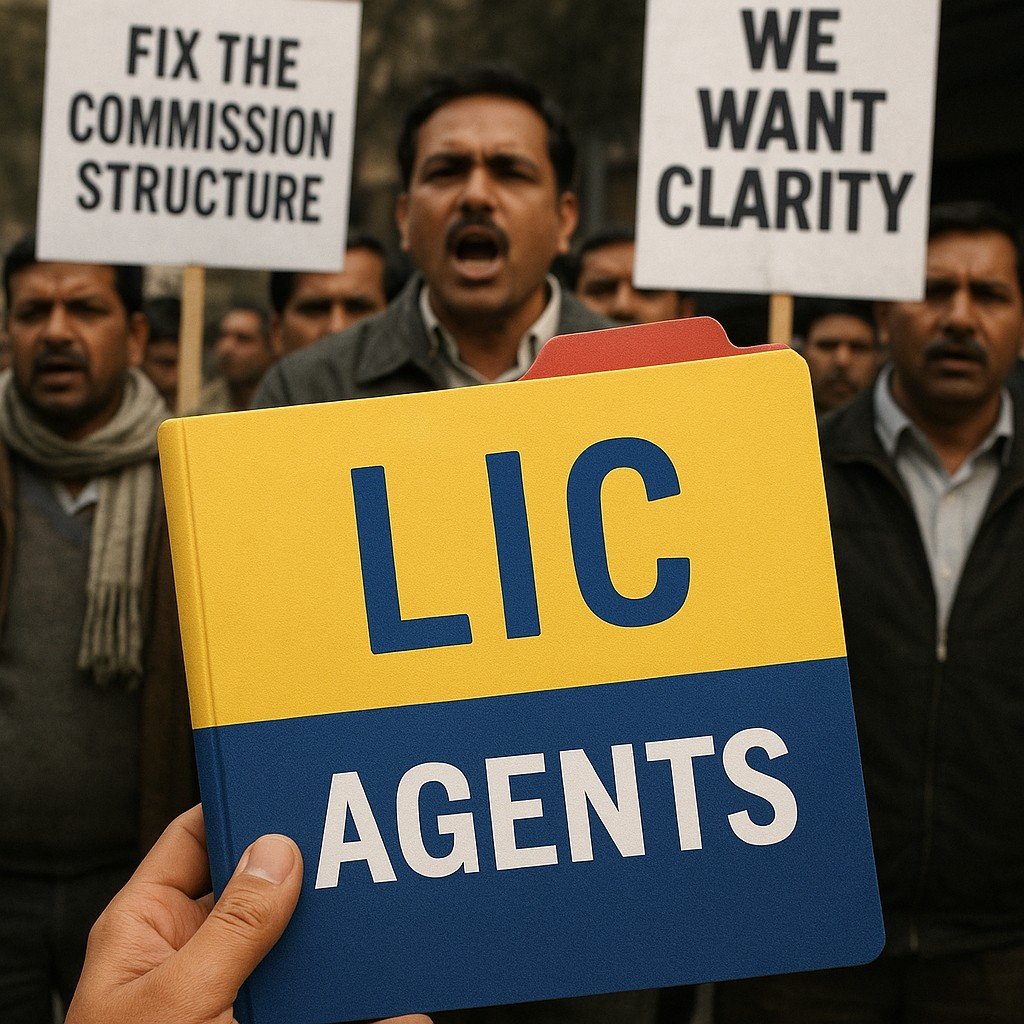

The Insurance Regulatory and Development Authority of India (IRDAI) may have aimed to offer “freedom” with its recent commission restructuring guidelines, but for over 13 lakh LIC agents, it has led to rising confusion, tension — and now, formal petitions.

Earlier this year, IRDAI removed the old cap on agent commissions, giving insurance companies the freedom to set their own payout models — as long as they stay within overall expense limits. Private insurers like HDFC Life and ICICI Prudential have already started using new commission structures. But LIC agents say they still haven’t been told how their earnings will change.

LIC Field Agents Voice Concerns

Several zonal groups of LIC agents have submitted letters to IRDAI and LIC management demanding a transparent, fixed structure that safeguards base income — especially for rural and senior agents who depend solely on trail commissions.

Sushil Yadav, an LIC Development Officer from Jaipur, told eBharat.com,

“We’re not against reforms — but there must be clarity. If private insurers start offering aggressive upfront commissions, LIC agents risk being left behind or underpaid.”

The concern isn’t just about rates. Agents fear monthly payouts could become variable, depending on how LIC adjusts to the EOM model — and that could severely impact small agents and part-time advisors.

| Earlier Rules | New IRDA Norms (2024–25) |

|---|---|

| Fixed commission % for every product | Companies can set their own commission models (within cost limits) |

| Same commission system across LIC | No official update yet from LIC |

| Agents got steady monthly earnings | Income may now vary month to month |

IRDAI’s Position

The regulator maintains that commission flexibility will encourage innovation and competition among insurers — and that “market forces” will determine how agents are rewarded. However, with LIC being a public sector giant with nearly 65% market share in life insurance, its delay in adapting or clarifying payout norms is adding to the unease.

Why It Matters

- Over 13 lakh LIC agents depend on commission as their main income.

- Uncertainty in payouts could impact rural insurance penetration.

- Transparent rules are crucial to prevent mass dropouts from agency force.

Many agents have also begun comparing commission trends across companies, especially as private players update their payouts. For a full breakdown, check the Insurance Agent Commission Chart to see how LIC stacks up against others.

For now, agents await an official response from LIC’s central office and further clarification from IRDAI.

For real-time updates on insurance reforms and agent earnings, follow eBharat.com on Instagram, LinkedIn, and X.