If you’re planning to start a career as an insurance agent in India — whether with LIC, HDFC Life, ICICI Lombard, or through a broker like eBharat — one of the first questions you’ll ask is:

How much commission will I earn?

In this 2025 updated guide, we break down the latest commission rates for life insurance, health insurance, and general insurance.

We’ll also explain how POSP agents under brokers like eBharat can earn more with the same effort.

What Is an Insurance Commission?

Insurance commission is the income an agent earns when selling a policy.

It is calculated as a percentage of the premium the customer pays.

- First-Year Commission (FYC): Paid when you sell a new policy

- Renewal Commission: Paid every year the customer renews the policy

- Performance Incentives: Bonuses, trips, or gifts for meeting sales targets

Example: If you sell a ₹50,000 premium term plan with a 30% commission rate, your first-year income is ₹15,000.

If the policy is renewed every year and you earn a 5% renewal commission, you’ll make ₹2,500 each year for as long as the policy is active.

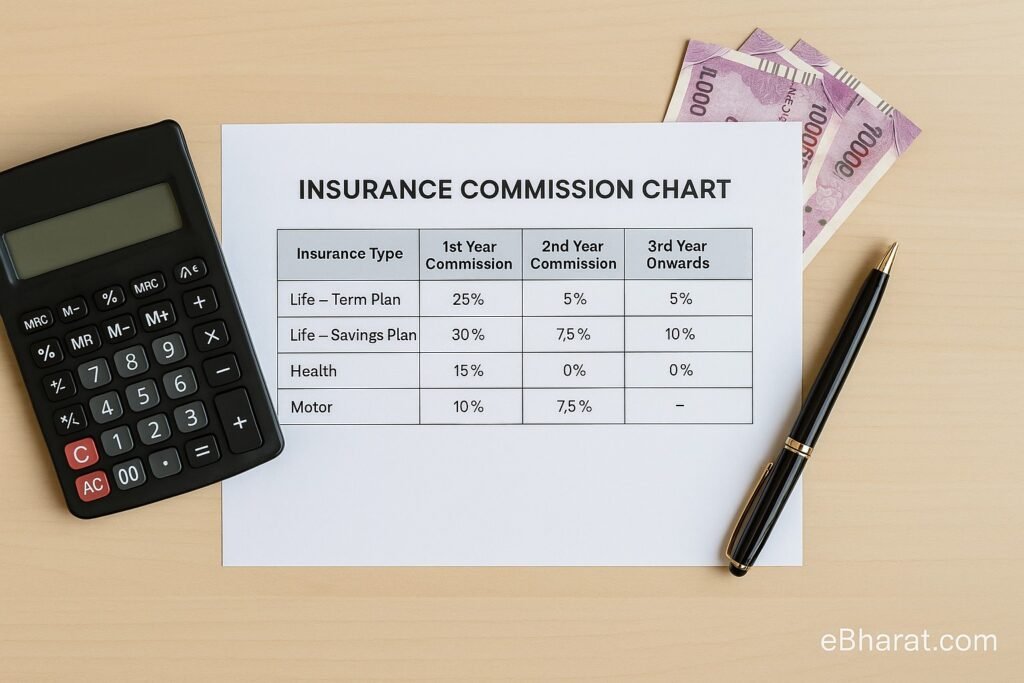

Life Insurance Commission Chart – 2025 (IRDAI Rules)

| Product Type | LIC Agents | Private Company Agents | POSP Agents via eBharat |

|---|---|---|---|

| Endowment/Savings Plans | Up to 35% FYC + renewals | 25–30% FYC + renewals | 25–35% FYC + renewals |

| Term Insurance Plans | 5–7% FYC | 25–30% FYC | 25–30% FYC |

| ULIPs | N/A for LIC | 10–20% FYC | 10–20% FYC |

Health & General Insurance Commissions (2025)

| Product Type | Commission Rate |

|---|---|

| Health Insurance Plans | 15–20% FYC |

| Motor Insurance (New & Renewal) | ~15% Flat |

| Travel Insurance | 10–15% |

| Property/Commercial Insurance | 10–15% |

Note: FYC = First-Year Commission — the percentage of the first year’s premium that the agent earns when selling a new policy. Renewal commissions are smaller but paid annually for the life of the policy.

Why POSP Agents with eBharat Earn More

When you join as a POSP agent under eBharat, you:

- Get access to 50+ insurance plans from 10+ top insurers (except LIC)

- Sell life, health, motor, and investment plans through one dashboard

- Have full commission transparency — no hidden cuts

- Can earn ₹10,000 to ₹1,00,000+ per month depending on sales volume

- Use digital tools like PlanMatch, WhatsApp scripts, and auto-reminder systems

- Work from anywhere in India, no office visits needed

Case Study: Ramesh from Bikaner joined eBharat in 2024 as a part-time POSP agent. In his first month, he sold 3 term plans, 2 health policies, and 4 motor insurance renewals — earning ₹38,000 in commissions without leaving his job.

Bonus, Contest & Incentives

Apart from regular commissions, most insurers and brokers offer:

- Quarterly & Annual Cash Bonuses for meeting targets

- Domestic & International Trips for top performers

- Referral Incentives when you bring in new agents

- Special Festive Contests with gadgets, gold coins, and gift vouchers

High performers can double their income just through bonuses and contests.

Quick Commission Snapshot (2025)

- Life Insurance: Up to 35% FYC + renewals

- Health Insurance: 15–20% FYC

- Motor Insurance: ~15% flat (new & renewal)

- POSP Model: More flexibility + sell across companies

- Bonus Trips & Cash Incentives: Available with most insurers

Final Thoughts

Insurance agent commissions in India (2025) are highly rewarding — especially if you:

- Sell a mix of term, savings, and health plans

- Use digital tools to find and close more clients

- Work under a transparent broker model like eBharat’s

There’s no income cap — your earnings depend entirely on your effort.

Build Your Insurance Income with eBharat

Access 50+ insurance plans, close faster with digital tools, and earn from Day 1.

Access 50+ Plans

- Life, Health, Motor & ULIPs

- Compare & pick best-fit products

100% Online Onboarding

- IC-38 help & e-KYC

- Go live in 2–3 days

Earn from Day 1

- Transparent commissions

- Bonuses, trips & contests

No fees. No targets. Work from anywhere in India.