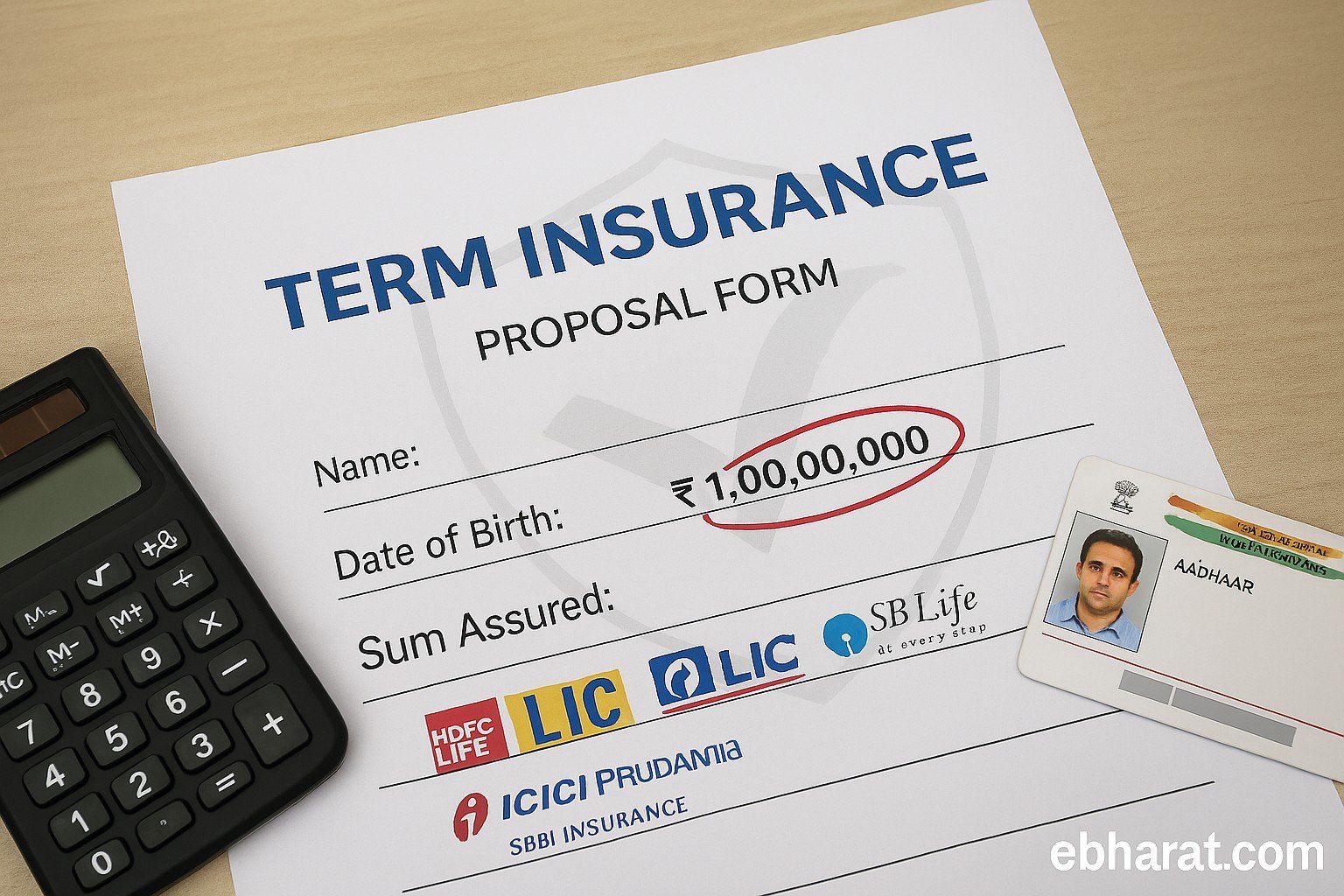

IRDAI may revisit pricing caps for standard term insurance plans under ₹1 crore. With affordability in focus, the regulator is exploring fair pricing bands to boost protection coverage.

| Topic | IRDAI Revisits Standard Term Plan Pricing Cap |

|---|---|

| Regulator | Insurance Regulatory and Development Authority of India (IRDAI) |

| Coverage Focus | Pure term insurance plans under ₹1 crore |

| Objective | Enhance affordability and standardize pricing |

| Expected Change | Revised pricing band or upper cap |

What’s Under Review?

The IRDAI is reportedly considering reopening its earlier discussions on price capping standard term insurance products — specifically, those offering pure protection cover up to ₹1 crore.

According to senior officials familiar with the matter (via Business Standard, Aug 6), this move is part of the regulator’s broader push to make term life plans affordable for the Indian middle class.

“While we don’t want to restrict market innovation, the regulator is concerned about the wide variation in pricing for similar protection plans,” said a senior IRDAI official.

Why Price Capping Was Initially Shelved

Back in 2020–21, IRDAI had proposed standardizing term plans (like Saral Jeevan Bima) with simpler terms and pricing discipline. However, concerns over mortality assumptions, reinsurance rates, and underwriting freedom led to the shelving of any hard price cap.

Now, with increasing interest in low-ticket protection products and growing fintech distribution, the discussion is back on the table.

What May Change?

- Introduce a pricing band for ₹25–50 lakh and ₹50–100 lakh term plans

- Recommend caps on commissions for standard plans

- Ask insurers to justify premium variance across identical profiles

The pricing discussion may first be tested through Saral Jeevan Bima 2.0 or a similar mass-market product redesign.

Term Insurance Uptake Still Low

India’s life insurance protection gap remains massive:

- Protection penetration (as % of population): <10%

- Most term plans sold: >₹1 crore, urban metro-focused

- Average term plan premium: ₹12,000–₹18,000 annually

Many middle-income families still rely on endowment or money-back policies due to lower perceived value of pure term plans.

“If premiums were lower and benefits clearer, more young Indians would buy term insurance,” says Prashant Kumar, a term plan distributor from Jaipur.

Why This Could Impact You

- Middle-income Indians may soon get better-priced term plans under ₹1 crore

- IRDAI’s move can pressure insurers to reduce margins and commissions

- It may revive interest in pure protection products beyond metro cities

Many Indian families are unsure how much term insurance they actually need — even before price becomes a factor. Use this 3-step formula to calculate your ideal cover

eBharat.com will track the outcome of these discussions and notify users if IRDAI issues fresh guidelines or pricing frameworks.

Share this update with someone considering term insurance — and follow eBharat.com on X, Instagram, and LinkedIn for smart insurance tips.