The Indian equity markets started the week on a high note as insurance stocks saw strong buying interest. The rally came after reports suggested that the government is actively considering reducing Goods and Services Tax (GST) on both health and life insurance premiums from the current 18% to as low as 5% or even zero.

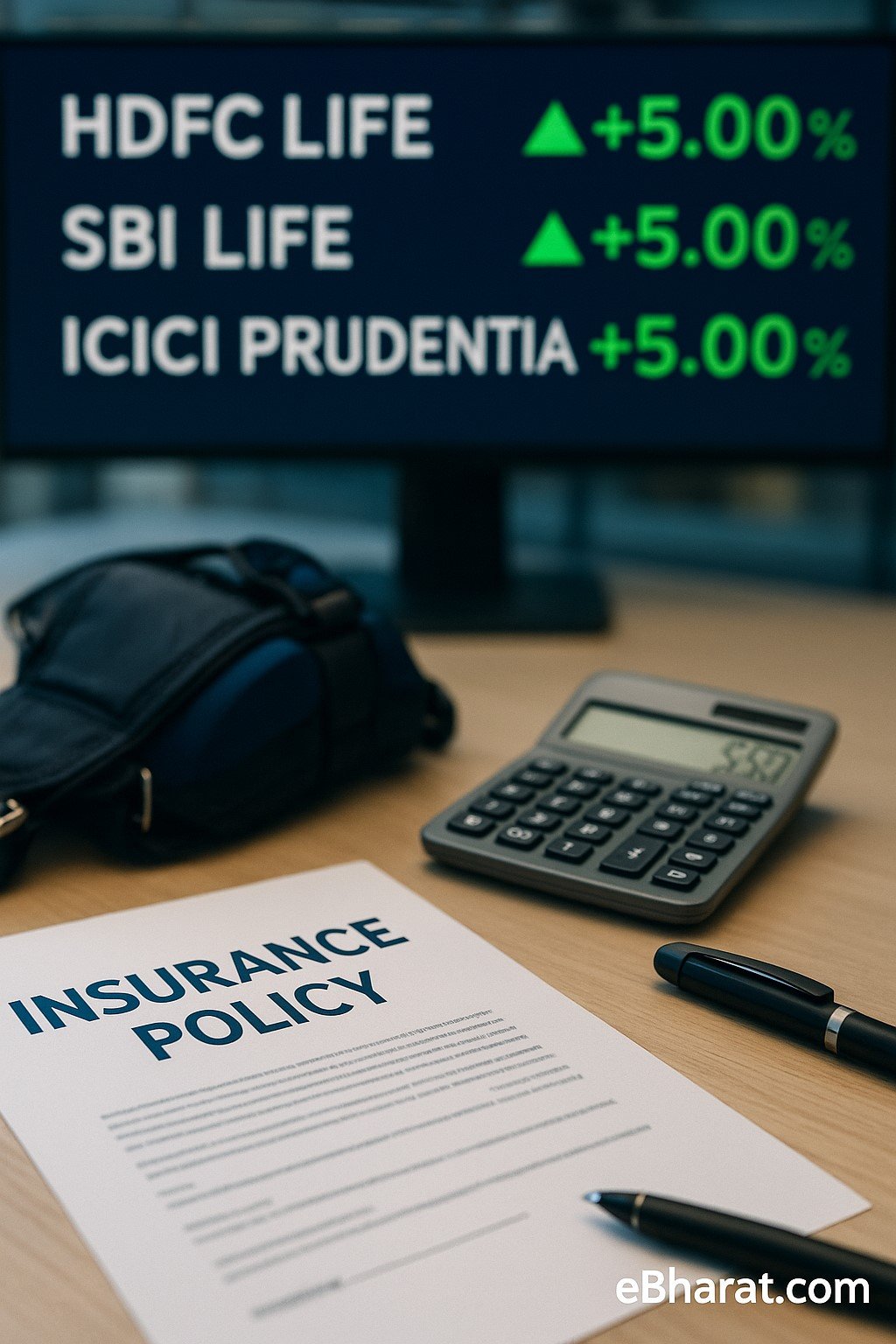

The news sparked immediate investor enthusiasm. In the morning session alone, shares of HDFC Life, SBI Life, and ICICI Prudential surged between 4–5%, contributing significantly to gains in the broader financial services index.

Market Movement and Performance

Insurance companies led the charge on Dalal Street, outperforming the benchmark indices.

- HDFC Life Insurance: Rose nearly 4.8% intraday, hitting its highest level in six months.

- SBI Life Insurance: Climbed 4.5%, supported by strong institutional buying.

- ICICI Prudential Life Insurance: Jumped close to 5% after heavy trading volumes were reported.

- New India Assurance and General Insurance Companies: Also witnessed gains of 2–3%, reflecting optimism across the sector.

The Nifty Financial Services Index gained more than 1%, largely propelled by insurers, while the Sensex and Nifty also traded higher on the back of positive sentiment in financials.

Why Investors Reacted Strongly

The government’s proposal is seen as a double benefit:

- For consumers – A reduction in GST makes policies more affordable, directly easing the financial burden on middle-class families.

- For insurers – Lower premium costs are expected to encourage higher uptake, leading to strong revenue growth.

Currently, GST on insurance is 18%, which has often been criticized for discouraging penetration in a country where only about 4% of the population has adequate insurance cover. Lowering the rate to 5% or zero could push millions of first-time buyers into the insurance net.

Expert Opinions

Industry and market analysts were quick to highlight the significance of the proposal:

- Rakesh Arora, Market Strategist: “The rally reflects investor conviction that if GST is cut, demand for insurance will skyrocket. The penetration gap in India is massive, and this tax cut could be the trigger the industry has been waiting for.”

- Shalini Gupta, Insurance Analyst at Kotak Securities: “For health insurance, affordability is always the key barrier. A cut in GST could reduce premiums by nearly one-sixth, encouraging both renewals and new customer acquisition.”

- Motilal Oswal Institutional Report: Stated that the move could add ₹15,000–20,000 crore annually to the insurance sector’s premium collections within the next 2–3 years.

Impact Beyond the Stock Market

The proposed GST reduction is not just about stock prices. It carries broader implications:

- Financial Inclusion: More affordable premiums can help rural and semi-urban families access basic health and life insurance.

- Long-Term Policy Renewals: Lower renewal premiums will reduce policy lapses, ensuring sustained protection for families.

- Government’s Social Security Goals: It aligns with the government’s push to achieve “Insurance for All by 2047.”

- Boost to Investor Sentiment: Both domestic and foreign institutional investors are likely to increase exposure to insurance companies.

Historical Context

The insurance industry has been lobbying for lower GST since 2017, when the 18% slab was first applied. Despite continuous requests, rates remained unchanged for years, dampening consumer appetite.

This Diwali season, the government is reportedly keen to announce a “festival gift” for the middle class, and a GST cut on insurance premiums could be part of that package.

What to Watch Next

- Final Cabinet Decision: A decision is expected in the coming weeks, possibly before Diwali.

- Impact on Stock Valuations: Analysts believe insurers may see a 10–15% re-rating in valuations if GST cuts are implemented.

- Competitive Premiums: With lower GST, insurers may also roll out new products targeting younger demographics and gig economy workers.

Insurance has long been considered a “luxury” for many Indian households due to high costs. By reducing GST, the government has an opportunity to make financial protection more accessible and universal. For the stock market, the rally is a reflection of optimism that this step will fundamentally transform the sector, creating sustained long-term growth for insurers and enhanced security for millions of Indians.