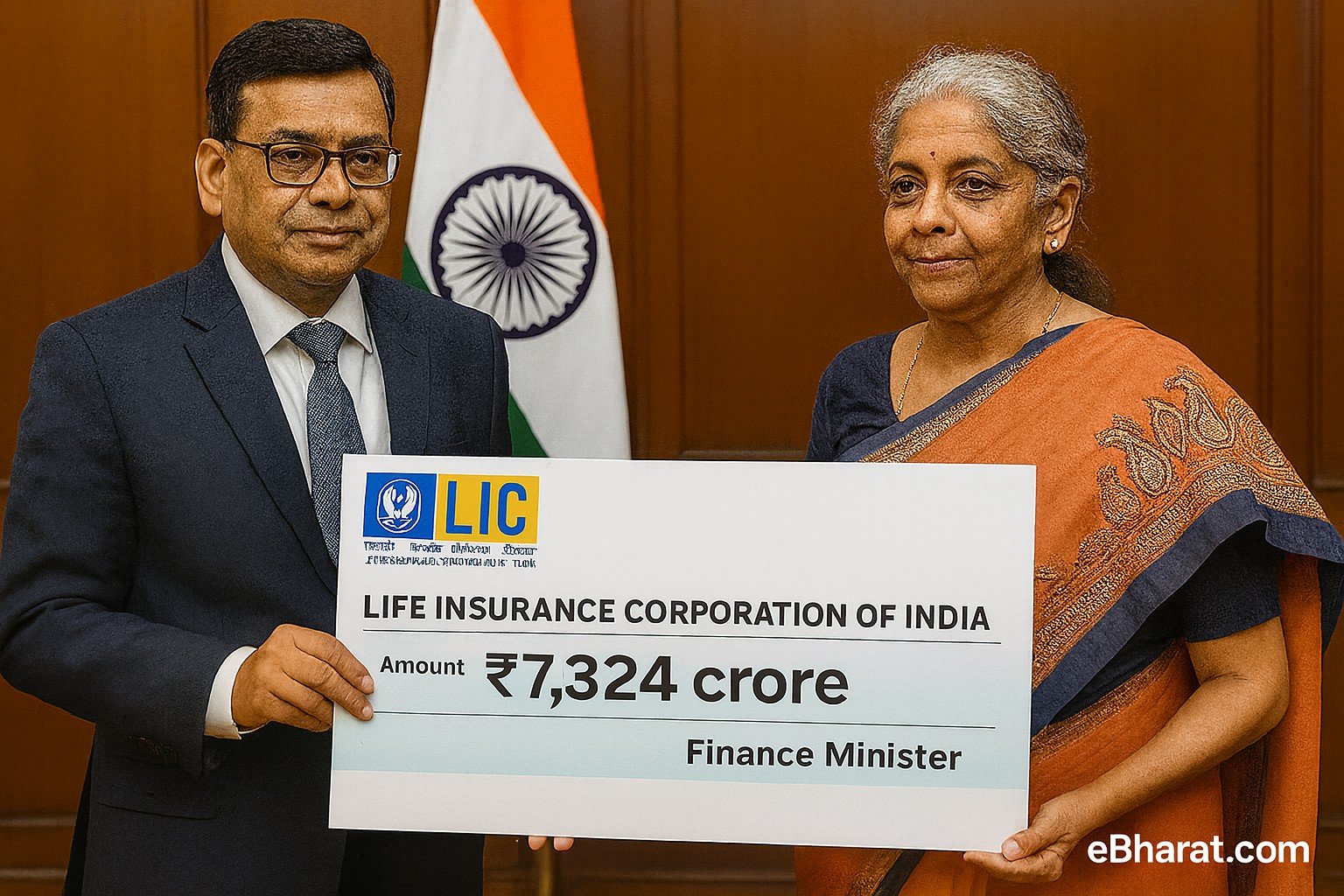

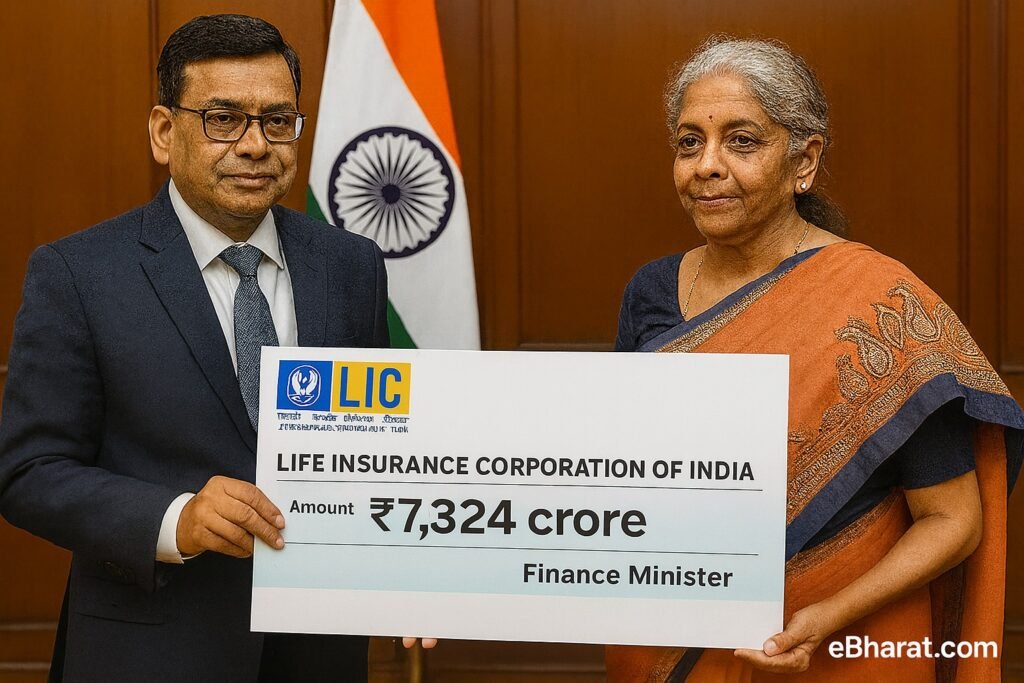

The Life Insurance Corporation of India (LIC) has handed over a dividend cheque worth ₹7,324.34 crore to Finance Minister Nirmala Sitharaman for the financial year 2024-25. This dividend reflects LIC’s continued importance as a financial powerhouse and one of the biggest revenue contributors to the Indian government.

The cheque was formally presented by LIC Chairman Siddhartha Mohanty, underscoring the insurer’s strong performance despite challenges in the insurance and investment markets.

LIC’s Role in Government Finances

LIC, being the largest life insurer in India, has historically been a key source of funds for the government:

- The dividend adds directly to the government’s non-tax revenues, helping bridge the fiscal gap.

- LIC’s investments in infrastructure, banking, and equity markets also make it a stabilizing force in the Indian economy.

- This year’s dividend is seen as a vote of confidence in LIC’s resilience amid rising competition from private insurers.

Policyholders vs. Government: Dividend Split

As per LIC:

- 95% of the surplus goes to policyholders in the form of bonuses and benefits.

- The remaining 5% is shared with the government as a shareholder dividend.

This ensures that while the government benefits from LIC’s profits, policyholders remain the biggest beneficiaries of the corporation’s financial success.

Why This Matters for Policyholders

For millions of LIC customers, this dividend is more than just a corporate number. It signals:

- Financial Strength: A healthy LIC means timely bonuses and reliable claim settlements.

- Policyholder Confidence: The dividend demonstrates LIC’s ability to balance both social obligations and profitability.

- Long-Term Security: As LIC expands digital services and product offerings, policyholders can expect stronger returns in the years ahead.

Simplify Your Insurance Decisions

LIC’s dividend shows the strength of India’s insurance sector—but what’s the best policy for you? With Insurance+ by eBharat, compare life, health, and investment policies, get claim guidance, and make smarter financial choices.

Explore Insurance+Government Perspective

For the Union Government, LIC’s dividend comes at a crucial time. With ambitious spending targets for infrastructure, healthcare, and social schemes, such inflows provide much-needed fiscal support.

Economists also highlight that as the government proceeds with IDBI Bank’s privatization and reforms in the financial sector, LIC’s strong dividend payout showcases its continued relevance in India’s growth story.

As India’s largest insurer, LIC continues to be more than just a financial institution—it is a pillar of stability for both policyholders and the government. With a dividend of over ₹7,300 crore this year, LIC reaffirms its dual role of social security provider and national financial contributor.

Start Your Journey in Insurance

LIC has built trust for decades—now you can be a part of the industry. Join our HDFC Life Agent Network and grow with expert tools and training.

Apply Now to Become an Agent