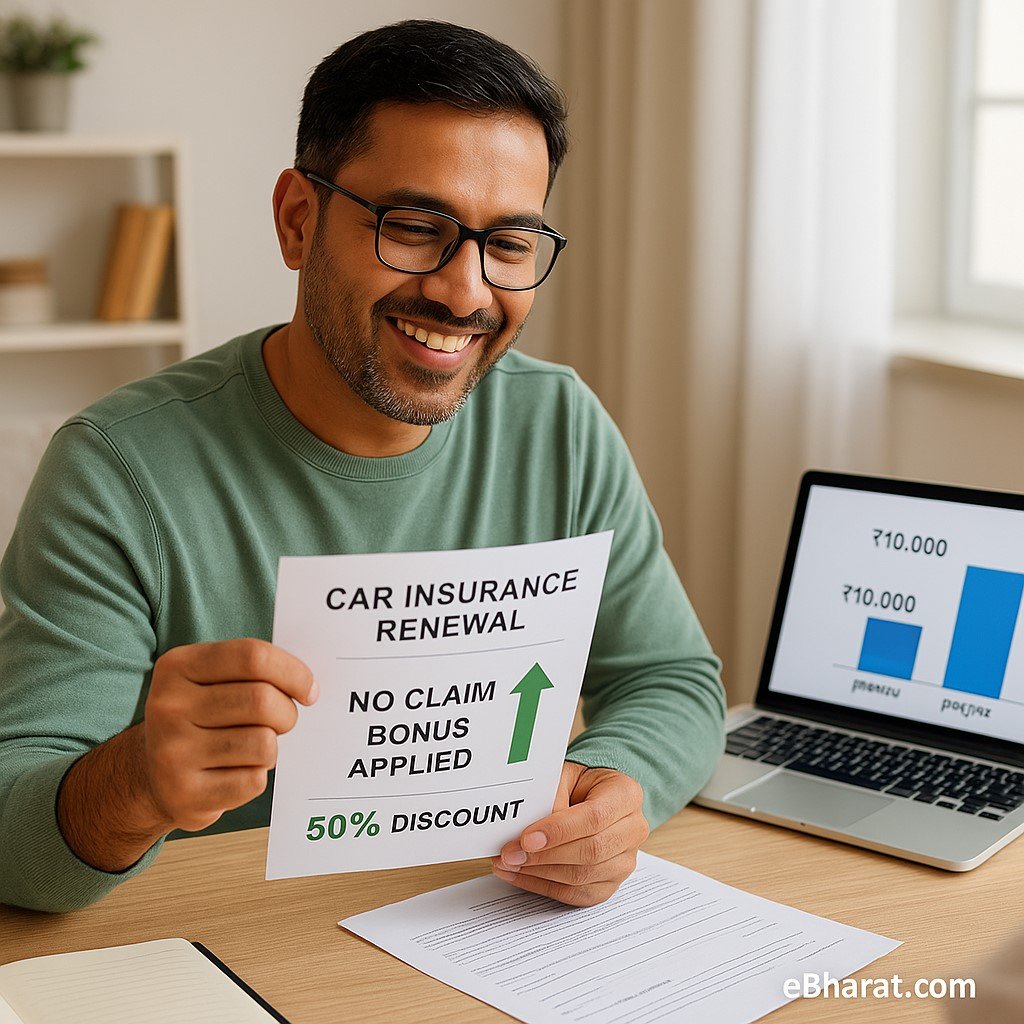

Many vehicle owners in India hear about No Claim Bonus (NCB) when renewing their car or bike insurance. But few actually understand how it works.

In 2025, with rising premiums and stricter IRDAI rules, knowing how to use NCB smartly can save thousands every year.

What Is No Claim Bonus?

- NCB is a reward given by insurers to policyholders who don’t make a claim in a policy year.

- It applies only to the own-damage portion of the premium (not third-party).

- It starts at 20% discount and can go up to 50% after 5 consecutive claim-free years.

NCB Slabs (IRDAI 2025)

| Claim-Free Years | NCB Discount on OD Premium |

|---|---|

| 1 year | 20% |

| 2 years | 25% |

| 3 years | 35% |

| 4 years | 45% |

| 5 years+ | 50% (maximum) |

Example: How NCB Saves Money

Ravi owns a sedan with an own-damage premium of ₹10,000.

- After 1 claim-free year: 20% NCB → Premium reduces to ₹8,000.

- After 3 years: 35% NCB → Premium reduces to ₹6,500.

- After 5 years: 50% NCB → Premium reduces to ₹5,000.

Over 5 years, Ravi saves ₹20,000+ just by avoiding claims for minor damages.

Key Rules of NCB in 2025

- Linked to Policyholder, Not Vehicle

- If you sell your car and buy a new one, NCB can be transferred.

- One Claim = Reset to Zero

- Even a small claim cancels your accumulated NCB.

- Grace Period for Renewal

- If you don’t renew within 90 days of expiry, NCB lapses.

- NCB Protection Add-On

- Lets you keep your NCB even after one minor claim.

Common Mistakes to Avoid

- Claiming for small damages (₹2,000–₹3,000) that cost less than the NCB savings.

- Forgetting to transfer NCB when switching cars or insurers.

- Missing the renewal grace period and losing years of discounts.

Case Study: Anita’s Smart Renewal

Anita, a 35-year-old IT professional, avoided making a ₹4,000 claim for a small scratch repair. At renewal, her NCB saved her ₹7,500, much more than the repair cost.

Lesson: Sometimes paying small repairs yourself is better than losing NCB.

Why This Matters

NCB is one of the easiest ways to reduce motor insurance costs in India. With premiums rising in 2025, making smart decisions about when to claim and when not to can save families thousands annually.

Next, read: Car Insurance Premium Rates 2025: Trends Across Insurers

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent