If your family earns ₹10,000 to ₹15,000 a month, you already know the pressure. Every rupee goes toward food, rent, school fees, and emergencies. So, when someone talks about buying life insurance, your first thought might be, “Can I even afford this?”

The good news? You can protect your family — without breaking your monthly budget.

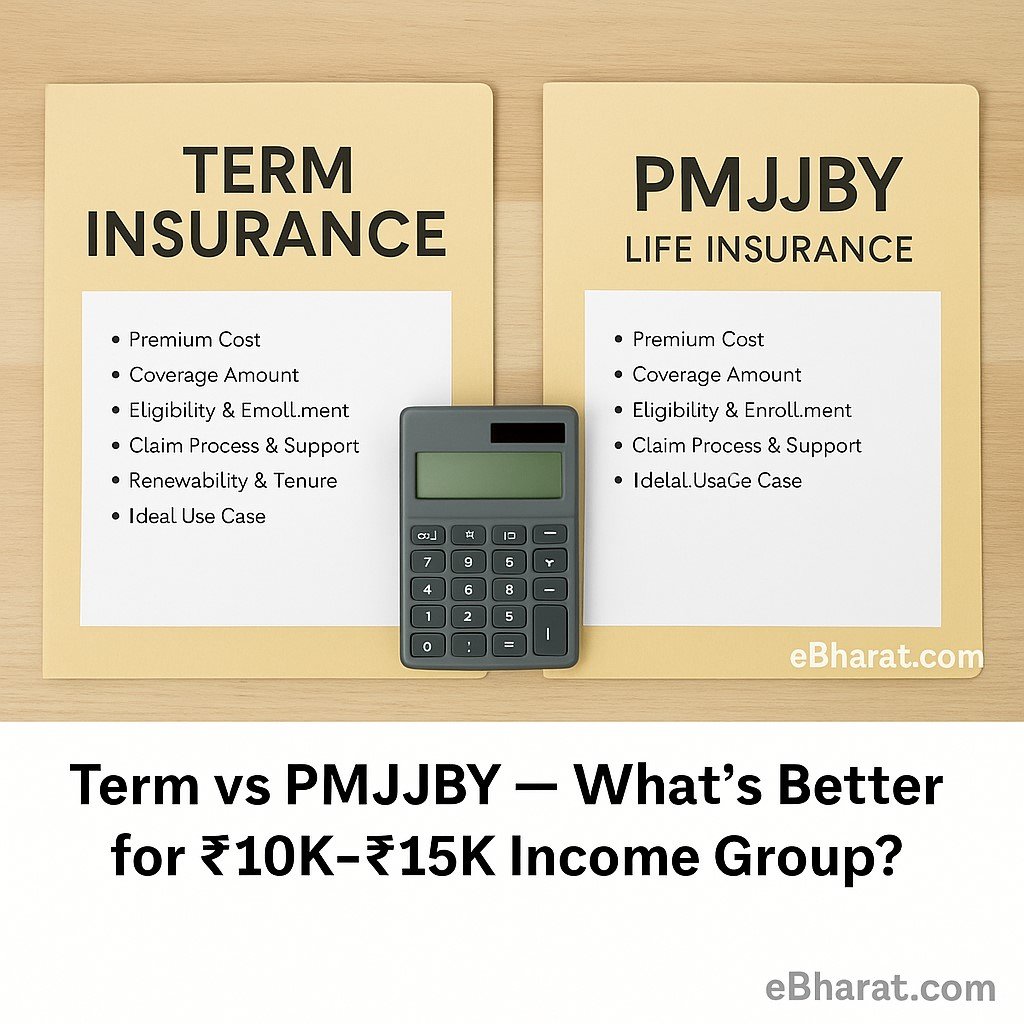

Two of the most popular options for low-income households are:

- PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana)

- A Basic Term Insurance Plan (like HDFC Life Click2Protect or LIC Tech Term)

Let’s break them down in simple, honest terms — so you can decide what suits your situation best.

Premium Cost – What Will You Pay?

PMJJBY: Just ₹436 per year — that’s less than ₹2/day. It’s automatically deducted from your bank account, once a year.

Term Plan: A basic plan with ₹5–₹10 lakh coverage usually starts from ₹1,500 to ₹3,000 per year (₹125–₹250 per month). Slightly higher, but with way more protection.

Verdict: PMJJBY is easier to start. Term plans offer more value per rupee in the long run.

Life Cover – How Much Will Your Family Get?

PMJJBY: Fixed payout of ₹2 lakh if the insured dies. No matter your income or age — this is the cap.

Term Plan: You can choose your coverage amount — from ₹5 lakh to ₹1 crore or more. Even if you start small with ₹10 lakh, the coverage is 5x what PMJJBY offers.

Verdict: Term plans give families a better financial safety net.

Who Can Apply — And How?

PMJJBY: Anyone aged 18–50 with a savings account and Aadhaar can enroll. No health checkups. Ideal for rural or semi-urban earners.

Term Plan: Available for ages 18–65. For higher coverage, some insurers may ask for a medical check or health declarations.

Verdict: PMJJBY is simpler to start. Term plans need a few more steps but are still easy if you’re healthy and under 40.

Claim Process – How Easy for Families?

PMJJBY: Claims are submitted through your bank, and while it’s straightforward, families often need follow-up or help from someone at the branch.

Term Plan: Claims go directly to the insurance company. Reputed insurers have digital claim systems, 24×7 helplines, and settlement ratios above 95%.

Verdict: Term plans offer better customer support — especially if bought from known private insurers.

How Long Does It Last?

PMJJBY: Renewed every year until age 55. The premium can go up if the government changes it in future.

Term Plan: You can lock in your premium for 10, 20, or even 40 years. Once bought, your premium won’t increase during the term.

Verdict: Term plans give better peace of mind and long-term protection.

Who Should Choose What?

PMJJBY is best for you if:

- Your monthly income is under ₹12,000

- You’re just starting out

- You have no other insurance

- You want a no-frills backup for your family

Term Insurance is better if:

- You’re the only earning member

- You have school-going kids or loans

- You can afford ₹150–₹300/month

- You want at least ₹5–₹10 lakh in cover

The Smartest Move? Combine Both.

You don’t have to choose only one. Many families follow this 2-step formula:

- Start with PMJJBY for just ₹436/year — quick and basic.

- Add a ₹5–₹10 lakh term plan when your income allows (even ₹150/month is enough to start).

This way, your family is never left completely exposed — even if money is tight today.

Real Example

Let’s say you earn ₹12,000/month.

- Start PMJJBY this week for ₹436/year

- Next year, take a term plan of ₹5 lakh for ₹2,000/year

- Total cost = Less than ₹3,000/year

- Protection = ₹7 lakh for your family

That’s affordable, real, and reliable peace of mind.

Final Thought

You don’t need to wait until you’re rich to buy life insurance. You just need to start small and stay committed. Because even ₹2 lakh can mean groceries, rent, or school continuity for your loved ones.

👉 Don’t delay. Start with what you can — and build up as you go.