August 4, 2025 |

The Insurance Regulatory and Development Authority of India (IRDAI) has proposed a landmark move to introduce internal ombudsmen within every insurance company in India — a step aimed at speeding up complaint resolution and improving customer trust.

IRDAI, India’s apex insurance regulator, believes this structural shift will reduce the burden on external grievance redressal bodies like the Insurance Ombudsman and Consumer Courts, while encouraging insurers to proactively resolve policyholder issues internally.

What Is the Proposal?

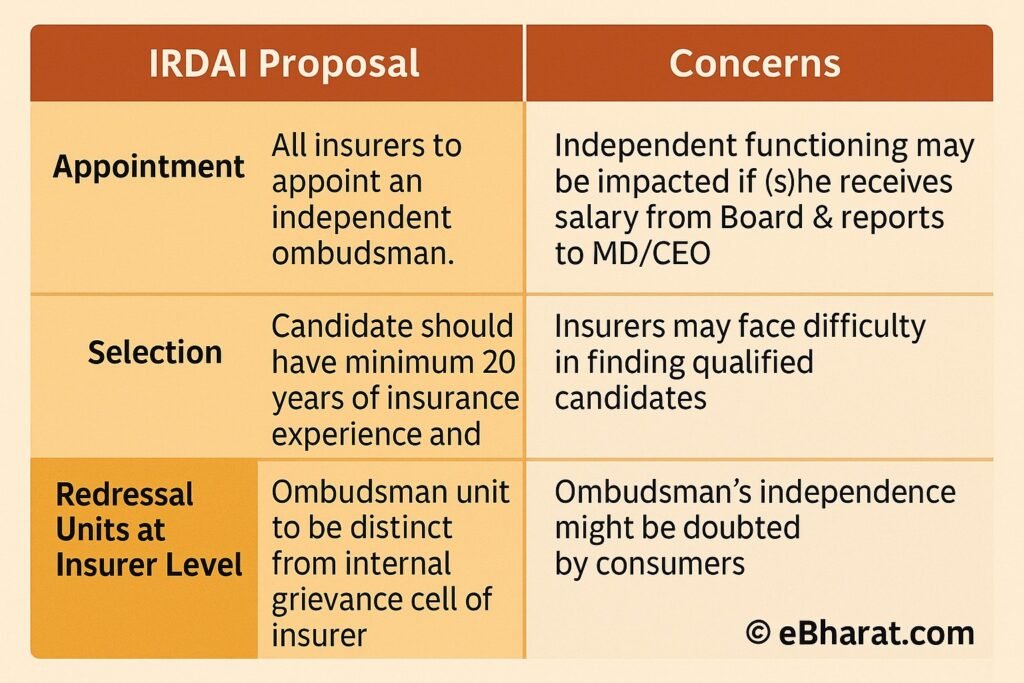

As per the draft circular released on August 3, 2025, IRDAI has suggested that all insurers — both life and non-life — should appoint an Internal Ombudsman (IO) with defined powers to review complaints that remain unresolved even after the insurer’s internal grievance cell has responded.

The Internal Ombudsman must be a senior retired insurance officer or ex-judicial member, with no ties to the insurer, and will act as the final reviewer of policyholder complaints before they are escalated externally.

Commenting on the proposal, an IRDAI official said the initiative will “instil fairness, transparency, and faster turnaround times” in customer service — especially for complaints involving delayed claims, mis-selling, policy lapses, and service denials.

Why This Matters for Policyholders

Currently, if an insurance buyer is unhappy with the company’s resolution, they must approach external authorities like the IRDAI Grievance Cell (IGMS), the Insurance Ombudsman, or even consumer courts — a process that can take months or years.

With internal ombudsmen in place, policyholders could soon get binding, final decisions within weeks, saving time, money, and legal hassle.

The move is seen as part of IRDAI’s broader push to make insurance more consumer-friendly and bring it closer to the banking sector’s grievance redressal model — which already uses internal ombudsmen.

Read the full proposal on IRDAI.gov.in

🛡️ Faster Complaint Resolution, Stronger Protection for You

With IRDAI’s new proposal for internal ombudsmen, insurers will be accountable to solve your complaints more quickly. But as a policyholder, choosing the right insurance plan is still your first defense.

👉 Compare trusted policies in one place with Insurance+ on eBharat.com.