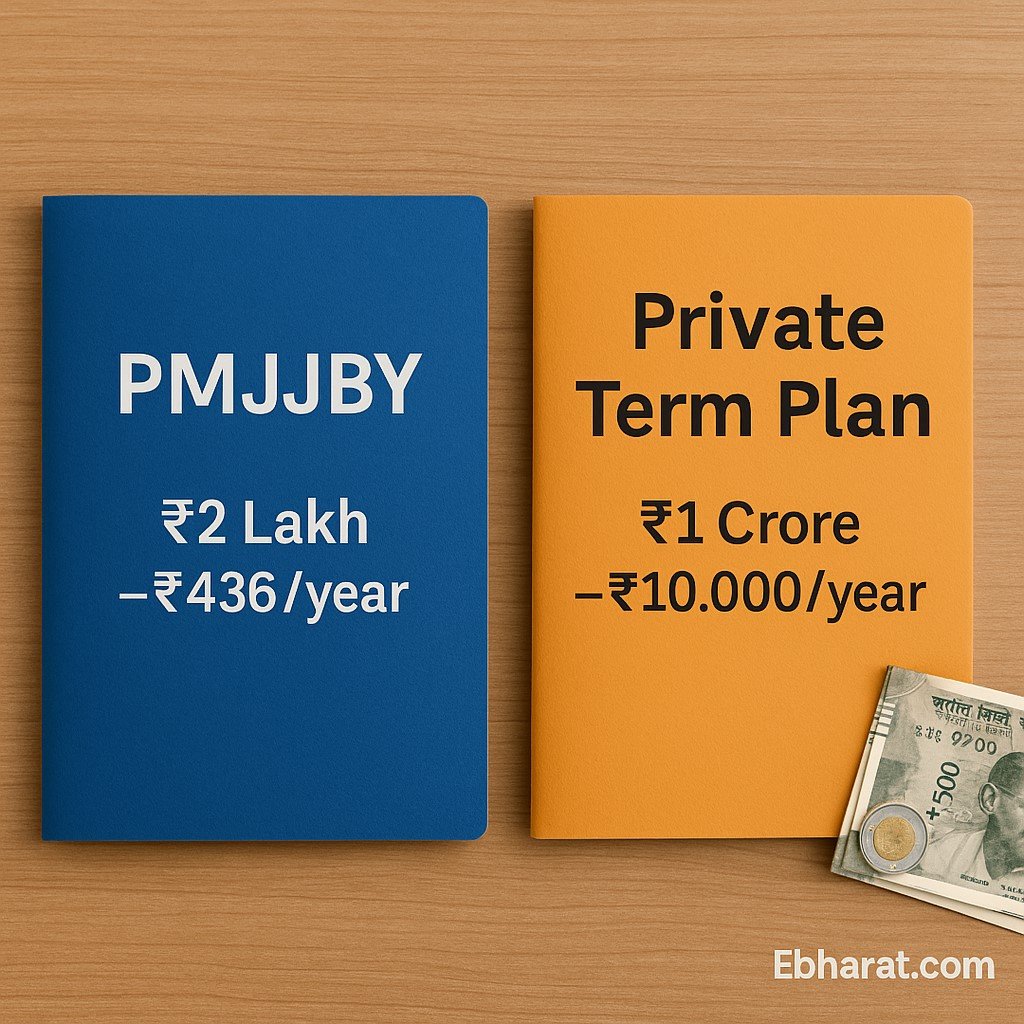

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is one of India’s most affordable life insurance schemes — ₹436/year for ₹2 lakh cover. But if you already have a large private term plan, you may wonder: Do I really need PMJJBY too?

In 2025, with better private term insurance options available, the decision comes down to cost, convenience, and your overall insurance strategy.

PMJJBY vs Private Term Plan – Quick Comparison

| Feature | PMJJBY | Private Term Plan |

|---|---|---|

| Annual Premium | ₹436 | ₹5,000–₹25,000+ |

| Coverage | ₹2 lakh | ₹25 lakh–₹5 crore |

| Eligibility | 18–50 years | 18–65 years |

| Renewal | Auto-debited annually via bank | Annual/semi-annual/quarterly options |

| Best For | Low-income individuals, basic safety net | Primary income replacement for dependents |

Why You Might Keep PMJJBY Even with a Term Plan

- Extremely Low Cost: ₹436/year is negligible for most people.

- Extra Layer of Protection: Adds ₹2 lakh on top of your term cover.

- Ease of Renewal: Auto-debit means no missed payments.

- Claim Simplicity: PMJJBY claims are processed through banks, often faster in rural areas.

Why You Might Skip PMJJBY

- You already have adequate coverage through your term plan and other policies.

- You want to avoid multiple small policies for simplicity.

- You live abroad and no longer maintain an eligible Indian bank account.

Case Example

Anil has a ₹1 crore private term plan and also keeps PMJJBY. When he passed away in an accident, his family received ₹1 crore from the private insurer and ₹2 lakh from PMJJBY — the latter covering immediate funeral and emergency expenses while the larger claim processed.

Best Strategy in 2025

If you can afford it, keep PMJJBY alongside your term plan. The extra cover for such a low cost is worth it, and it can serve as quick-access money for your family during emergencies.

Why It Matters

Life insurance is about securing your family’s future. PMJJBY may not replace a term plan, but it can complement it at an unbeatable cost.

Sometimes, keeping a small, cheap policy can make a big difference. Share this eBharat.com guide so more people see the value of PMJJBY as a top-up cover.

Internal Links: