In a move that highlights its customer-first approach, Kotak Mahindra Life Insurance has launched the Gen2Gen Income Plan—a participating, non-linked individual savings product.

The new plan is positioned as a “strategic bet for 2025 and beyond”, offering flexible income options designed to support families across generations.

What is the Gen2Gen Income Plan?

The product is built to provide regular income while also ensuring financial protection. Policyholders can choose between:

- Lifelong Income → steady payouts for life.

- Fixed-Term Income → guaranteed payouts up to a chosen age.

This flexibility allows the plan to suit multiple life goals—child education, retirement planning, or supplementing household income.

Key Features of the Plan

- Participating Plan → Eligible for bonuses, boosting long-term wealth creation.

- Savings + Protection Combo → Provides insurance cover along with income benefits.

- Flexible Payouts → Monthly or annual income streams.

- Generational Benefit → Can secure children’s and grandchildren’s futures.

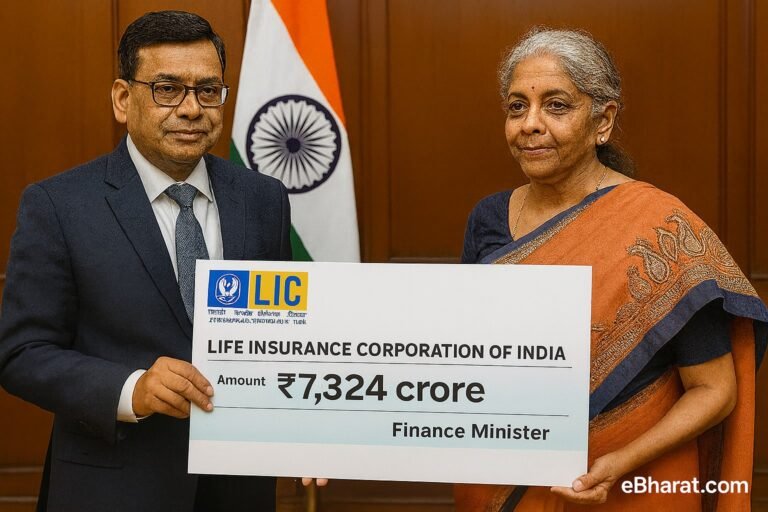

👉 Related: Best Digital Tools Every HDFC Life Agent Must Use

Why Kotak Calls It “Strategic”

- Focus on financial independence across generations.

- Fits India’s rising demand for long-term income solutions.

- Matches the trend of customers seeking guaranteed, predictable returns in uncertain markets.

Expert Take

Analysts say Kotak’s Gen2Gen plan reflects a customer-centric pivot in India’s insurance sector—moving beyond just risk cover towards income-oriented financial planning.

The product may attract middle-class families, parents, and retirees looking for stability and legacy planning.

Why This Matters

With rising healthcare, education, and retirement costs, Indian households increasingly need guaranteed income solutions. Kotak’s Gen2Gen product is designed to fill that gap, combining insurance protection with intergenerational wealth transfer.

🔍 Compare New Savings Plans

Use Insurance+ to compare Kotak Gen2Gen with other life insurance savings products and choose what fits your family goals.

Explore with Insurance+🚀 Build Your Career in Insurance

Join eBharat’s HDFC Life Agent Network and help families choose the right savings and protection plans while growing your income.

Apply Now to Become an Agent