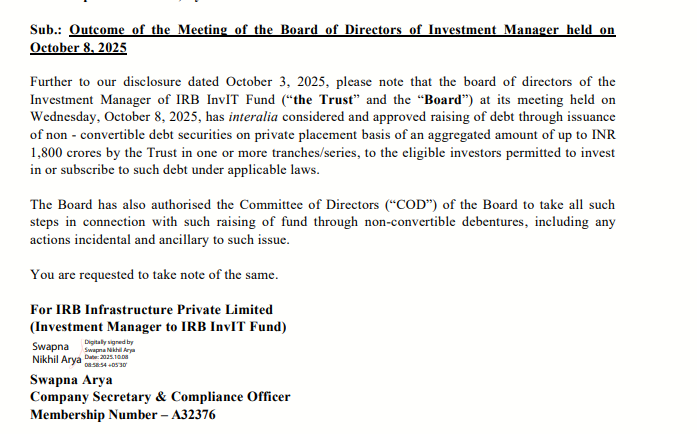

Mumbai | 8-Oct-2025, 12:50 IST — Filed via stock-exchange disclosure

IRB Infrastructure Investment Trust (IRB InvIT) has approved raising up to ₹1,800 crore through the issue of non-convertible debentures (NCDs) on a private placement basis. The fundraise, cleared by the Board/Investment Manager, gives the InvIT flexibility to tap the debt market in multiple tranches depending on market conditions and refinancing needs.

Why this matters

- Deleveraging & flexibility: Fresh NCDs can refinance existing borrowings, smoothen maturities, and lower blended cost of debt if coupons clear at favourable levels.

- Pipeline execution: Additional debt headroom supports operating SPVs’ needs—O&M, capex, and routine project expenses—without immediate equity dilution.

- Signal to bond market: Repeat issuance by listed InvITs helps deepen the rupee bond market for infrastructure assets.

What the filing indicates

IRB InvIT plans to issue listed, rated secured NCDs (typical for InvITs) in one or more tranches. Final terms—tenor, coupon, security, repayment schedule, listing venue and trustee details—will be specified in the respective placement memoranda at the time of tranche launch.

Note: Use-of-proceeds in InvIT NCDs generally includes refinancing existing debt, meeting capital expenditure at SPVs, and general trust purposes; exact allocation will be disclosed with the tranche documents.

Market context

Indian InvITs continue to access rupee debt markets as rates stabilize and demand from mutual funds, insurers, and pension funds remains steady. Structured, asset-backed cash flows and predictable annuities from toll/annuity assets often support strong ratings, helping issuers clear paper at efficient coupons.

What to watch

- Term sheet specifics: Tenor (3–10 yrs typical), coupon guidance, amortizing vs bullet structure, and covenant package.

- Rating action: Credit rating note for the proposed NCDs and outlook on the overall debt programme.

- Debt profile post-issue: Pro-forma leverage at Trust and SPV levels; impact on interest coverage and distributions.

- Timeline: Tranche launch windows and listing date for the first series.

Risks

- Rate volatility: If yields back up, coupons may be higher than expected.

- Refinancing concentration: Bunched maturities can pressure cash flows without staggered profiles.

- Project performance: Traffic/annuity variations at SPVs can affect coverage metrics.

A green light for the ₹1,800-crore NCD programme gives IRB InvIT room to refinance and smooth maturities without equity dilution, but the payoff will hinge on coupon prints, tenor mix, and final security/covenants cleared with the first tranche. A well-subscribed issue could lower funding costs and keep distributions steady; a tougher rate backdrop could blunt savings. With documentation, ratings and listing to follow, investors should track the placement memorandum, DSRA/coverage metrics, and pro-forma leverage in the next quarterly update.