With over 20 crore two-wheelers on Indian roads, bike insurance is one of the largest segments of motor insurance. In 2025, IRDAI has updated premium rates and digital policies have made buying and renewing much easier.

This guide breaks down the costs, coverage, and add-ons in two-wheeler insurance so you can make the right choice.

Types of Two-Wheeler Insurance

1. Third-Party Insurance (Mandatory)

- Covers damages to others (person, property, or vehicle).

- Legally required under the Motor Vehicles Act.

- Cheapest option, but does not cover your own bike.

2. Comprehensive Insurance

- Covers third-party liability + own damage.

- Protects against theft, fire, natural calamities, and accidents.

- Can be enhanced with add-ons.

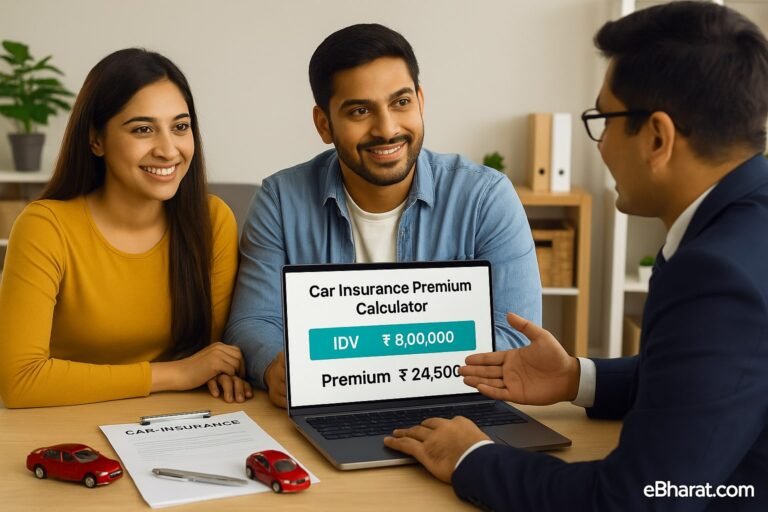

Average Costs in 2025

| Bike Type | Third-Party Premium (Annual) | Comprehensive Premium (Annual) |

|---|---|---|

| Scooter (Activa, Jupiter) | ₹1,000–₹1,200 | ₹3,500–₹5,000 |

| Commuter Bike (Splendor, Pulsar) | ₹1,200–₹1,500 | ₹4,000–₹6,000 |

| Sports Bike (Royal Enfield, KTM) | ₹2,000–₹3,000 | ₹8,000–₹15,000 |

Popular Add-Ons in 2025

- Zero Depreciation Cover – Full claim settlement without depreciation deductions.

- Roadside Assistance (RSA) – Help for breakdowns, flat tyres, or fuel issues.

- Pillion Rider Cover – Extra personal accident cover for your passenger.

- Engine Protection – Covers water damage and engine failure repairs.

Tips to Reduce Premiums

- Opt for long-term policies (3–5 years) → IRDAI encourages with discounts.

- Avoid small claims → Protect your NCB.

- Install anti-theft devices → Reduces premium by ~5%.

- Compare insurers online → Premium varies up to 20% across companies.

Case Study: Rajesh’s Bike Insurance Renewal

Rajesh, a 28-year-old software engineer in Bengaluru, initially bought only third-party cover for his Activa. After a flood damaged his scooter’s engine in 2024, he paid ₹22,000 from his pocket.

In 2025, he upgraded to comprehensive cover with engine protection at just ₹5,200/year, securing peace of mind.

Why This Matters

Two-wheeler insurance in India is not just about legal compliance. In 2025, with rising repair costs, theft risks, and natural disasters, comprehensive insurance with the right add-ons is the smarter choice for most bike owners.

👉 Next, read: Electric Vehicle Insurance in India: New Rules & Premium Models

🚀 Start Your Career as an HDFC Life Agent

Join eBharat’s Agent Network and get training, digital tools, and mentorship to build a successful career in insurance.

👉 Apply Now to Become an Agent