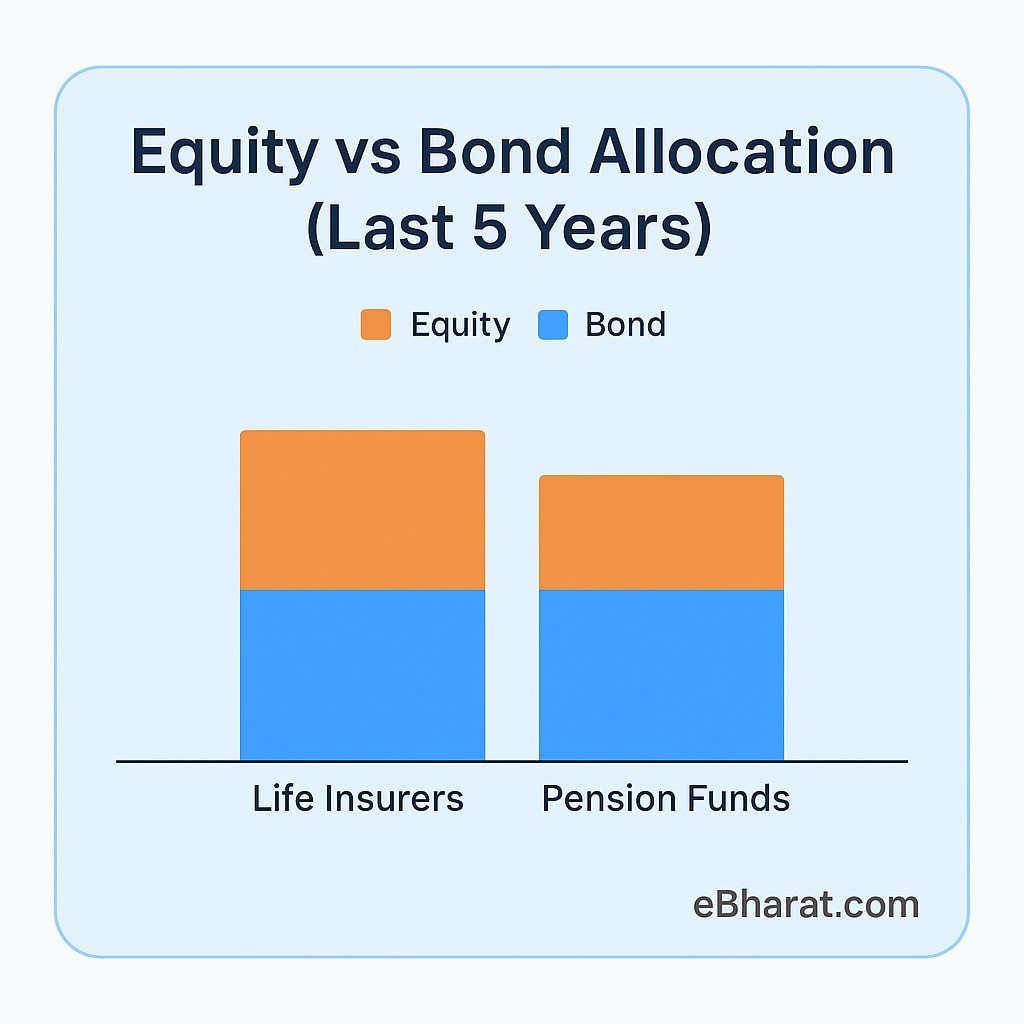

India’s life insurance companies and pension funds have quietly emerged as one of the biggest forces in the stock market this year. Official data shows their equity buying has climbed to the highest level in the last five years — a sign of growing confidence in long-term growth opportunities.

For years, these institutional giants played it safe, parking most of their money in bonds and other fixed-income instruments.. But with bond returns weakening and funding ratios improving, they are now shifting strategies to capture higher returns from equities and other growth-oriented assets.

| Institution | Equity Investment Level | Key Reasons for Shift |

|---|---|---|

| Life Insurance Companies | Highest in 5 years | Lower bond returns, search for growth, policyholder bonus potential |

| Pension Funds | Highest in 5 years | Strong funding status, global diversification, higher yield expectations |

Why the Shift is Happening

1. Declining Bond Attractiveness:

When interest rates go up, bond prices usually fall. This means investors earn less from bonds. That’s why, even though shares can be risky, they’re now looking like a better option for long-term growth.

2. Improved Financial Health:

Many pension funds now have a funding ratio well above 100%, meaning their assets exceed their liabilities. This stronger balance sheet gives them room to take on calculated market risks without jeopardising obligations to policyholders or retirees.

3. Search for Better Yields:

Both insurers and pensions are under pressure to deliver better returns in an inflationary environment. By increasing equity exposure, they hope to beat inflation and deliver higher bonuses or pension payouts.

Impact on the Market

Big buying by Indian insurers and pension funds has helped support the stock market this year. Even when foreign investors sold shares in some months, their strong purchases kept the main market indexes steady.

They’re mainly buying well-known companies in banking, IT, and energy, and also picking a few mid-sized companies with strong profits.

Regulatory Push and Global Trends

- In India: SEBI has proposed changes to IPO rules, increasing allotment quotas for insurance companies and pension funds in large issues. This could further boost their equity participation.

- Globally: In the UK, the “Mansion House Accord” is pushing pension funds to invest more in shares to boost the economy. In China, the government wants state-owned insurers to put more money into local stock markets.

Why This is Important

- Market Stability: When Indian insurers and pension funds buy more shares, it helps keep the market stable even if foreign investors sell.

- Long-Term Gains: Shares can give much higher returns than bonds over many years.

- Economic Boost: More money in shares helps companies grow, which can create more jobs and support the economy.

- Risk Factor: Investing more in shares also means they could lose more if the market falls

This big change by India’s top long-term investors could shape the market’s future.

Also read: Life Insurance Market in India Projected to Reach $170 Billion in 5 Years — and see how this growth could impact investors and policyholders.