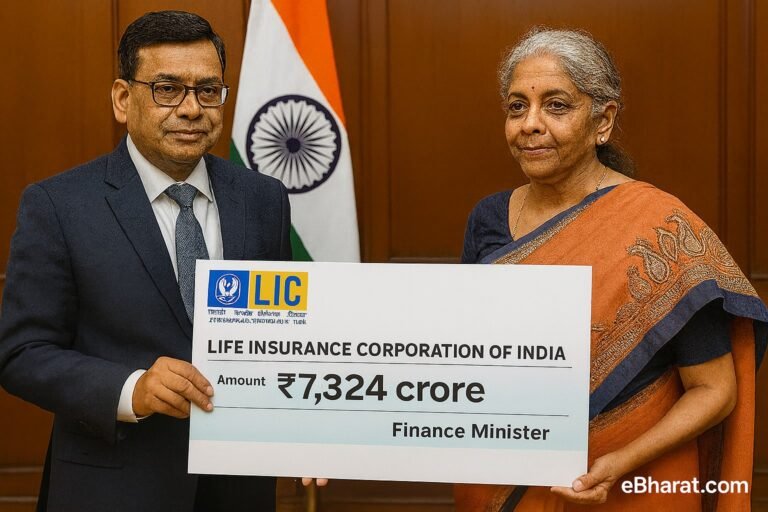

In the aftermath of devastating floods across Punjab, opposition leaders have sharply criticized the government for what they call “meagre and unfair” compensation to farmers. The state’s current payout of ₹6,750 per acre is being labeled inadequate compared to actual crop losses, with many pointing to gaps in the Pradhan Mantri Fasal Bima Yojana (PMFBY).

Flood Compensation Snapshot – Punjab

| Parameter | Details |

|---|---|

| Govt. payout | ₹6,750 per acre |

| Average loss reported | ₹15,000–₹20,000 per acre |

| Scheme in question | PMFBY (Crop Insurance) |

| Opposition demand | Enhanced payouts, better claim processing |

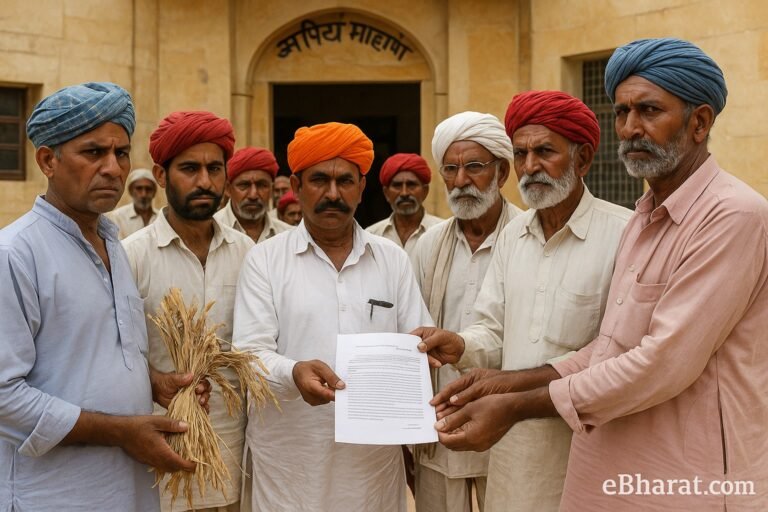

Farmers’ Frustration

Flood-hit farmers have argued that the official payouts don’t reflect the real cost of seeds, fertilizers, and labour. Many claim they are left with no option but to borrow money or sell assets to survive. Farmer unions say withholding from the PMFBY scheme has worsened distress, as premiums were paid but benefits remain uncertain.

Opposition’s Stand

Opposition parties in Punjab’s assembly allege that the ruling government is dragging its feet on compensation reforms. Leaders have demanded:

- Immediate revision of per-acre compensation rates.

- Transparent settlement of PMFBY claims.

- Centre–State coordination to ensure disaster relief reaches every farmer.

Government’s Response

State officials argue that compensation is being distributed as per existing guidelines, and more relief may follow once crop damage assessments are finalized. However, political observers note rising pressure on the administration to act swiftly as farmer protests gain momentum.

Why It Matters

Punjab is India’s grain bowl, and crop insurance policies directly impact both rural households and national food security. The ongoing debate signals the need for reforms in PMFBY, especially in flood-prone regions where payouts often fall short of ground realities. For insurance policyholders, this episode underlines why timely claims and fair assessments are just as important as having coverage.

🌾 Insurance Works Both Ways

Farmers deserve stronger protection—and so do you. Explore Insurance+ to compare policies and claims help. Or step up and become an agent to guide others and earn with every policy.