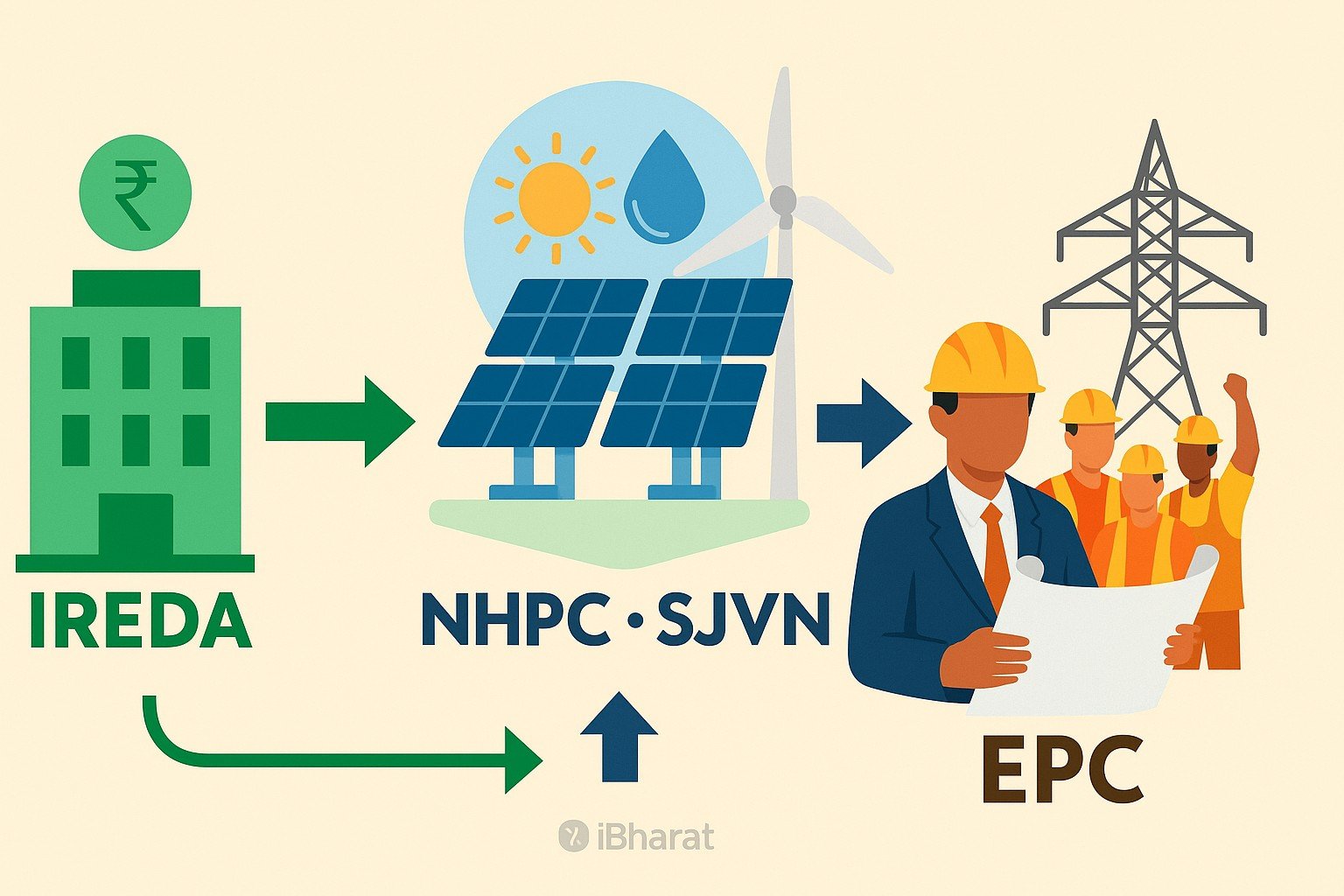

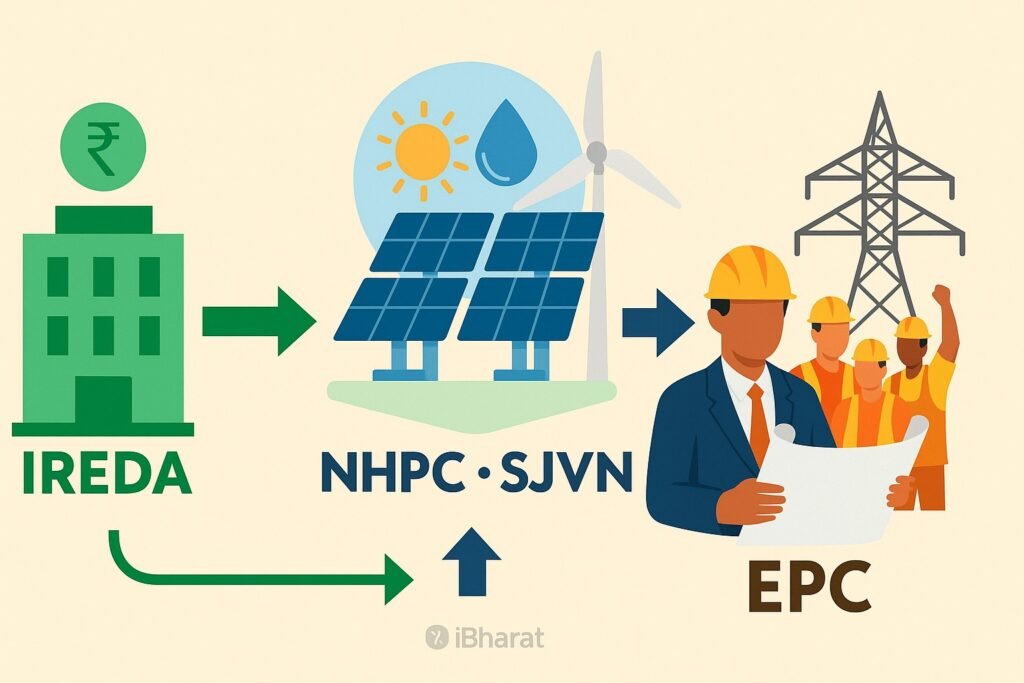

New Delhi — India’s green transition is anchored not just in megawatts of capacity, but in the financing flows that enable PSU majors like NHPC and SJVN to roll out large renewable projects. At the heart of this system is the Indian Renewable Energy Development Agency (IREDA), the state-owned lender that sanctions and disburses loans across solar, hydro, and wind.

Understanding how IREDA’s pipelines connect to PSU capex cycles provides clarity on which projects move fastest, how tariff bids get funded, and where spillovers emerge for EPC contractors and power equipment makers.

IREDA Loan Pipelines: By Technology

IREDA’s loan book is spread across solar, hydro, wind, and emerging technologies.

- Solar: The largest share, with consistent sanctions for NHPC’s utility-scale solar parks and SJVN’s hybrid plants.

- Hydro: Tailored financing for NHPC, which continues to expand run-of-river and storage hydro capacity.

- Wind: Smaller share, but targeted support for SJVN projects in Rajasthan and Gujarat.

Disbursement pace matters as much as sanction volume — faster disbursals translate into quicker project mobilization and EPC order placement.

From Sanction to PSU Capex

The pipeline works in a three-step pass-through:

- IREDA sanctions loan lines to NHPC/SJVN against identified projects.

- Disbursements begin once land acquisition, tariff bidding, and regulatory approvals are in place.

- PSUs release EPC tenders to firms like BHEL, KEC International, Tata Power Solar, and others, enabling on-ground execution.

This linkage means IREDA’s sanction announcements are early indicators of upcoming PSU tender flows.

Tariffs, Bids, and Commissioning Timelines

Sanctioned projects feed directly into tariff bids at SECI/state auctions. For example:

- NHPC’s 1,000 MW solar projects financed partly through IREDA lines saw tariffs in the ₹2.50–₹2.60/kWh band, commissioned in phases over 18–24 months.

- SJVN’s hybrid parks in Gujarat and Rajasthan moved from IREDA approval to EPC award in under a year, with commissioning targeted for FY27.

Commissioning timelines often track loan drawdowns, since EPC contractors get paid against milestone-linked disbursements.

Spillovers Into PFC/REC

While IREDA leads in green lending, PFC and REC often co-finance larger projects, especially hydro schemes.

- For NHPC’s Subansiri and Teesta projects, PFC/REC joined in syndicates alongside IREDA.

- This creates a blended capex pipeline, where multiple state financiers align their books with the execution calendars of PSUs.

Linking Pipelines to EPC Orders

The real economy impact is in EPC order flows. A clean schematic looks like this:

IREDA Sanctions → NHPC/SJVN Project Capex → EPC Orders to BHEL/KEC/L&T

Examples:

- 2022–23: IREDA cleared ~₹2,000 crore in loans for NHPC’s solar projects in Rajasthan; EPC orders followed to Tata Power Solar and L&T.

- 2023–24: SJVN’s wind-solar hybrid in Gujarat saw IREDA + REC financing; contracts issued to KEC International for transmission links.

- 2024–25: NHPC’s floating solar initiatives (500 MW) drew IREDA support, with BHEL bagging module supply and balance-of-system EPC work.

For investors, tracking IREDA’s sanction pipeline provides:

- Early signals of PSU-led renewable capacity growth.

- Visibility into EPC order books of listed contractors.

- Clues on commissioning risk if disbursals lag.

As India targets 500 GW of renewables by 2030, IREDA’s role as the financing bridge makes its quarterly loan announcements a leading indicator of capex flows and EPC earnings visibility.