When it comes to life and accident insurance, most low-income families either skip protection or don’t know where to begin. That’s where two government schemes — PMJJBY and PMSBY — step in. For less than ₹500 a year, you can give your family a financial safety net against death or disability.

But what exactly are these two plans? How are they different — and should you take both?

Let’s break it down simply.

What Each Plan Covers

Think of PMJJBY as your basic life insurance. If the insured person dies — whether due to illness, accident, or any natural cause — the nominee gets ₹2 lakh.

Now think of PMSBY as your accident insurance. It pays out only if the person dies in an accident or suffers a disability because of one.

So:

They’re not duplicates — they cover different risks.

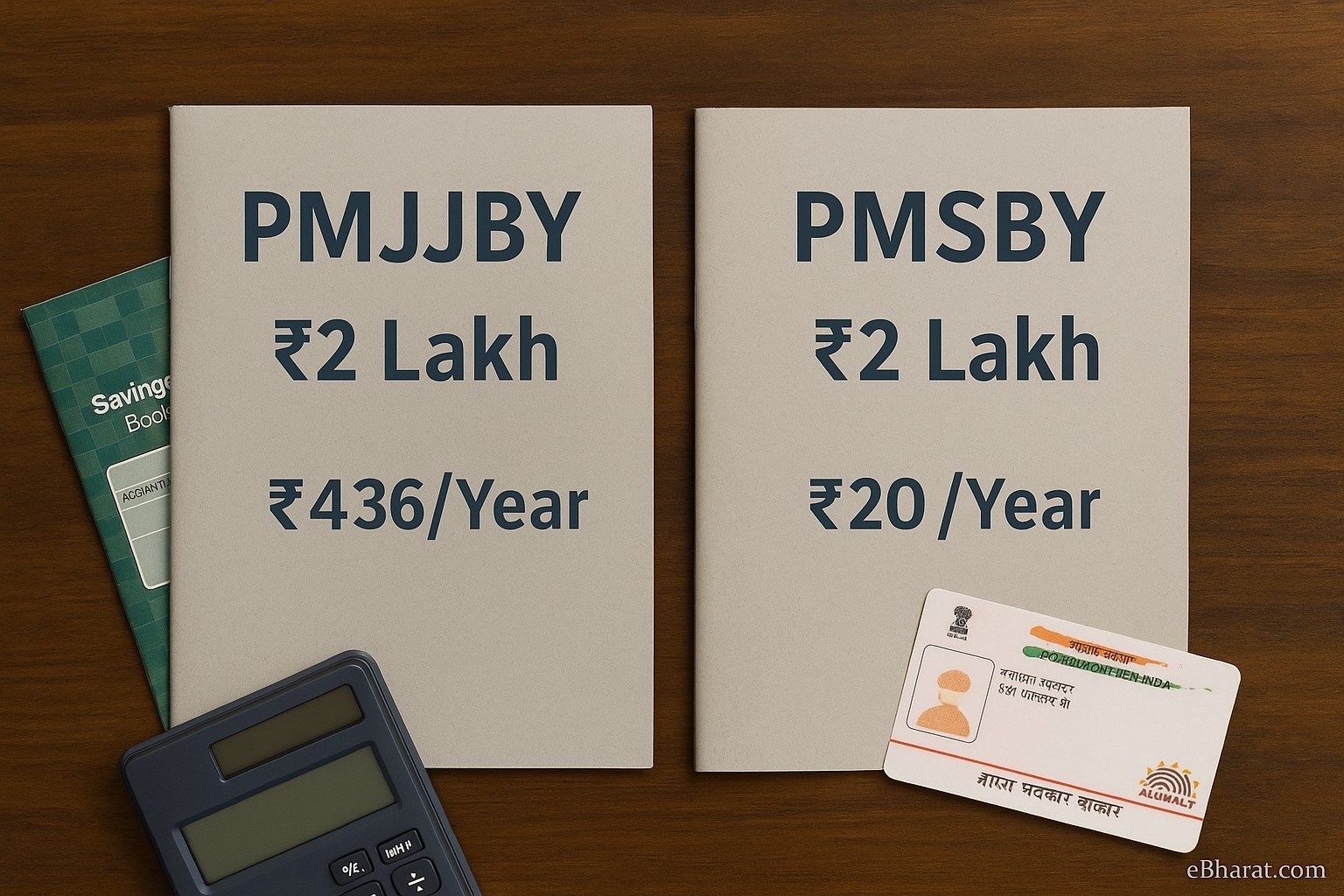

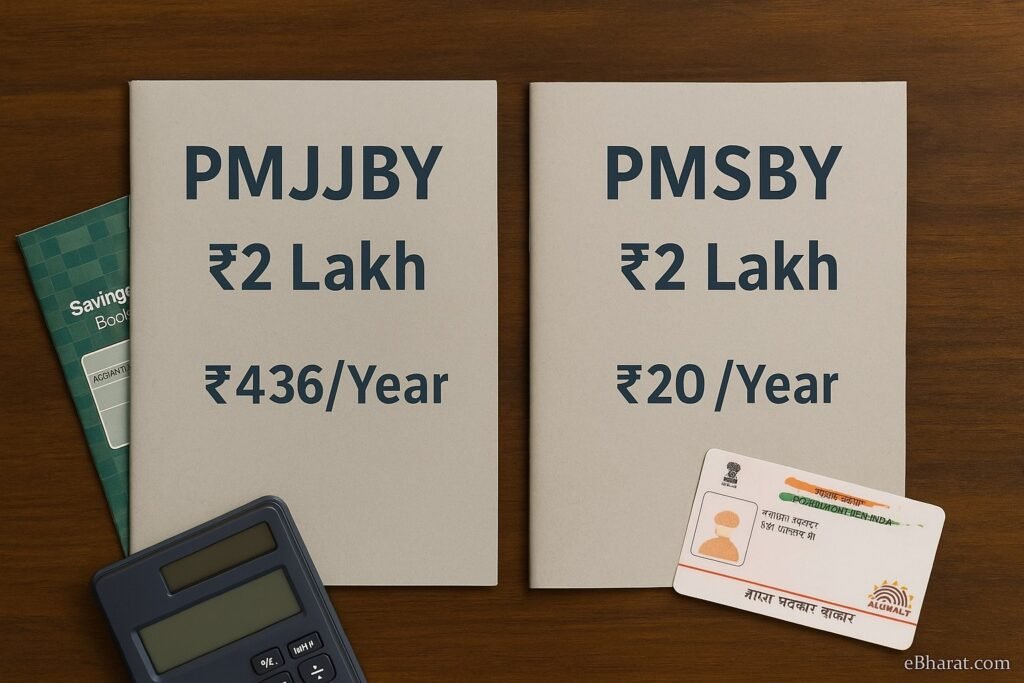

Premium: What It Costs Per Year

- PMJJBY costs ₹436/year

- PMSBY costs just ₹20/year

Yes — ₹456 for both, which is less than ₹40/month. No other insurance gives this kind of coverage for this little.

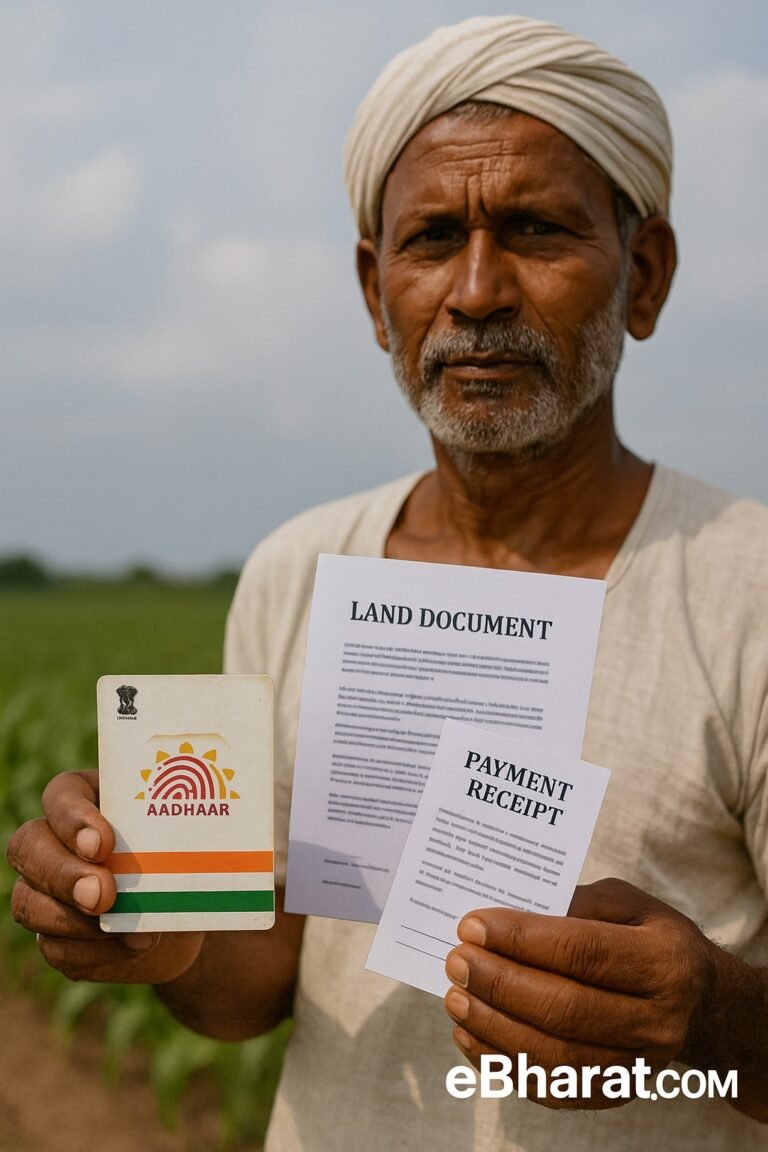

Who Can Apply

Both schemes are meant for everyday working-class Indians.

- PMJJBY: Anyone aged 18–50 can enroll (renewable up to 55)

- PMSBY: Anyone aged 18–70 can enroll

You need just two things:

- A savings account (preferably Jan Dhan or regular bank account)

- Aadhaar card linked to the account

The premium gets auto-debited yearly — no need to remember dates.

How to Claim

- PMJJBY: Nominee has to submit the claim through the bank + insurer (LIC or SBI Life, for example).

- PMSBY: Requires accident-related documents like FIR, medical/hospital report, and claim form via the bank.

Tip: At the time of buying the policy, make sure:

- The nominee’s name is correctly entered

- Aadhaar and bank details are updated

This makes the claim smoother for your family.

Policy Renewal

Both plans are annual. The bank will auto-deduct the premium (usually in May or June) if there’s enough balance. You won’t get reminders — so make sure the money is there.

Should You Take Both?

Absolutely. If you earn ₹10,000–₹30,000/month, these plans are not optional — they’re essential.

Together, they offer:

- ₹2 lakh if you die (any reason) from PMJJBY

- ₹2 lakh more if death is accidental, or ₹1 lakh for partial disability from PMSBY

So, for just ₹456/year, you get double-layer protection. That’s powerful peace of mind for your spouse, children, or parents.

PMJJBY is your basic life shield.

PMSBY is your accident backup.

Together, they’re smart, simple, and super affordable.

PMJJBY vs PMSBY

| Feature | PMJJBY | PMSBY |

|---|---|---|

| Type of Insurance | Life (any cause of death) | Accident only (death or disability) |

| Coverage | ₹2 lakh on death | ₹2 lakh (death/full disability), ₹1 lakh (partial disability) |

| Premium | ₹436/year | ₹20/year |

| Eligibility | Age 18–50 (renew till 55) | Age 18–70 |

| Claim Process | Via bank & LIC/insurer | Via bank (with FIR, hospital papers) |

| Auto Renewal | Yes (bank auto-debit) | Yes (bank auto-debit) |

At the end of the day, both PMJJBY and PMSBY serve different purposes — one protects your life, the other covers accidental risks. If you can afford, the both can give your family a basic but much-needed layer of financial protection. But remember, these are entry-level schemes. As your income grows, consider upgrading to a private term or personal accident plan with better coverage. Start small, but think long-term.

Still unsure whether these ultra-low-cost plans are genuinely worth it in the long run? Our deeper analysis — ₹12 and ₹330 Insurance Schemes: Are They Really Worth It in 2025? — looks beyond just premiums and explores the real-life pros and cons of each scheme.