Many people assume that insurance agents only work for commissions. While commissions form the income base, successful HDFC Life agents know insurance selling is about impact—not just income.

In 2025, with stricter IRDAI rules, smarter customers, and tougher competition, focusing only on commission will make you fail. Focusing on customer trust, financial education, and long-term relationships will make you succeed—and commissions will follow.

Insurance Agents: Protectors, Not Just Sellers

When you sell an insurance plan, you’re not just closing a deal—you’re protecting a family’s future.

- A term plan may become the lifeline for a widow.

- A child plan may secure education for a child even after a parent’s untimely death.

👉 Commission is the reward. The real product is financial security.

Why Commission Alone Can’t Sustain an Agent

- Customers don’t trust pushy sellers chasing money.

- Mis-selling brings short-term income but long-term damage.

- Agents driven only by money often quit early when sales drop.

What Really Builds Success

1. Customer-Centric Selling

- Always ask: “What does my client truly need?”

- Sell policies that match goals, not just commissions.

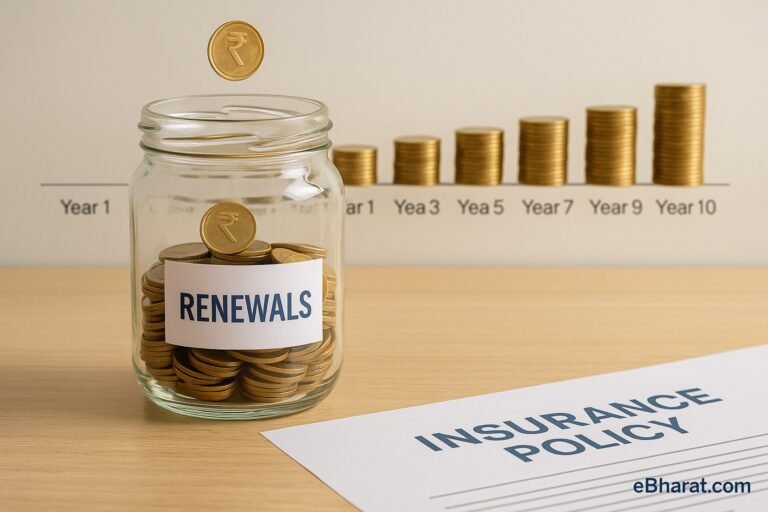

2. Long-Term Relationships

- Renewals = recurring income.

- One satisfied client brings 3–5 referrals.

3. Education & Guidance

- Explain policies in simple, relatable terms.

- Position yourself as a financial guide, not just a salesman.

4. Reputation & Trust

- In today’s digital world, one bad review spreads fast.

- Honest advice builds reputation → reputation builds income.

Case Example: Priya’s Story

Priya, a new HDFC Life agent, focused on customer-first selling instead of chasing high-commission products.

Earned 2.5x more commission than peers who pushed only high-payout plans.

Sold her first 5 policies by addressing real client needs.

Within a year, her referrals doubled.

Commission vs Value-Driven Selling

| Focus | Outcome |

|---|---|

| Commission-Only Selling | Short-term income, high dropouts, poor client trust |

| Value-Driven Selling | Customer loyalty, referrals, recurring commissions |

Why This Matters

The Indian insurance industry is evolving:

- IRDAI demands higher transparency.

- Digital platforms empower customers to compare instantly.

- Awareness is rising—families prefer ethical, customer-first advisors.

Agents who embrace value-driven selling will not only protect more families but also earn more commissions in the long run.

👉 Next, read: The Future of Insurance Agents in India: Digital, Trust, and Growth

🔍 Find the Best Insurance Plans

Use Insurance+ to compare term, health, and savings plans and choose the one that’s right for your family’s future.

Explore with Insurance+🚀 Build a Career as an Insurance Agent

Join the eBharat HDFC Life Agent Network to access mentorship, digital tools, and real leads—and start earning from day one.

Apply Now to Become an Agent