In 2025, India’s healthcare costs are climbing faster than inflation. A single surgery in a private hospital can cost ₹3–5 lakh, while ICU bills may run up to ₹1.5 lakh per week.

Yet, most Indians are under-insured, meaning their health insurance cover is far less than the actual cost of treatment. For example, a family floater with only ₹5 lakh sum insured may be exhausted in just one hospitalization.

Why do Indians buy smaller covers despite knowing the risks? Let’s explore the behavioural and financial reasons.

Behavioural Reasons for Under-Insurance

- Optimism Bias

- Many people believe “nothing will happen to me.”

- This leads to buying only the minimum coverage required.

- Focus on Premium, Not Coverage

- Families compare policies by premium instead of benefits.

- A cheaper policy feels attractive, but it often means inadequate coverage.

- Lack of Awareness

- Many don’t know actual treatment costs in private hospitals.

- Example: Heart surgery costs ₹4–6 lakh, but most policies cover only ₹2–3 lakh.

- Trust on Employer Health Plans

- Many salaried individuals rely only on company health insurance.

- They forget that job changes or retirement leave them uncovered.

Financial Reasons for Under-Insurance

- High Premiums for Higher Covers

- A ₹5 lakh policy may cost ₹12,000/year.

- A ₹20 lakh cover may cost ₹25,000/year—many skip it due to affordability issues.

- Senior Citizen Premiums

- Health insurance premiums for 60+ are very high.

- Families often reduce coverage to keep premiums manageable.

- Multiple Priorities

- Middle-class families prioritize school fees, EMIs, and household expenses over insurance.

- Lack of Tax Awareness

- Many forget that Section 80D allows deductions up to ₹1 lakh for family + senior citizen health insurance.

Real Impact of Under-Insurance

- A family with ₹5 lakh coverage faces a ₹9 lakh hospital bill. They must pay the remaining ₹4 lakh out of pocket.

- This often leads to borrowing, selling assets, or dipping into savings meant for education/retirement.

Quick Infobox: Signs You’re Under-Insured

| Sign | What It Means |

|---|---|

| Coverage below ₹5 lakh | Insufficient for major surgeries in 2025 |

| Relying only on employer insurance | Risky after job change/retirement |

| Choosing cheapest premium | Likely missing riders & top-up options |

How to Avoid Being Under-Insured

- Buy Adequate Cover

- Minimum ₹10–15 lakh sum insured for urban families.

- Use super top-up plans to reduce premiums.

- Use Family Floaters Wisely

- If you have elderly parents, buy separate policies for them.

- Upgrade Regularly

- Review your cover every 3 years to match rising medical costs.

- Take Advantage of Section 80D

- Claim tax benefits on premiums for self, family, and parents.

Case Study: Sharma Family

Mr. Sharma, 42, had a ₹5 lakh family floater. When his wife required cancer treatment costing ₹12 lakh, the policy covered only ₹5 lakh. The family borrowed ₹7 lakh at high interest.

Later, Sharma upgraded to a ₹20 lakh cover with a top-up plan. If he had done this earlier, the financial stress could have been avoided.

Why This Matters

Under-insurance is as dangerous as no insurance. With medical inflation at 12–14% annually, Indian families must think beyond minimum coverage to truly protect themselves.

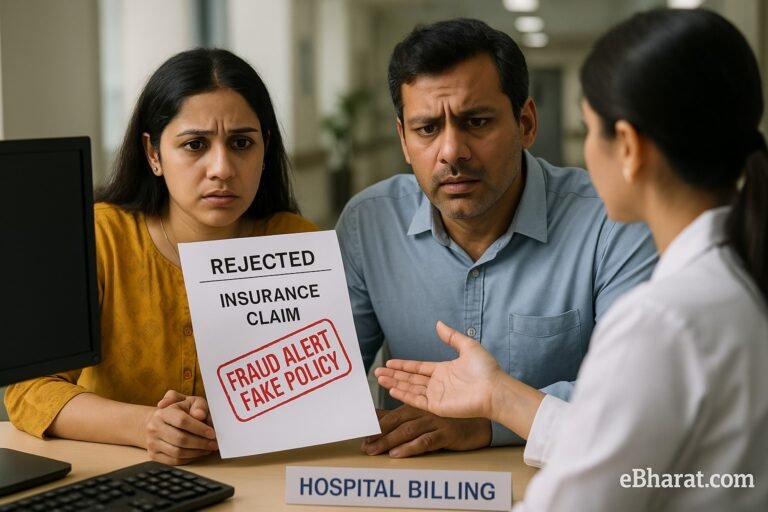

👉 Next, read: Health Insurance Fraud in India: Common Scams & How to Avoid

⚠️ Don’t Stay Under-Insured

Use Insurance+ to compare health policies with adequate coverage, or join eBharat’s Agent Network to help families avoid under-insurance.

🔍 Compare Health Policies