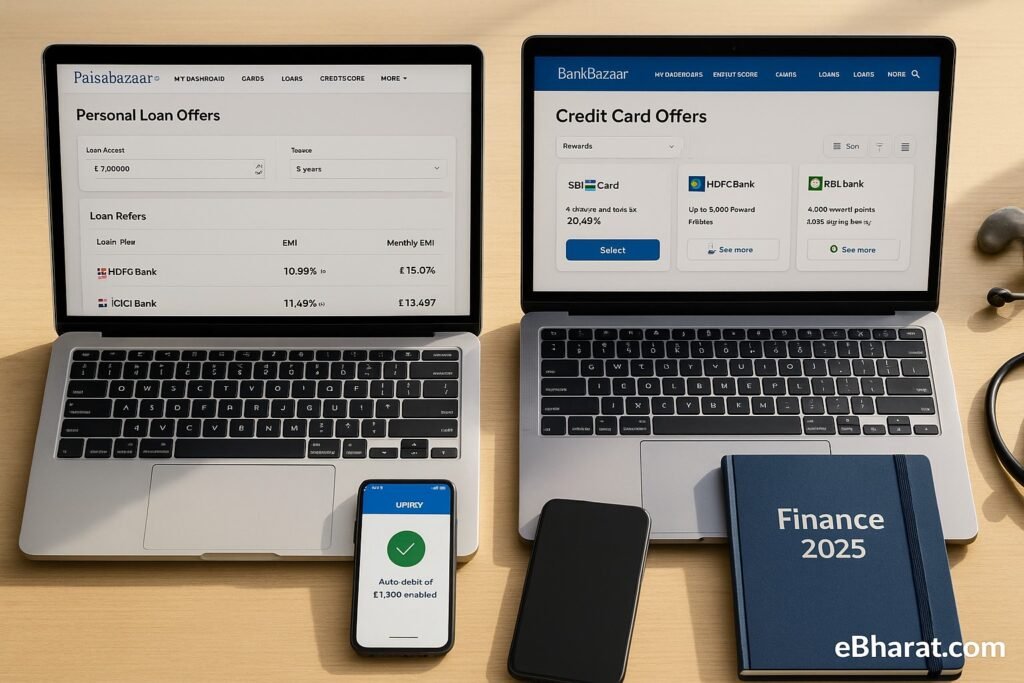

When it comes to credit cards and personal loans, two names dominate India—Paisabazaar and BankBazaar. Both are RBI-registered platforms, but they serve slightly different needs: Paisabazaar is stronger for loans and credit health, while BankBazaar shines in card comparisons. Here’s our 2025 review.

India Snapshot

| Feature | Paisabazaar | BankBazaar | Notes |

|---|---|---|---|

| Credit Cards | 100+ cards from HDFC, ICICI, SBI, Axis | 150+ cards including Amex & Citi | BB wider |

| Personal Loans | 30+ banks/NBFCs, instant loan approvals | 20+ lenders, fewer instant approvals | PB stronger |

| Credit Score | Free Experian & CIBIL score tracker | Limited score tracking | PB wins |

| App Rating | 4.5⭐ Play Store | 4.2⭐ Play Store | PB slightly higher |

| Payments | UPI, NetBanking, auto-debit for EMIs | UPI, NetBanking, auto-debit for EMIs | Tie |

| GST Invoice | Yes | Yes | Tie |

| Best For | Loan seekers + credit health tracking | Card seekers + reward hunters | Depends on goal |

Compare cards & loans in minutes:

Check Offers on Paisabazaar

Find Deals on BankBazaar

Paisabazaar: The Loan & Credit Health Leader

- Known as India’s biggest loan marketplace.

- Partnerships with HDFC, ICICI, Axis, Kotak, SBI, Bajaj Finserv, and more.

- Offers instant personal loans via paperless KYC.

- Free credit score tracker (Experian + CIBIL).

- Weakness: Fewer curated credit card offers compared to BankBazaar.

Best for: Borrowers focused on personal loans and credit health.

BankBazaar: The Card Hunter’s Platform

- Specializes in credit card comparisons—cashback, travel, fuel, rewards.

- Partnerships with HDFC, ICICI, Citi, SBI, Amex, and more.

- Detailed card filters (spends, rewards, lifestyle).

- Weakness: Personal loan approvals not as instant.

Best for: Users searching for credit cards with perks & rewards.

Pros and Cons

Paisabazaar Pros

- Best for personal loan seekers.

- Free credit score tracking.

- Strong app with instant KYC features.

Paisabazaar Cons

- Limited credit card curation.

- Frequent follow-up calls from banks.

BankBazaar Pros

- Best for comparing credit cards.

- Wide partnerships including Amex & Citi.

- Easy filters for rewards-based decisions.

BankBazaar Cons

- Loan approvals slower than Paisabazaar.

- App interface less smooth.

Quick Checklist

- Want personal loans + credit score tracking → Paisabazaar.

- Want credit card rewards comparison → BankBazaar.

- Always check GST invoice & EMI setup.

- Verify lender interest rates before applying.

- Use UPI/NetBanking for faster EMI setup.

Compare and apply today:

Get Personal Loans & Credit Score Free on Paisabazaar

Find Best Credit Cards on BankBazaar

In 2025, Paisabazaar is best for personal loans and credit health tracking, while BankBazaar wins for credit card seekers looking for perks and rewards. Both are safe, GST-ready, and UPI-friendly. Your choice depends on whether you want cash in hand or card in wallet.