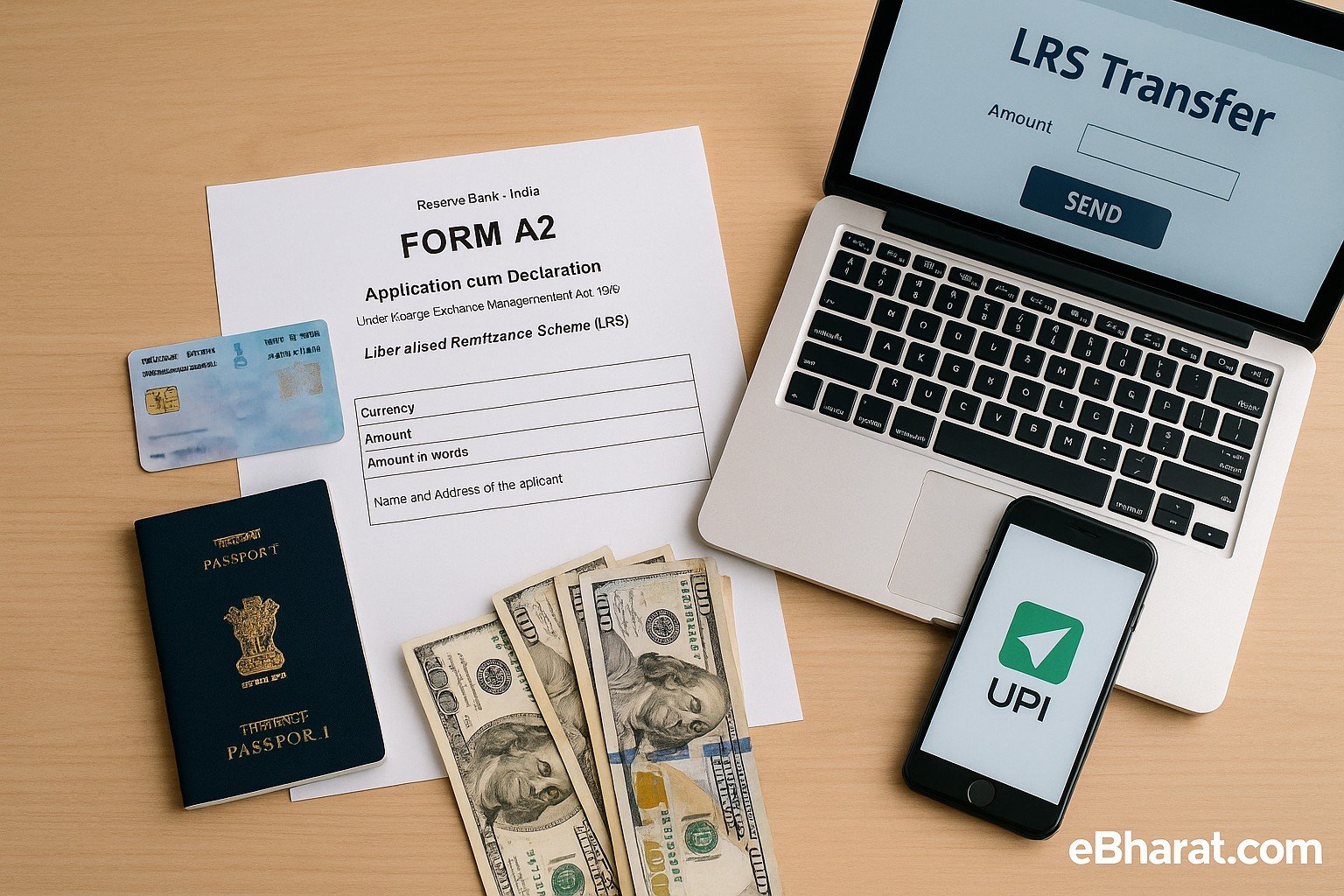

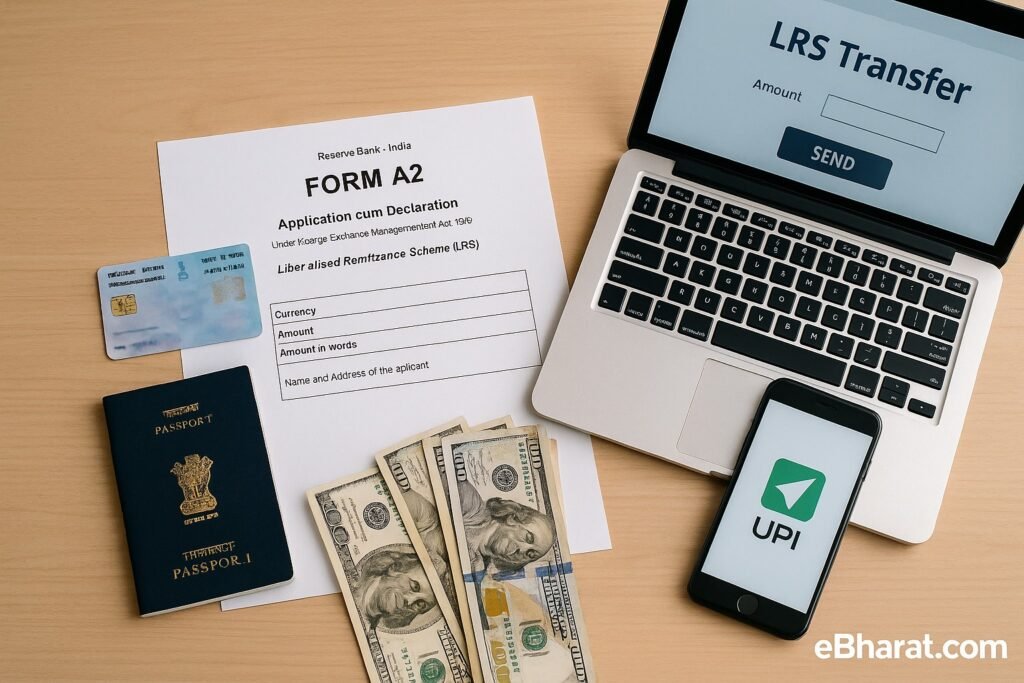

Global investing is easier than ever for Indian investors. Thanks to the Liberalised Remittance Scheme (LRS) by the Reserve Bank of India (RBI), individuals can legally send money abroad for investments, education, travel, and more.

For investors, LRS is the route to buy foreign stocks, ETFs, mutual funds, and overseas property. Here’s everything you need to know in 2025.

What Is LRS?

- Introduced by RBI in 2004, LRS allows Indian residents to remit money abroad.

- Current limit: USD 250,000 (approx. ₹2.05 crore) per financial year per person.

- Can be used for investments, education, travel, gifts, property purchase, and medical expenses.

- Minors are also eligible (with guardian signature).

LRS Limits (2025)

- Annual limit: USD 250,000 per person.

- Family members can combine limits (e.g., 4 family members = USD 1 million).

- Amounts beyond require special RBI approval.

Forms Required

- Form A2: Mandatory declaration form for outward remittance.

- KYC Documents: PAN, Aadhaar, passport copy.

- Declaration: Confirmation that funds will not be used for prohibited transactions (e.g., margin trading, lottery).

Banks That Support LRS Transactions

| Bank | Key Features | Notes |

|---|---|---|

| HDFC Bank | Fast online LRS portal | Popular for overseas stock investing |

| ICICI Bank | Integrated with ICICI Direct Global | Quick remittance + stock account link |

| Axis Bank | Global currency remittance desk | Supports USD, GBP, EUR transfers |

| SBI | Large branch network | Offline-heavy but reliable |

| Kotak Mahindra Bank | Private banking LRS desk | HNIs, NRI-linked accounts |

What Can Investors Do with LRS?

- Buy foreign stocks (Apple, Google, Tesla).

- Invest in ETFs & global mutual funds.

- Purchase foreign property.

- Diversify into international bonds & startups.

Prohibited: Margin trading, cryptocurrency (unless regulations change), or lottery.

Benefits of Using LRS

- Diversification outside India.

- Build USD-denominated wealth.

- Hedge against rupee depreciation.

- Access global opportunities (e.g., Nasdaq tech stocks).

Key Risks

- Currency risk: Rupee depreciation can reduce gains.

- Taxation: Foreign income taxable in India (with DTAA relief).

- Bank charges: Conversion + remittance fees apply.

Start Investing Abroad with LRS

Open a global investment account via Zerodha, Upstox, or partner brokers. Track limits and tax implications using eBharat Tools.