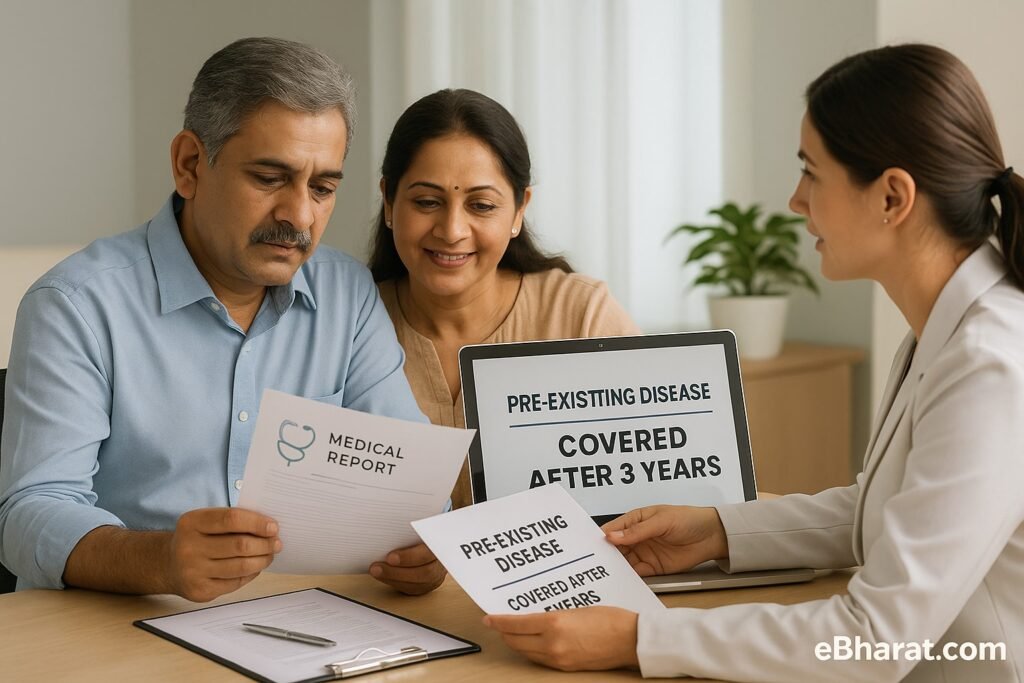

One of the biggest hurdles in health insurance is Pre-Existing Disease (PED) waiting periods. Until recently, insurers could exclude coverage for diabetes, hypertension, or asthma for 3–4 years, leaving families vulnerable.

In 2025, the Insurance Regulatory and Development Authority of India (IRDAI) has changed the rules to make health insurance more inclusive and consumer-friendly. Let’s break down what’s new.

What Counts as a Pre-Existing Disease in 2025?

Earlier, definitions were vague, leading to disputes. Now IRDAI defines PED as:

- Any disease, condition, or symptom diagnosed by a doctor within 3 months before policy issuance.

- Long-term chronic conditions like diabetes, hypertension, thyroid disorders, asthma, and cancer.

- Past medical history declared during proposal.

What’s NOT a PED anymore? Minor conditions that don’t require ongoing treatment, like seasonal flu or a one-time fever, are not classified as PED.

Key IRDAI Changes in 2025

- Maximum Waiting Period Capped at 3 Years

- No insurer can impose more than 3 years waiting period for PEDs.

- Earlier, some policies had 4–6 year waiting periods.

- Standardized Definition Across Insurers

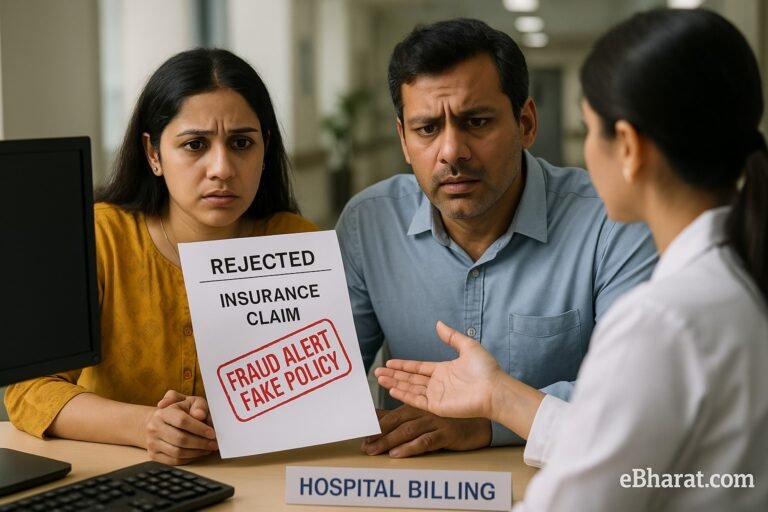

- Eliminates confusion and unfair claim rejections.

- Mandatory Disclosure by Insurers

- Every policy must clearly list PED waiting rules upfront.

- Coverage for Controlled PEDs

- If a disease is controlled with medication (e.g., diabetes), some policies now cover hospitalization from Day 1 (with higher premium).

Why This Is a Game-Changer

- Families with chronic conditions no longer face long exclusion windows.

- Elderly buyers can access coverage sooner.

- Claim disputes due to vague PED definitions will reduce significantly.

Quick Infobox: PED Rules at a Glance (2025)

| Old Rules | 2025 Rules |

|---|---|

| Waiting period 4–6 years | Max 3 years |

| Vague PED definitions | Standardized definitions |

| Coverage often denied | Fairer inclusion |

Case Example: Rajesh’s Experience

Rajesh, a 45-year-old diabetic, bought a policy in 2022 with a 4-year waiting period. Under the old rules, his hospitalization due to a diabetes complication in year 3 would not have been covered.

But under IRDAI’s 2025 rules, any new policy will have only a 3-year maximum waiting period, ensuring Rajesh gets protection earlier.

Tips for Buyers in 2025

- Always disclose your medical history honestly—non-disclosure can void claims.

- Look for policies that offer Day 1 PED coverage riders.

- Use Insurance+ to compare PED rules across insurers.

- For senior citizens, pick insurers with lowest waiting periods.

Why This Matters

Pre-existing diseases are common in Indian families. By standardizing rules and capping waiting periods, IRDAI has made health insurance fairer, faster, and more accessible in 2025.

Next, read: Tax Benefits under Section 80D: Practical Examples for Families

💊 Compare PED-Friendly Health Plans

Use Insurance+ to find policies with shorter waiting periods for pre-existing diseases, or join eBharat’s Agent Network to guide families with chronic health conditions.

🔍 Compare PED-Friendly Plans