India’s Life Insurance Sector Poised for Massive Growth

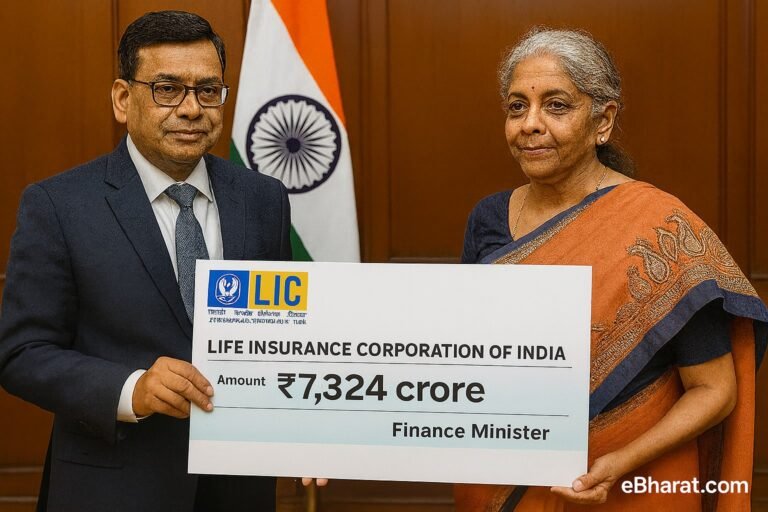

India’s life insurance industry is on the brink of a major leap forward. Market experts project that the sector could touch $170 billion (₹14 lakh crore+) in premium collections within the next five years. With a compound annual growth rate (CAGR) of 8–10%, India is set to become one of the fastest-growing insurance markets globally — second only to China among emerging economies.

Key Drivers Behind the Growth

1. Rising Disposable Income

India’s expanding middle class is one of the biggest contributors to this surge. With increasing salaries, better job opportunities, and growing aspirations, more households are now willing to invest in long-term financial protection products. For many families, life insurance is no longer a luxury — it’s a necessity.

2. Digital Transformation

The insurance industry has undergone a tech revolution. From instant e-KYC and Aadhaar-based onboarding to mobile-first apps, insurers have simplified buying and renewing policies. Claims that once took weeks are now being processed within days — in some cases, hours.

3. Wider Awareness & Financial Literacy

Thanks to government awareness campaigns, fintech platforms, and social media, Indian consumers today are far more informed about the importance of life cover. Younger buyers in Tier-II and Tier-III cities are actively researching and comparing policies online before making a decision.

4. Product Innovation

Insurance companies are introducing flexible, customer-centric products — such as:

- Customizable Term Plans with riders for critical illness and disability.

- ULIPs (Unit Linked Insurance Plans) with guaranteed benefit options.

- Microinsurance Policies targeting low-income households at affordable premiums.

📌 Recommended Read

Participating products are regaining popularity in the Indian insurance market. They not only provide life cover but also allow policyholders to share in the insurer’s profits.

👉 Read: Participating Products Make a Comeback in Life InsuranceWhy It Matters for Indian Families

- Financial Security: Higher penetration means more households will have a safety net in emergencies, reducing reliance on personal loans or selling assets during crises.

- Better Choices: A growing market fosters healthy competition, resulting in lower premiums, flexible features, and faster claim settlements.

- Wealth Creation: Many life insurance products now blend protection with investment, helping families build long-term wealth alongside security.

Currently, India’s life insurance penetration is around 3.2% of GDP — significantly below the global average of 7–8%. With this growth, penetration could rise to 4–4.5% by 2030, covering over 60% of Indian households.

Market Snapshot

| Metric | 2025 | 2030 (Projected) |

|---|---|---|

| Total Premiums | $110 Billion | $170 Billion |

| GDP Penetration | 3.2% | 4–4.5% |

| Households Covered | 38% | 60%+ |

Challenges on the Path Ahead

While growth looks promising, there are still challenges that insurers and policymakers need to address:

- Rural Penetration: Many rural households still lack awareness or cannot afford adequate cover.

- Product Complexity: Complicated terms and conditions discourage first-time buyers.

- Trust Gap: Incidents of mis-selling in the past have left some customers cautious.

Expert Insight

According to officials at the Insurance Regulatory and Development Authority of India (IRDAI), new reforms are on the way. The regulator is working on:

- A single-window digital insurance marketplace.

- Mandating 100% digital issuance of policies.

- Ensuring transparency to make buying insurance as easy as starting a mutual fund SIP.

Final Word

India’s life insurance industry is entering a golden phase. For families, this means more affordable policies, better protection, and innovative solutions that match their financial goals.

🔗 Compare the Best Life Insurance Plans on eBharat Insurance+

Apply Now to Become an Insurance Agent