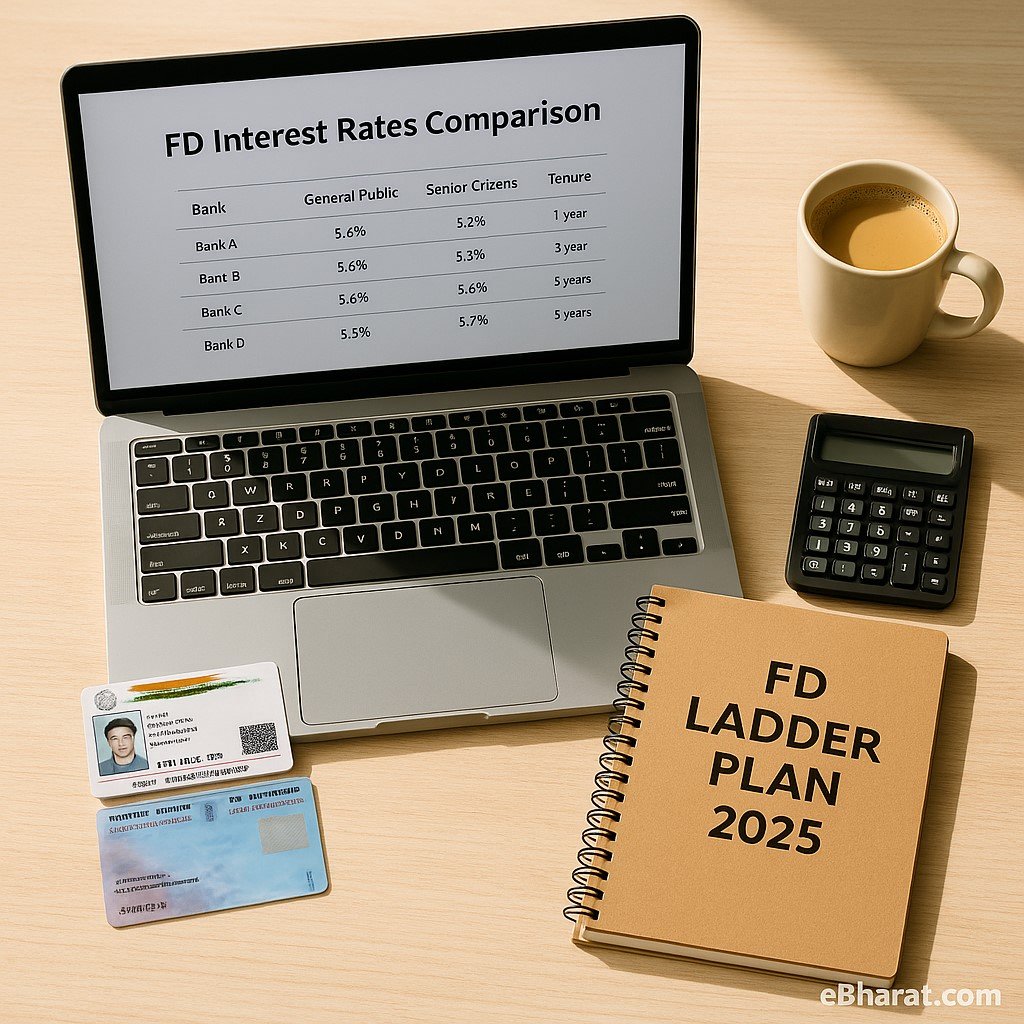

Smart FD Ladder Builder (Explained)

- Step 1: Split ₹5 lakh into 5 parts of ₹1 lakh each.

- Step 2: Book across 1 yr, 2 yr, 3 yr, 4 yr, 5 yr FDs.

- Step 3: Every year, reinvest the matured FD into a fresh 5-year FD at the prevailing highest rate.

- Result:

- Liquidity every year (₹1 lakh matures).

- Capture rising rates (as RBI cycles move).

- Higher average return than single-tenure FD.

Use this strategy to beat inflation while keeping money liquid.

Pros and Cons

Pros

- High certainty of returns.

- Laddering = better liquidity + higher blended yield.

- Senior citizen benefit = extra income.

Cons

- Interest fully taxable.

- Premature withdrawal penalties.

- FD rates may drop if RBI cuts rates.

Quick Checklist

- Compare PSU, private, and SFB FD rates.

- Use FD laddering for balance of safety + liquidity.

- Prefer online booking for instant GST invoices.

- Seniors → always choose senior citizen FD variant.

- Reinvest interest payouts for compounding.

Maximize your FD returns with smart choices:

Check FD Rates & Open on Paisabazaar

Compare Bank FDs on BankBazaar

In 2025, fixed deposits in India remain a safe and popular choice, with small finance banks offering up to 9.25% returns. Pairing this with an FD ladder strategy ensures both liquidity and better yields. For savers, it’s the best way to balance safety, growth, and flexibility.