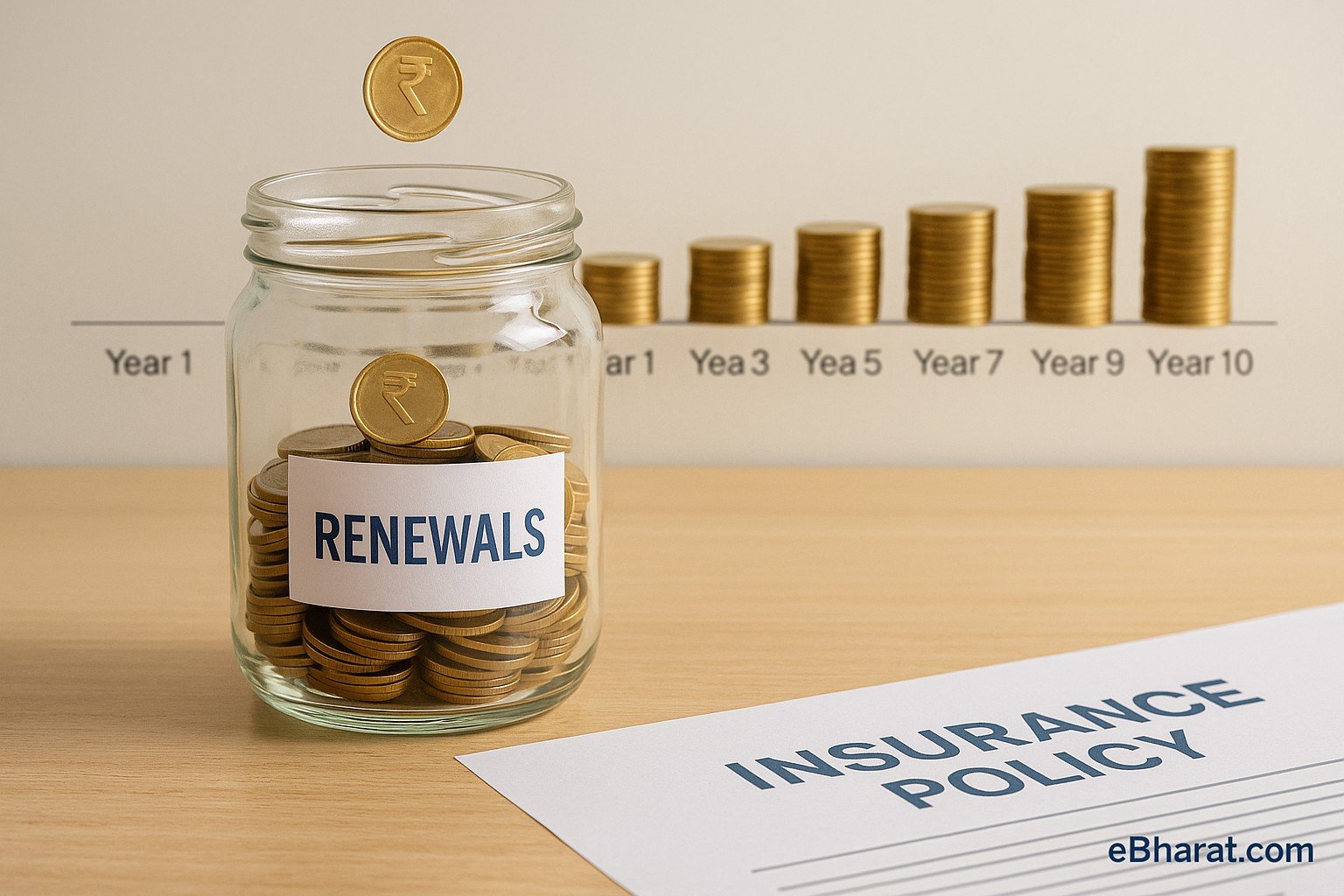

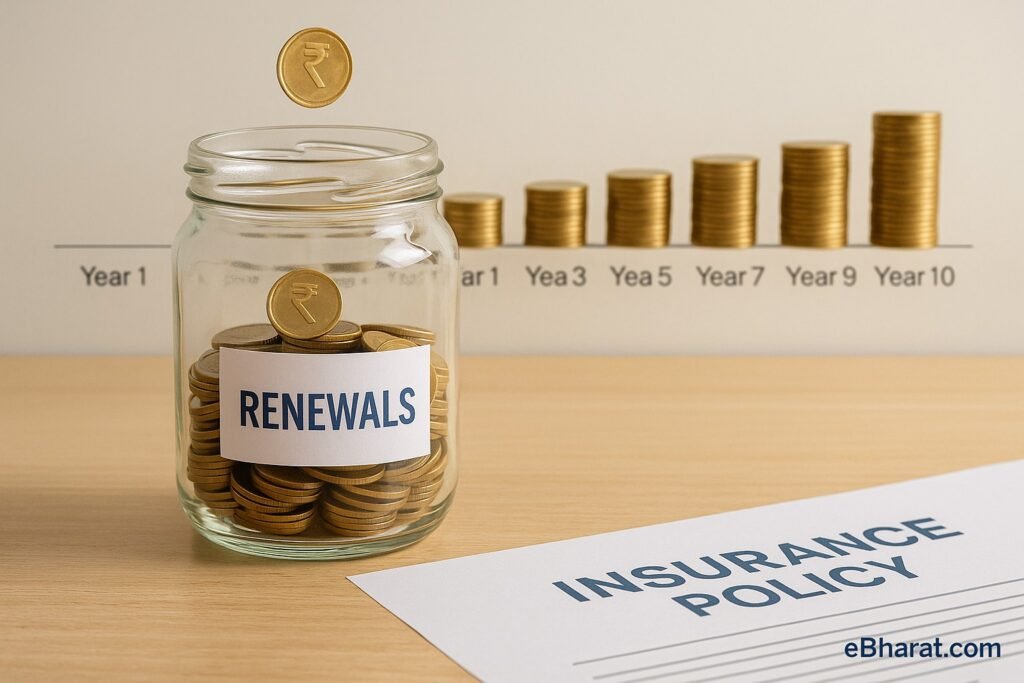

One of the biggest advantages of becoming an insurance agent is that your income doesn’t stop after the first year. Every time your client renews their policy, you keep earning. Over time, this renewal income turns into a powerful passive income stream — something most other careers don’t offer. Let’s break down how much agents can realistically earn from renewals in 10 years.

1. What Are Renewal Commissions?

When you sell a policy, you earn a high first-year commission (25–40% depending on the product). In subsequent years, you continue earning a smaller percentage — usually 5–7% of the annual premium. Though it looks small, when multiplied across hundreds of policies, it becomes substantial.

2. A Practical Example

Suppose an agent sells 100 policies in the first two years, each with an average premium of ₹25,000.

- First Year: Big payout — 30% = ₹7,500 per policy.

- From Year 2 onwards: Renewal commission ~₹1,500 per policy annually.

- Total Renewal Pool (100 policies): ₹1.5 lakh every year, even without new sales.

Now imagine consistently selling 50–60 new policies every year. In 10 years, your renewal base could cross 500+ policies, generating ₹7–10 lakh annually as passive income.

3. The 10-Year Wealth Effect

Renewals don’t just add up — they compound:

- Year 1–2: Mostly fresh commissions.

- Year 3–5: Renewals start cushioning income dips.

- Year 6–10: Renewal pool can generate a steady monthly income, even if fresh sales slow down.

Agents often call renewals their “second salary,” one that grows every year.

4. Why Renewals Matter More Than Ever

- Financial Freedom: Agents with a large renewal base can take vacations or handle personal priorities without worrying about income gaps.

- Career Stability: Even during economic downturns, renewals keep flowing.

- Legacy Income: If maintained, renewal income can even be passed on to legal heirs.

5. Tips to Strengthen Renewals

- Always maintain client relationships — birthdays, anniversaries, and service check-ins.

- Promote auto-debit / ECS payment to avoid lapses.

- Focus on long-term products like endowments, ULIPs, and whole-life policies.

- Track persistency ratio — a 90% persistency can double your 10-year renewal pool compared to a 60% one.

Why It Matters

For agents, renewals are more than side earnings — they’re the foundation of long-term wealth. By consistently adding policies and keeping clients engaged, an ordinary agent can turn their book of business into a ₹1 crore+ lifetime income asset.

This article is part of the complete career roadmap. Read the full guide here → From IC-38 Exam to General Agency: Step-by-Step Agent Income Journey