India’s Top Life Insurers Are Shifting Gears — Here’s What You Should Know

The Indian life insurance space is undergoing quiet but significant changes in 2025.

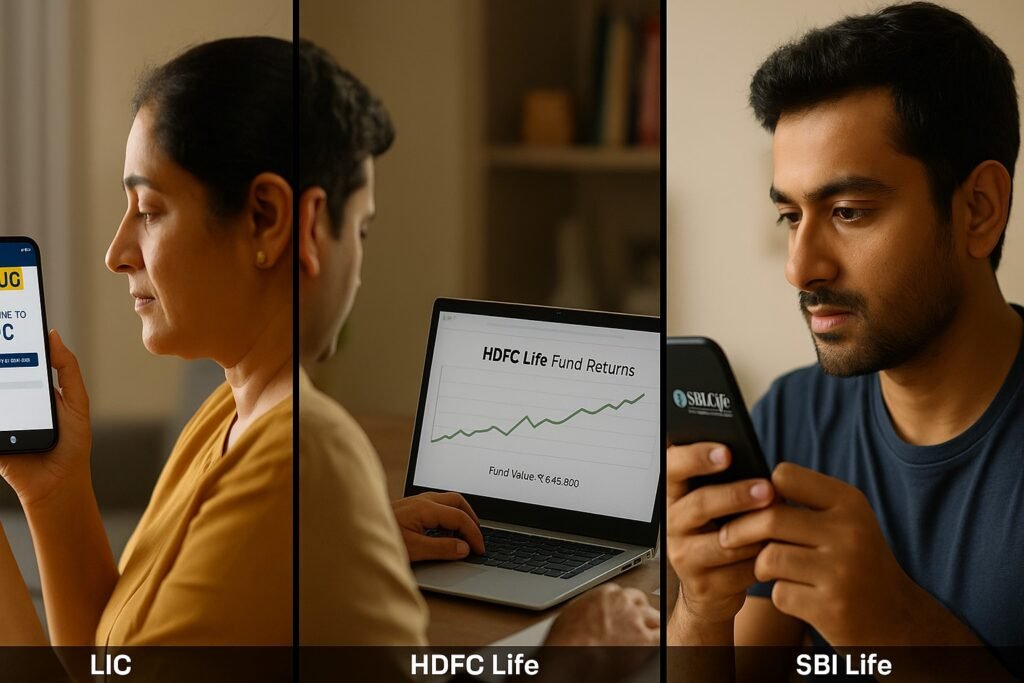

From smarter tech adoption to IRDAI-led reforms, leading insurers like LIC, HDFC Life, and SBI Life are actively upgrading how they operate — and how they serve policyholders.

Whether you already own a policy or are thinking of buying one soon, here’s your mid-year update on what’s changed — and why it matters to you.

LIC: Going Digital, Transparent, and IRDAI-Ready

India’s largest insurer is often seen as slow to adapt — but 2025 tells a different story.

What’s new at LIC?

- First fully digital term plan launched via LIC mobile app

- AI-based claim processing to speed up settlements

- Integrated IRDAI’s new surrender charge reforms for endowment plans

- Added UPI AutoPay and WhatsApp Pay for premium payments

- Upfront surrender value tables in brochures for new policies

Why this matters:

These updates bring LIC closer to private insurer levels of transparency and tech — while staying affordable for the masses. If you’re a buyer, you’ll now know exactly how much you’ll get if you exit early.

HDFC Life: Personalized ULIPs & Smarter Dashboards

HDFC Life continues to focus on tech-savvy, goal-based products — particularly in the ULIP (Unit Linked Insurance Plan) space.

Key 2025 highlights:

- Launched “Auto-LifeStage” portfolios: investments shift from equity to debt as you age

- Introduced goal-based ULIPs with switches for life events (marriage, childbirth, retirement)

- Upgraded mobile dashboard: track NAVs, bonuses, and maturity timelines

- Rolled out dedicated NRI/expat service desk

- Linked policies to investment platforms like Paytm, Zerodha, Groww for seamless integration

Why this matters:

HDFC Life is making insurance feel more like investing. If you’re a tech-first buyer or NRI looking for low-friction, long-term wealth + protection — this insurer is ahead of the curve.

SBI Life: Expanding Access to Rural India

SBI Life is going grassroots — targeting underserved areas and low-income groups while modernizing digital journeys.

What’s new in 2025:

- Launched low-cost, high-cover plans for economically weaker sections

- Introduced “SBI Life Saathi” WhatsApp chatbot for instant help, claim tracking

- Tied up with India Post & CSCs for rural enrollments

- Claims now settled within 4 working days on average

- Full e-KYC onboarding enabled — no paperwork required

Why this matters:

If you live outside metro cities or are helping someone in rural India get insured, SBI Life’s newer tools and plans make the process simpler, faster, and paper-free.

Why These Changes Matter for You — the Policyholder

Whether you hold a LIC, HDFC Life, or SBI Life policy — or are planning to — these updates translate to:

- Faster claims and fewer delays

- Better access to digital tools and fund tracking

- Clearer exit terms and reduced surrender penalties

- More inclusive offerings for NRIs, rural customers, and low-income families

Gone are the days of endless forms and branch visits — 2025 is all about mobile-first convenience, regulatory transparency, and customer empowerment.

Final Word: India’s Life Insurers Are Evolving — And That’s Good News

LIC, HDFC Life, and SBI Life — the giants of India’s life insurance industry — are embracing change.

Whether it’s LIC’s digital leap, HDFC Life’s personalized investing approach, or SBI Life’s rural innovations, the focus is clear: make insurance more human, more helpful, and more honest.

If you’re buying or renewing a policy this year, take a second look — these new features could make your life insurance journey smoother than ever.