It Sounds Like a Lot — But Is It Really Enough to Protect Your Family?

For years, ₹1 crore has been the magic number in Indian life insurance. It sounds solid. Round. Comfortable.

But here’s the truth: ₹1 crore in 2025 isn’t what it used to be.

With inflation driving up living costs, education fees, and medical bills — and families living longer than ever — that once-reliable number is starting to fall short.

Let’s break it down and find out: is ₹1 crore really enough for your loved ones?

What Does ₹1 Crore Actually Do For Your Family?

Let’s say your nominee gets a ₹1 crore payout tomorrow.

If they invest it in a safe fixed-income option earning 6% annually, it will provide:

₹6,00,000 per year

= ₹50,000 per month

👉 That’s before taxes, medical emergencies, or inflation adjustments.

Now pause and ask: Can your family live on ₹50,000/month?

Think of rent, groceries, school fees, medical costs, EMIs. For a typical urban family in 2025, this amount may only cover the basics — and might not last beyond 12–15 years.

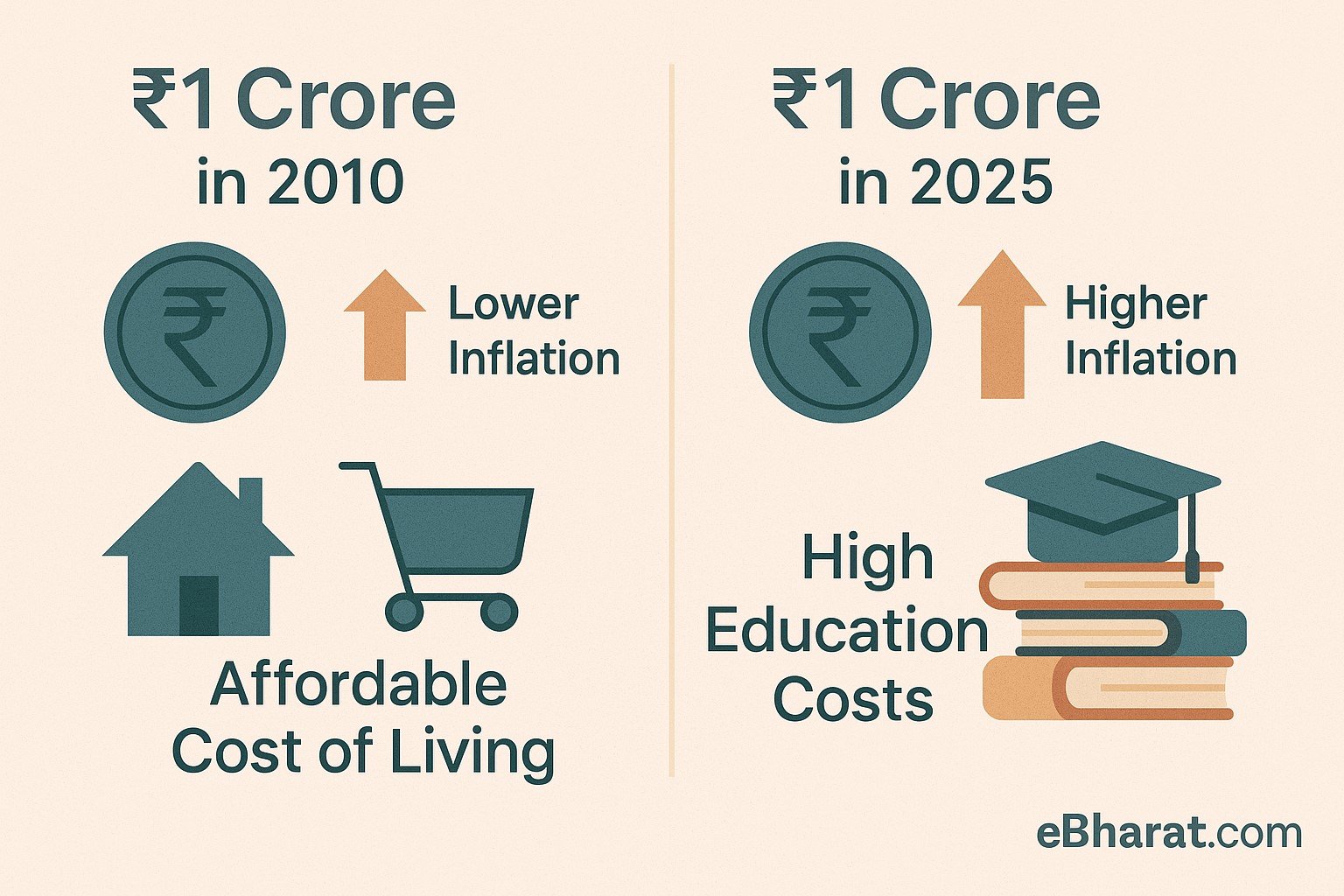

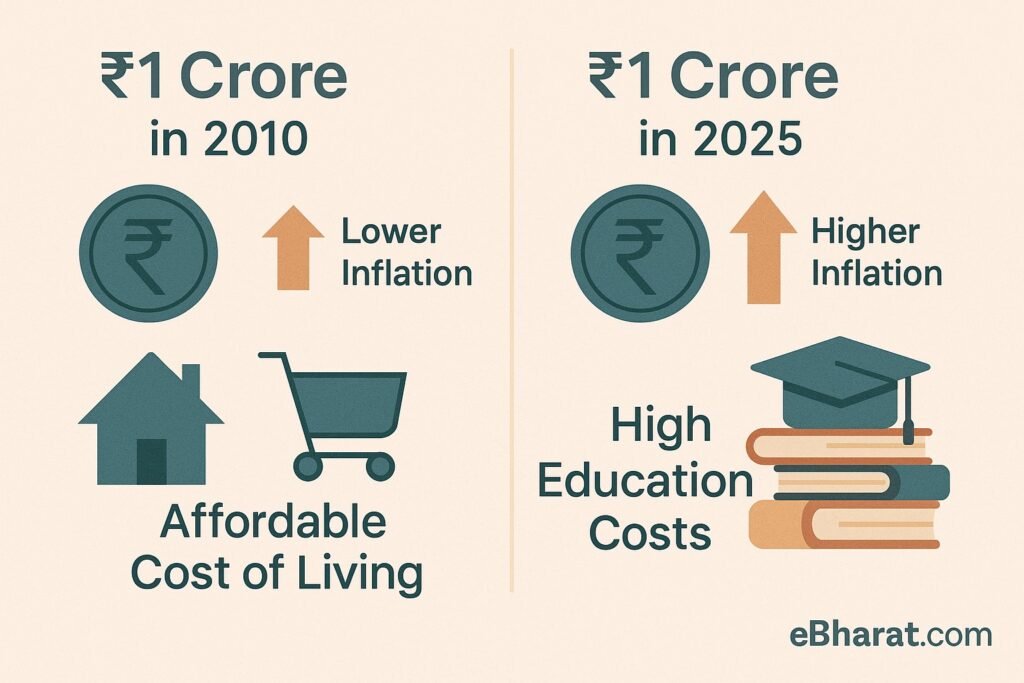

Why ₹1 Crore Was “Enough” — A Decade Ago

Back in 2010, ₹1 crore was massive. It was often 20x or 25x an average salary. People had fewer loans, education costs were lower, and inflation wasn’t biting as hard.

But today?

That same ₹1 crore often represents just 8x or 10x your annual income — and that’s before subtracting debts or future goals like your child’s education.

Simply put: ₹1 crore doesn’t stretch like it used to.

How to Calculate the Right Coverage for 2025

(Annual Income × Remaining Working Years)

+ Outstanding Loans

+ Future Financial Goals (Kids’ education, marriage, etc.)

− Existing Investments and Savings

- Age: 35

- Annual Income: ₹12 lakh

- Working Years Left: 25

- Loans: ₹25 lakh

- Future Goals: ₹30 lakh (2 kids’ college)

- Savings/Investments: ₹10 lakh

👉 Total required cover = (₹12L × 25) + ₹25L + ₹30L − ₹10L

= ₹3.45 crore

In this case, ₹1 crore covers less than one-third of your family’s needs.

When Can ₹1 Crore Still Be Enough?

There are a few exceptions where ₹1 crore might suffice:

- You’re single, with no dependents or major financial obligations

- Your spouse is financially independent, and your children are grown up

- You have significant existing wealth or passive income sources

- You want to only cover a specific short-term loan or a 5–10 year gap until retirement

If that’s your case, ₹1 crore can be a decent cushion.

But for most urban, working Indians with dependents, ₹2–3 crore+ is now the more realistic baseline.

What If You Can’t Afford ₹2–3 Crore Right Now?

Don’t worry. You don’t have to go all-in today. Start smart and scale up gradually:

- Begin with a ₹1–1.5 crore plan now

- Add riders like Waiver of Premium or Critical Illness for extra protection

- Reassess every 5 years — and increase your cover as your income grows

- Explore increasing term insurance where the sum assured rises annually

- Add a top-up policy later (many insurers allow this)

Remember: having some cover is better than none. Just treat ₹1 crore as your starting point — not the finish line.

Pro Tip: Don’t Guess — Calculate

Don’t choose a number that just sounds right. Calculate what your family would need if you weren’t around tomorrow.

Insurance isn’t for you. It’s for them — to ensure they don’t have to compromise on home, education, healthcare, or dignity.

Take 15 minutes to run the math. It could be the most important financial decision you make.

Final Word

In 2025, ₹1 crore is no longer the gold standard it used to be.

If you’re buying term insurance this year, rethink your number. Re-evaluate based on your age, income, liabilities, and family goals.

Because in the end, insurance is about peace of mind — not just a payout figure.