Insurance is one of the smartest financial decisions you can make — but only when it’s sold transparently.

Unfortunately, some agents use pressure tactics, exaggerated promises, or half-truths to close a deal fast. The result? Buyers stuck with costly, unsuitable policies they regret later.

Here are 7 red flags that should instantly make you pause when someone is pitching you an insurance policy.

1. “This Offer Is Only for Today!”

Any pitch that sounds like a flash sale is a trap.

- Real insurance protection doesn’t expire in 24 hours.

- Urgency is often used to stop you from reading the fine print.

Tip: Take your time, ask for a brochure, and review it at your own pace.

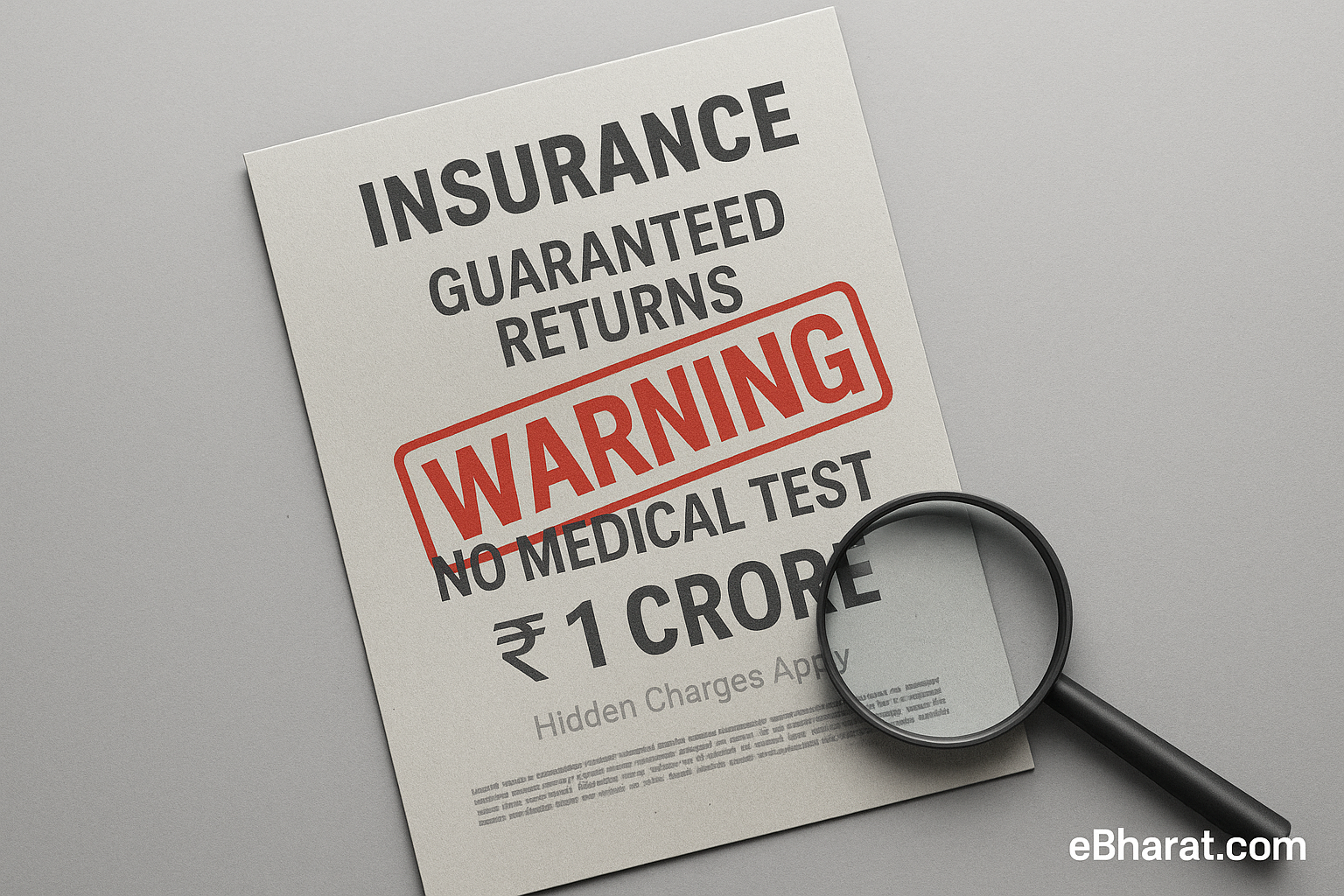

2. “No Medical Test Needed — Even for ₹1 Crore!”

Sounds convenient? It’s a warning sign.

- High-value term insurance normally requires medicals.

- Skipping them could lead to claim rejection later.

Tip: If a ₹1 Cr+ plan is offered without medicals, ask for written terms and Policy exceptions.

3. “Get Guaranteed 12–15% Returns!”

There’s no such thing in life insurance.

- Traditional plans give ~4–6% post-tax returns.

- ULIP returns depend on the market.

Tip: Always ask for the IRDAI-approved Benefit Illustration before buying.

4. “Tax-Free Maturity + Bonus + Cashback + Monthly Income — All in One!”

If it sounds like a buffet deal, it’s probably loaded with complex riders and hidden charges.

Ask:

- What type of plan is this? Term / Endowment / ULIP / Annuity?

- What’s the lock-in period?

- What’s the real return after charges?

If they can’t explain it simply — don’t sign.

5. “Don’t Worry, I’ll Handle Nominee and Payout Later”

NEVER leave key details for ‘later’.

- Nominee, payout mode, riders, term, and sum assured must be finalized before policy issuance.

- Verbal promises mean nothing — get it in writing.

6. “Term Insurance Is a Waste — You’ll Get Nothing Back!”

Classic high-commission sales tactic.

- Term plans offer maximum coverage at the lowest cost.

- They’re essential for family protection.

Tip: If an advisor dismisses term insurance without knowing your goals, walk away.

7. “I Don’t Have My IRDAI License Handy…”

Every agent must be IRDAI-certified.

- Ask for their Agent Code or POSP License Number.

- Verify on the IRDAI website.

If they dodge the question — it’s a clear red flag.

In Short — Don’t Get Trapped in a 10-Minute Sales Pitch

Insurance is a 10–30 year commitment. The wrong product can:

- Leave your family underinsured

- Lock you into expensive, unsuitable premiums

Before you buy:

Get all features in writing

Verify the agent’s IRDAI license

Never decide under pressure

Buy only what you fully understand

Pro Tip: Use Insurance+ to get 50+ insurance plans in minutes and avoid mis-selling traps.

“Smart insurance buying means asking the right questions, verifying every promise, and walking away from pressure tactics — because your family’s financial security deserves clarity, not confusion.”