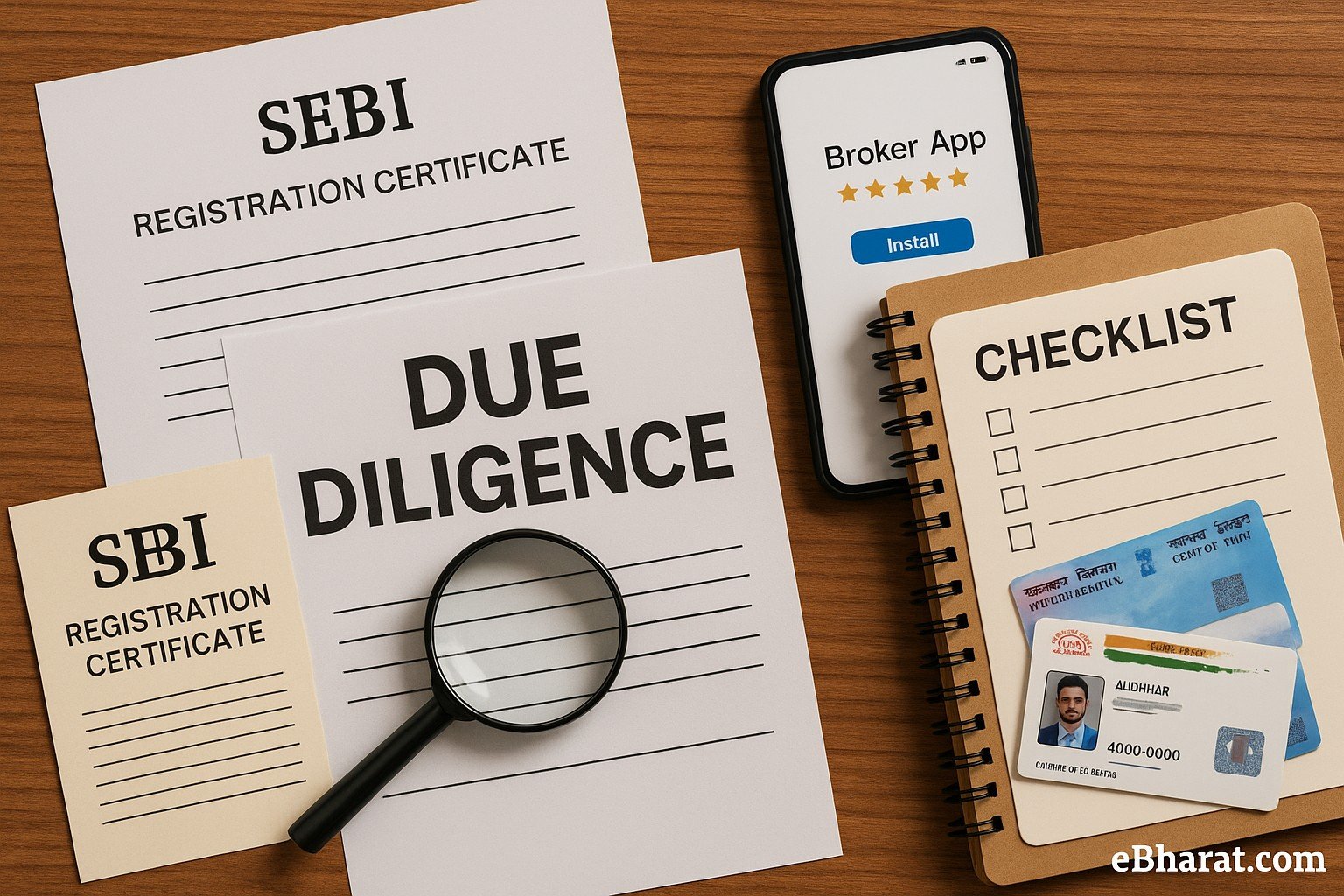

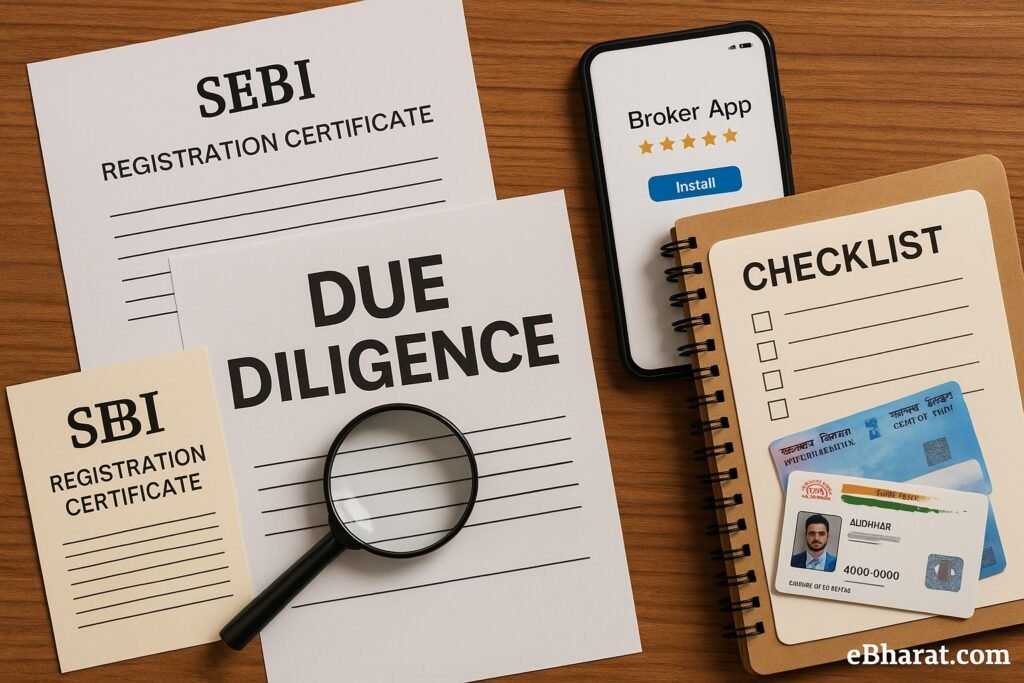

Before investing through any broker, fintech app, or platform, investors must ensure the platform is safe, compliant, and reliable. In recent years, cases of fraudulent apps, hidden charges, and data misuse have increased, making due diligence more critical than ever.

This checklist will guide you through key factors to check before trusting your money to a platform in 2025.

Regulatory Compliance

- SEBI Registration:

- Check if the broker is registered with SEBI.

- Search by name on SEBI Intermediary Portal.

- Depository Membership:

- Must be a member of CDSL or NSDL for Demat services.

- RBI/IRDAI/NHB Licenses:

- For payments, insurance, or housing finance-related services.

If the platform cannot show its SEBI registration number, avoid it.

Transparency of Charges

- Brokerage and transaction charges must be clear.

- Watch out for:

- Hidden platform fees.

- Inactivity charges.

- Extra AMC (Annual Maintenance Charges).

Always read the brokerage tariff sheet on the official site.

Data Security & Privacy

- Does the app use 2FA (Two-Factor Authentication)?

- Is the website/app SSL encrypted (https)?

- How do they store your Aadhaar/PAN data?

- Do they share customer data with 3rd parties without consent?

If a platform doesn’t mandate 2FA, it’s a red flag.

Technology & Reliability

- Check mobile app ratings on Play Store / App Store.

- Does the platform have frequent downtime during market hours?

- Are order execution speeds reliable?

- Does it offer backup channels (call & trade, web + mobile)?

Investor Protection Policies

- Grievance Redressal: Check if they have a SEBI SCORES complaint link.

- Insurance: Some platforms offer investor protection insurance.

- Dispute Resolution: Clear escalation matrix provided?

Product & Research Quality

- Does the platform only provide execution, or does it offer research/advisory?

- Are stock reports SEBI-compliant (no unauthorised tips)?

- Are the tools beginner-friendly (screeners, model portfolios)?

Customer Support

- Is there a toll-free helpline or only chatbots?

- How responsive are email & grievance redressals?

- Try contacting support before opening an account to test their efficiency.

Platform Due-Diligence Checklist Table

| Checklist Item | What to Verify | Why It Matters |

|---|---|---|

| Regulatory Status | SEBI registration, NSDL/CDSL membership | Ensures legal compliance |

| Charges | Tariff sheet, AMC, hidden fees | Avoids cost shocks later |

| Data Security | 2FA, SSL, privacy policy | Protects identity & assets |

| Technology | Uptime, speed, backup options | Ensures smooth trading |

| Support | Helpline, email, SCORES link | Helps resolve disputes quickly |

Red Flags

- Platform not listed on SEBI website.

- No clear mention of charges.

- Pushes unsolicited stock tips.

- Frequent downtime during market hours.

If you find even two red flags, avoid the platform.

Due diligence is not optional. Whether you’re opening a Demat account, using a fintech robo-advisor, or investing via a digital gold platform, always verify compliance, charges, and security.

This simple checklist can protect you from fraud, data misuse, and hidden costs.

Stay Safe Before You Invest

Compare platforms and read our detailed broker reviews to ensure your money is safe.