The Indian government offers three major low-cost financial protection schemes:

- PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana) – Life insurance cover.

- PMSBY (Pradhan Mantri Suraksha Bima Yojana) – Accident insurance cover.

- Atal Pension Yojana (APY) – Guaranteed monthly pension after retirement.

All three are designed for affordable access, especially for workers in the unorganized sector. But in 2025, with inflation, changing incomes, and new insurance products, which one actually delivers the most value?

Quick Comparison – PMJJBY vs PMSBY vs APY

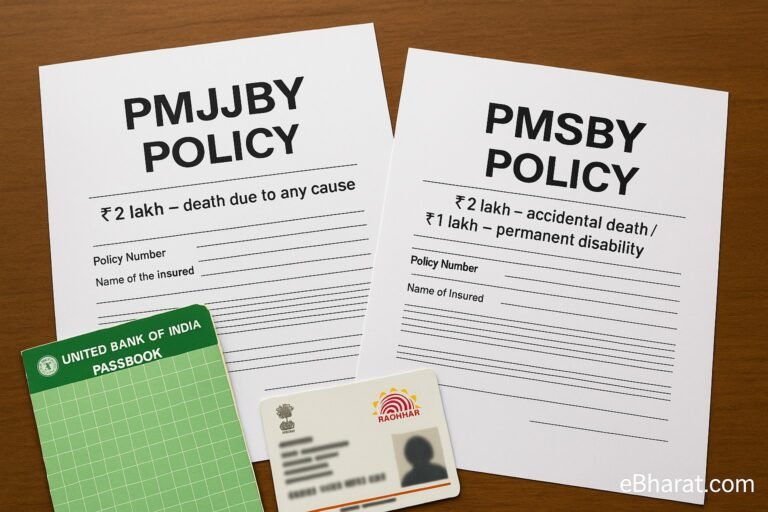

| Feature | PMJJBY | PMSBY | Atal Pension Yojana |

|---|---|---|---|

| Type | Life Insurance | Accident Insurance | Pension Scheme |

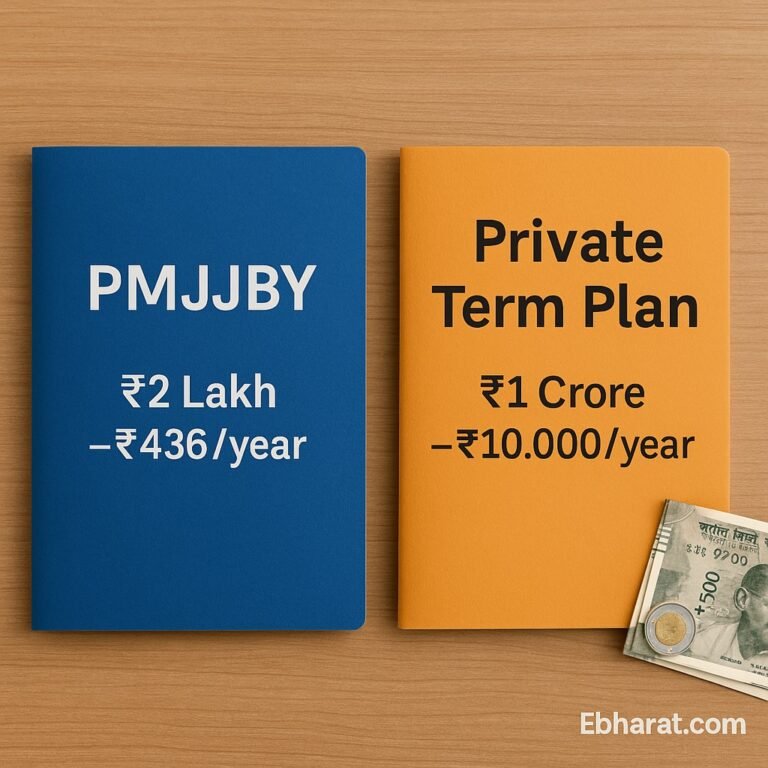

| Annual Premium | ₹436 | ₹20 | Varies by pension amount |

| Coverage | ₹2 lakh on death (any cause) | ₹2 lakh accidental death / ₹1 lakh partial disability | ₹1,000–₹5,000/month pension after 60 years |

| Eligibility | 18–50 years | 18–70 years | 18–40 years |

| Best For | Basic life cover for low-income workers | Accident protection for workers/travelers | Retirement income security |

Strengths & Weaknesses

PMJJBY

- Cheap life cover, easy to buy via bank account.

- Only covers death, no maturity or living benefit.

PMSBY

- Ultra-low cost, covers disability too.

- No health or illness coverage.

Atal Pension Yojana

- Guaranteed pension for life, govt-backed.

- Long lock-in; you must contribute regularly till 60.

Case Example

Ravi, a 32-year-old factory worker, takes all three:

- PMJJBY & PMSBY for immediate risk protection.

- Atal Pension Yojana for retirement security.

His total annual premium for the insurance schemes is just ₹456, and APY contribution is ₹376/month for a ₹3,000 pension.

Best Strategy in 2025

If eligible, combine PMJJBY + PMSBY for cheap protection today and add APY for future stability. Even if you upgrade later to private term plans or retirement funds, these schemes provide a solid foundation.

Why It Matters

These schemes are not perfect, but they are accessible, affordable, and government-backed — a great starting point for financial security in low and middle-income households.

For just a few hundred rupees a year, you can secure life, accident, and retirement protection. Share this eBharat.com guide so more people use these schemes wisely.

Internal Links: