The Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI) has become the gateway for Indians to invest and spend abroad. Whether it’s buying US stocks, paying for your child’s education, or funding international travel, the LRS allows you to send up to USD 250,000 per year per individual.

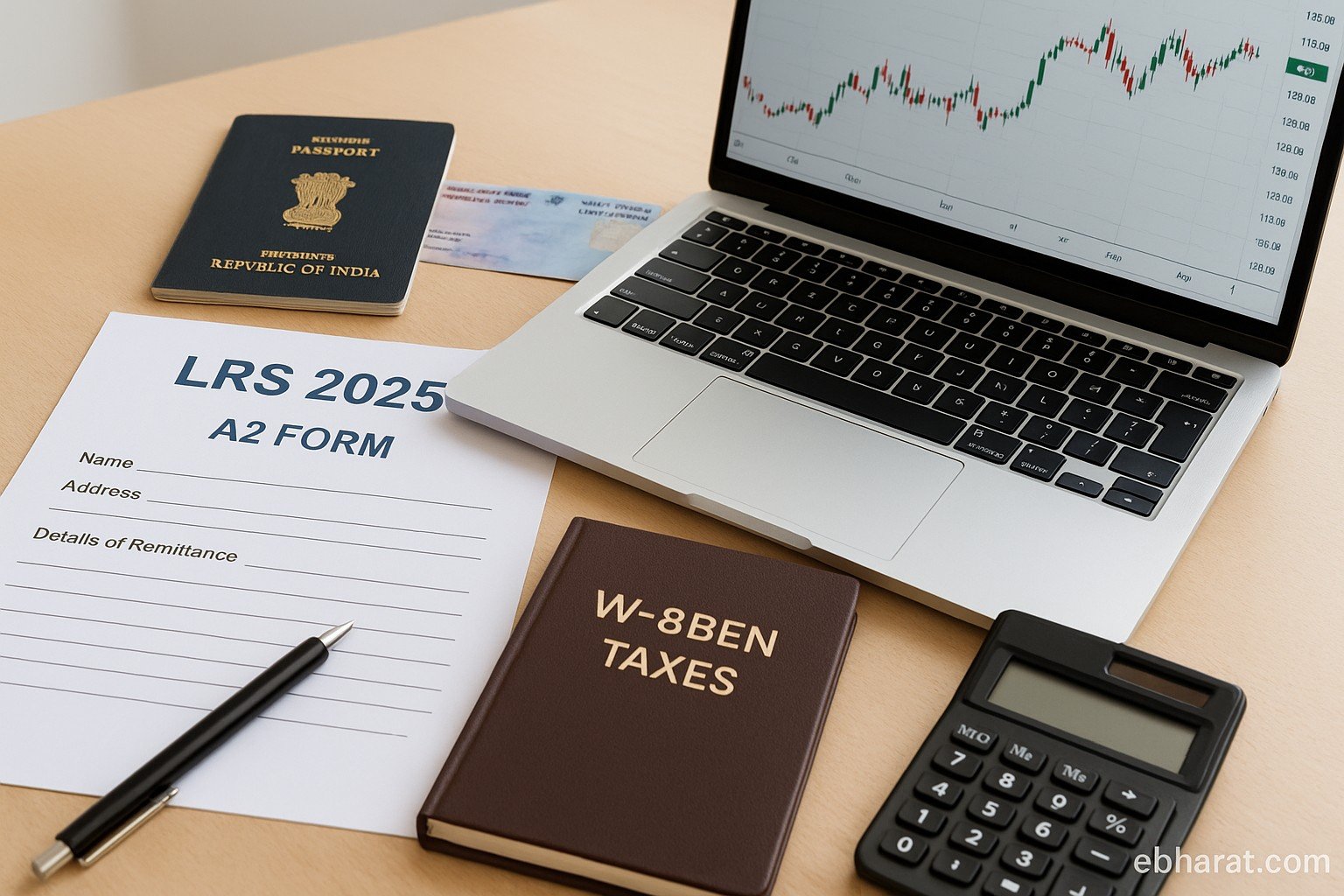

But with opportunity comes responsibility. Taxes, fees, W-8BEN forms, and compliance reporting often confuse first-time investors. This guide breaks down the basics of LRS, available account routes, tax implications, fees, and the best tracking tools for 2025.

LRS Basics in 2025

- Who is eligible?

Only resident individuals can use LRS. Companies, HUFs, and trusts are excluded. - What is allowed?

- Investment in global stocks, ETFs, and mutual funds

- Education and living expenses abroad

- Property purchase outside India

- Travel, medical treatment, and gifting money to relatives abroad

- What is not allowed?

- Lottery tickets and banned activities

- Margin trading or leveraged derivatives abroad

- Remittances to countries identified as “non-cooperative”

- Annual Limit:

Each individual can remit up to USD 250,000 per financial year under LRS.

Account Routes for LRS

Investors today have multiple ways to send money abroad and build global portfolios.

| Account Type | Process | Ease of Setup | Best For |

|---|---|---|---|

| Bank Route | Fill A2 form at your Authorised Dealer (AD) Bank; PAN mandatory | Moderate | Conservative investors, education, property |

| Broker/Fintech | Open account on apps like INDmoney, Groww, Vested, linked via AD bank | Easy | Retail investors in US stocks/ETFs |

| Direct US Broker | Register with Interactive Brokers, Schwab, etc., transfer funds via SWIFT | Harder | High-net-worth & active traders |

Taxes & W-8BEN Form Explained

Taxes are often the most misunderstood part of LRS.

- Capital Gains Tax (CGT):

- Short-term gains (<24 months): taxed at slab rates.

- Long-term gains (≥24 months): 20% with indexation.

- Dividends:

- US companies deduct 25% tax on dividends.

- Filing W-8BEN form with your broker reduces this to 15% (India-US DTAA benefit).

- Example:

Suppose you invest $10,000 in a US ETF that pays $500 dividend.- Without W-8BEN → $125 withheld (25%).

- With W-8BEN → $75 withheld (15%).

- You can claim credit for this $75 when filing Indian ITR.

- Reporting:

- Disclose foreign holdings in Schedule FA of ITR.

- Gains go under Schedule CG.

- Keep remittance certificates from your bank.

Fees & Charges under LRS

Sending money abroad isn’t free. Costs differ by route.

| Cost Head | Bank Transfer | Fintech Broker | Direct US Broker |

|---|---|---|---|

| Forex Markup | 0.5%–2% | 0.2%–0.5% | 0.2%–0.4% |

| Bank Charges | ₹500–₹1,500 per transfer | Usually lower, bundled | ₹1,000–₹2,000 SWIFT fees |

| TCS (above ₹7 lakh) | 20% collected upfront (adjustable at ITR) | ||

💡 Tip: Always compare all-in costs before choosing a route.

Tracking Tools & Compliance

Managing multiple accounts and currencies can be messy. Here’s how to simplify:

- Broker Apps:

- INDmoney: Consolidated US portfolio + tax reports.

- Vested: W-8BEN handling + portfolio tracking.

- Groww/Zerodha: In-app foreign stock access.

- DIY Tools:

- Google Sheets with USD/INR API for live tracking.

- Excel macros for dividend and tax credit tracking.

- Compliance Reminders:

- Renew W-8BEN every 3 years.

- Keep all A2 forms and bank remittance certificates.

- File Schedule FA even if no gains.

Why It Matters (2025 Outlook)

- LRS is becoming the default route for global investing.

- India’s outward remittances crossed USD 30 billion in FY2024.

- RBI is tightening monitoring to curb money laundering.

- For investors, this means: better access, but stricter compliance.

Being proactive about taxes, fees, and reporting saves money and prevents penalties.

Global investing is no longer a luxury—it’s mainstream. With the right account route, careful handling of taxes and W-8BEN forms, awareness of fees, and smart use of tracking tools, Indians can invest abroad confidently under the LRS.

❓ Got Questions on LRS?

Explore our FAQ on the Liberalised Remittance Scheme (RBI) and learn about account routes, taxes, and compliance. Plus, try smart investing tools to track your global portfolio on eBharat.com.