Mizoram’s State Policy Coordination Committee (MSPCC) has opened discussions to roll out livestock insurance under the state’s flagship Bana-Kaih (handholding) programme, aiming to protect households that depend on animal husbandry from disease and disaster shocks. The meeting—attended by Animal Husbandry & Veterinary Minister C. Lalsawivunga, MSPCC leadership, and department officials—focused on coverage design and implementation pathways.

| Programme | Bana-Kaih (Handholding) — Mizoram’s flagship livelihood scheme |

|---|---|

| What’s new | MSPCC discussed adding livestock insurance for beneficiaries engaged in rearing |

| Why now | Recurring disease risks (e.g., ASF in pigs) and income volatility among small rearers |

| Next steps | Finalize product design (sum insured, premium aid), insurer partnerships, vet certification, and claim workflows |

Background: Bana-Kaih supports “Progress Partners” with credit, interest support, and market linkage; MSPCC is the apex body overseeing delivery.

What the committee discussed

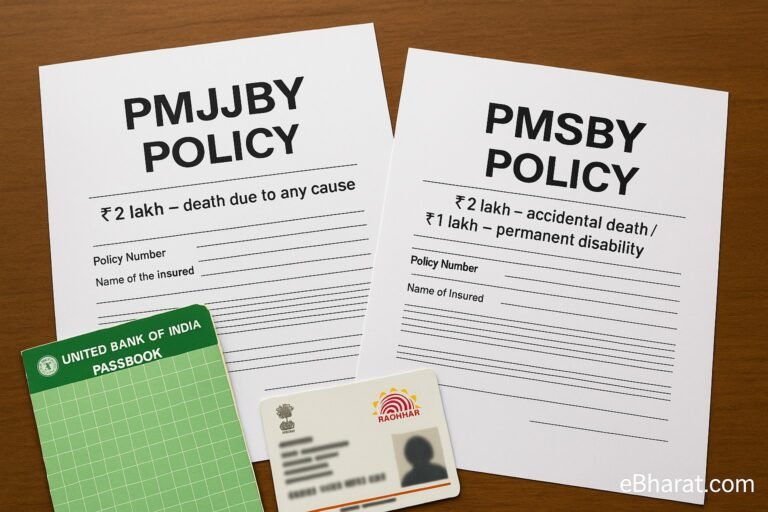

- Policy scope: Insurance for livestock (e.g., cattle, pigs, goats) owned by Bana-Kaih beneficiaries, to cushion households against mortality, epidemics, and natural hazards.

- Governance: The MSPCC—which steers Bana-Kaih—reviewed options with the Animal Husbandry & Veterinary Department and stakeholders.

- Rationale: Mizoram’s piggery sector has faced repeated African Swine Fever (ASF) episodes; risk pooling via insurance could help stabilise incomes. (Local reports flag ASF as a persistent challenge.)

How it could work (early contours)

While detailed guidelines are pending, officials signalled a few likely design choices:

- Sum insured linked to prevailing animal value; periodic valuation through approved vets.

- Premium support via the Bana-Kaih framework (handholding), potentially layered with central schemes wherever convergence is possible.

- Digital enrollment & claims: Simple forms, geo-tagging, and vet certification to speed up processing and reduce disputes.

- Bank tie-ins: Since Bana-Kaih already partners with SBI, MRB, and MCAB for credit delivery, the same rails could facilitate premium collection or claim disbursal.

Note: Final benefits, premiums, and eligibility will be notified after the government completes consultations and issues formal guidelines.

Why it matters for farmers and the state

- Income protection: One mortality event can wipe out a small rearer’s working capital. Insurance socialises that risk, preventing distress sales or fresh debt.

- Credit readiness: Lenders prefer insured herds; pairing insurance + credit can expand productive investment in livestock.

- Food security & prices: Smoother herd recovery post-outbreak helps stabilise meat supply and retail prices in Mizoram’s markets.

Where Bana-Kaih fits in the bigger picture

Launched in 2024, Bana-Kaih is a handholding-centric model that mixes bank credit with state support, aligned to “Viksit Bharat” goals. The state has already signed MoUs with partner banks and issued implementation guidelines; the MSPCC leads execution. Adding livestock insurance would extend the programme from financing to risk management, closing a critical gap for rural livelihoods.

What to watch next

- Official notification: Look for a government order outlining eligible species, premium rates, claim triggers, and documentation.

- Insurer partnerships: Which insurers sign on (public/private) and the size of the cashless veterinary network.

- ASF-specific provisions: Any disease exclusions or special windows for epidemic events.

- Pilot districts & timeline: Whether the rollout starts in high-incidence districts before scaling statewide.