Flash floods in Uttarakhand trigger quick response from insurers, who have deployed early claim teams to handle rising motor, property, and crop insurance claims in affected areas.

| Event | Flash Floods in Uttarakhand (August 6, 2025) |

|---|---|

| Impact Zones | Chamoli, Rudraprayag, Tehri, parts of Almora |

| Damage Reported | Homes, shops, vehicles, crops |

| Insurance Impact | Spike expected in motor, property, and crop claims |

| Insurer Action | Quick Response Teams (QRTs) deployed |

Flash Floods Hit Uttarakhand

Torrential rains and sudden cloudbursts have caused severe flash floods across Chamoli, Rudraprayag, and Tehri districts in Uttarakhand. With multiple homes, shops, and vehicles submerged or swept away, both state-run and private insurers are preparing for a sharp rise in claims.

As per the latest report from the Uttarakhand Disaster Response Force (SDRF), at least 9 fatalities have been reported, with hundreds displaced.

Insurers Activate Quick Response Teams (QRTs)

Leading insurers like New India Assurance, HDFC Ergo, Tata AIG, and IFFCO Tokio have already activated ground teams in the affected districts.

“We’ve set up a mobile claim desk in Rudraprayag and Tehri to fast-track inspection and verification,” said a regional head from HDFC Ergo.

These QRTs are responsible for:

- On-site damage verification

- WhatsApp-based document uploads

- Emergency claim registration numbers

- Linking insured to garages, hospitals, or crop surveyors

What Types of Claims Are Rising?

| Claim Type | Coverage Involved | Risk Scenario |

|---|---|---|

| Motor Insurance | Own Damage & Engine Protector Add-On | Vehicles swept by floodwaters |

| Home Insurance | Structure + Content Cover | Water damage to homes, electronics |

| Crop Insurance | PMFBY or standalone schemes | Crop failure due to soil erosion or submersion |

“In past floods, claim ratios in such districts jumped 4x. This time we are trying to be preemptive,” said an official from the General Insurance Council.

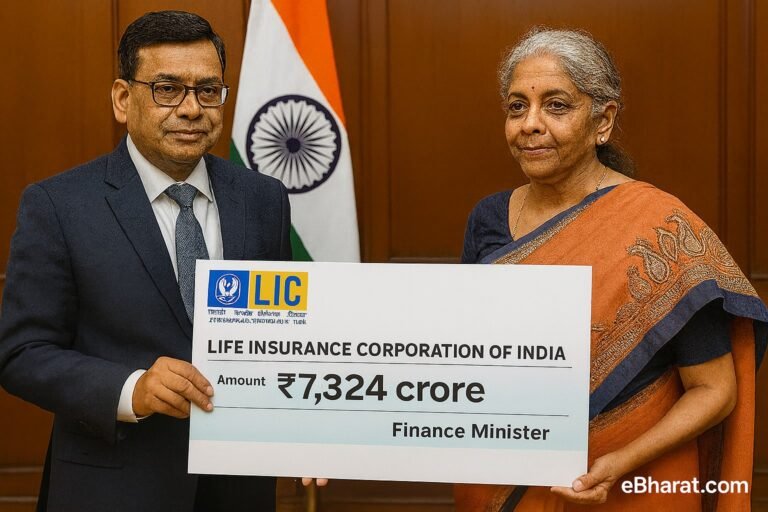

Claim Advisory Issued by IRDAI

The Insurance Regulatory and Development Authority of India (IRDAI) has advised insurers to:

- Waive off requirement for FIRs in motor claims

- Offer on-the-spot settlements for claims below ₹50,000

- Simplify crop loss survey procedures

A public notice is expected soon on the IRDAI portal.

To help settle complaints faster during disasters, IRDAI has suggested having in-house ombudsmen within insurance companies. Read the full update here

Why This Update Matters for Policyholders

- Flood-prone regions may now benefit from faster, easier claims if insured

- Add-ons like engine protectors and zero depreciation become crucial

- Affected farmers should contact their local bank or CSC to activate PMFBY claim surveys

eBharat.com will continue tracking insurer responses, claim deadlines, and advisory updates for Uttarakhand residents.

Know someone affected? Share this article — and follow eBharat.com on X, Instagram, and LinkedIn for more verified insurance updates.