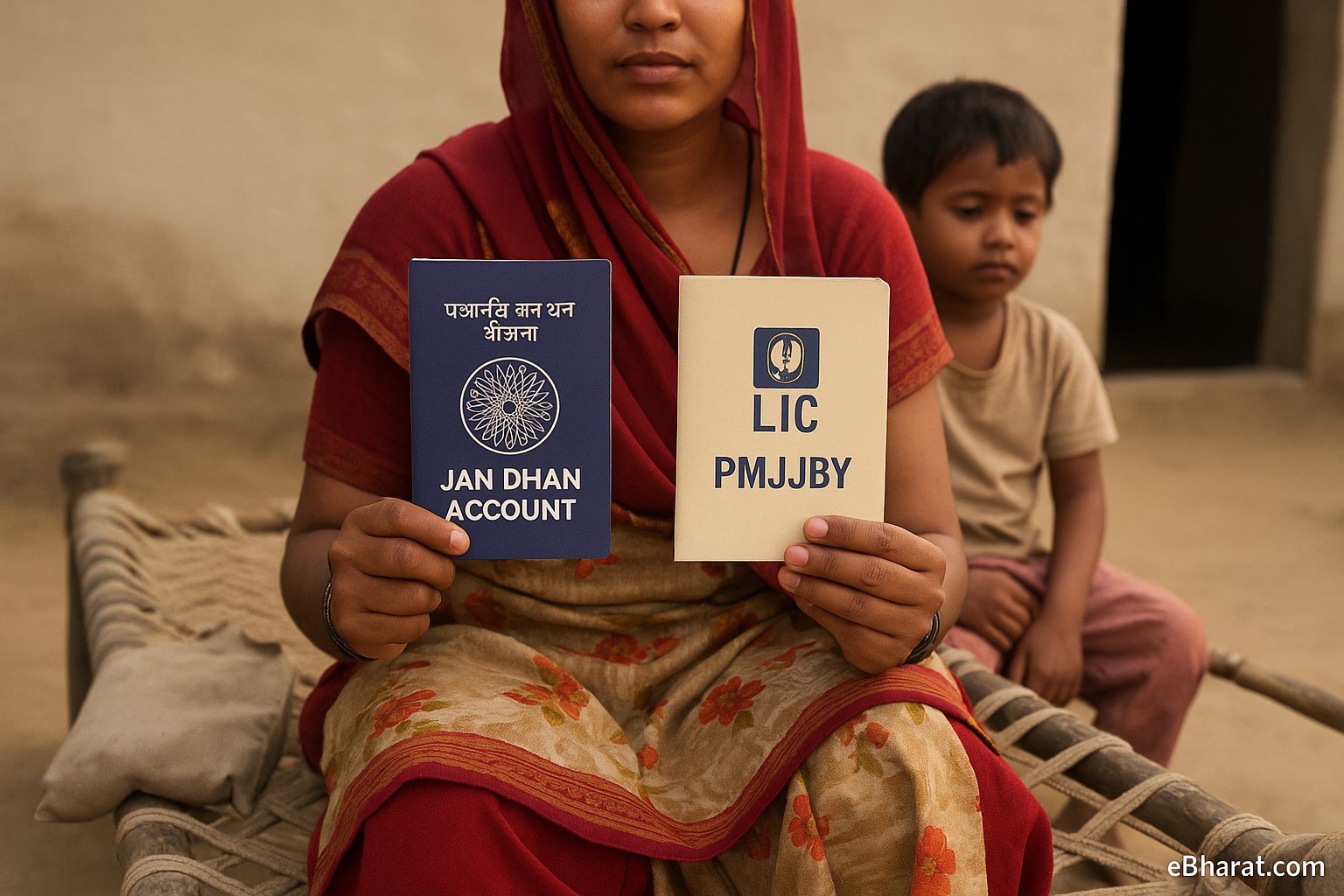

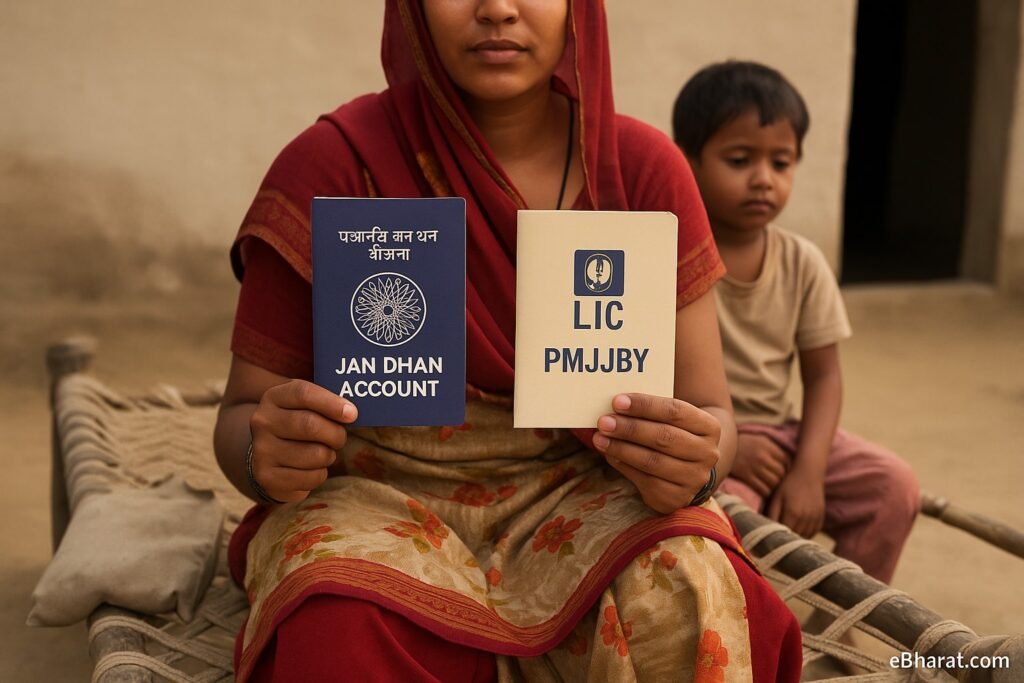

Lakshmi Devi, a farm worker from a small village, opened a Jan Dhan account when the bank team visited during a camp. She thought it was just for receiving her NREGA wages. But what she didn’t realize? That same account could give her ₹2 lakh life insurance for just ₹436 a year — without any paperwork or medical checkup.

This powerful combo — Jan Dhan + PMJJBY — is one of the simplest, most affordable safety nets for rural families in India.

Let’s break it down and understand how you can use it today.

What Is Jan Dhan Yojana?

The Pradhan Mantri Jan Dhan Yojana (PMJDY) is a zero-balance bank account scheme launched to ensure every Indian household has access to a formal bank account.

When you open a Jan Dhan account, you automatically get:

- Zero-balance savings account

- RuPay debit card

- Accidental insurance cover (₹1–₹2 lakh)

- Direct Benefit Transfer (DBT) for government schemes

- Auto-debit access to low-cost insurance like PMJJBY & PMSBY

Over 50 crore accounts have been opened — but sadly, most users never activate the built-in insurance features.

What Is PMJJBY (Life Insurance)?

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a life insurance plan backed by LIC and Indian banks.

Here’s what you get:

- ₹2 lakh life cover — paid to your nominee if you pass away (due to illness or accident)

- ₹436 per year — just ₹1.19/day

- No medical checkup required

- Available to anyone between 18–50 years (coverage continues till age 55)

- Premium is auto-debited from your Jan Dhan or savings account

How Do Jan Dhan + PMJJBY Work Together?

If you already have a Jan Dhan account, enrolling in PMJJBY is super simple:

Follow These Steps:

- Visit your bank branch (where your Jan Dhan account is active)

- Fill PMJJBY enrollment form (name, Aadhaar, nominee details)

- Link your Aadhaar, if not already linked

- Bank will auto-debit ₹436 every year (in May/June)

- You’ll receive an SMS confirmation

That’s it! Your family is now covered for ₹2 lakh — in case something unexpected happens to you.

Why It Matters for Rural & Low-Income Families

Most rural households don’t have any term insurance or financial backup.

If the earning member dies — father, mother, or son — the family is suddenly left without income, and often, without hope.

But PMJJBY changes that.

Even ₹2 lakh can:

- Support the family for 6–12 months

- Keep children in school

- Help the widow start a small income

- Cover funeral or urgent medical expenses

And all this for just ₹436/year.

Real-Life Exmple

Lakshmi Devi’s husband passed away in a tractor accident. She didn’t even know they were enrolled in PMJJBY through his Jan Dhan account. But when she visited the bank, they helped her file the claim. Within a few weeks, she received ₹2 lakh — enough to repay loans, manage school fees, and survive the worst.

This story isn’t rare. It’s just under-used.

Final Thought: Don’t Let Your Jan Dhan Account Sit Idle

Most people don’t know that their basic bank account holds the key to basic protection. You don’t need big premiums or complicated policies. Sometimes, all it takes is one visit to your bank and ₹436 a year.

Already have Jan Dhan? Go activate PMJJBY today.

Don’t have one? Ask your local bank or SHG to help you open it.

Because in rural India, where life can change overnight, even small protection is big protection.

Activate Insurance With Jan Dhan Today!

🟡 Plans under ₹500/year

🟡 No medical needed

🟡 Bank-based enrollment support

👉 Click here to get help enrolling today